About Us

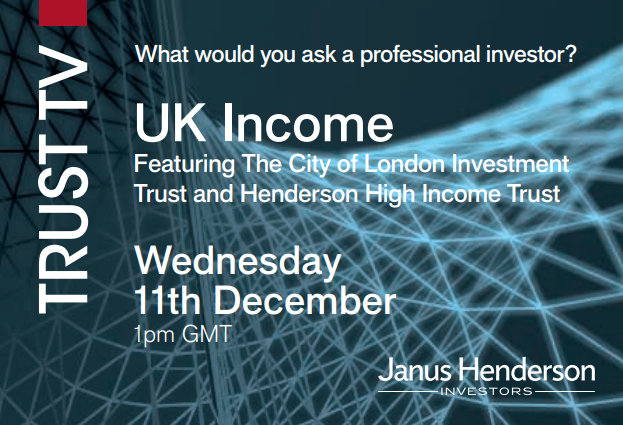

Formed in 2017 from the merger between Janus Capital Group and Henderson Global Investors, we are committed to adding value through active management.

For us, active is more than our investment approach – it is the way we translate ideas into action, how we communicate our views and the partnerships we build in order to create the best outcomes for clients.

There are three key principles that underpin the way we work with our clients:

- We put our clients first

- We act like an owner

- We succeed as a team

We take pride in what we do and care passionately about the quality of our products and the services we provide. While our investment managers have the flexibility to follow approaches best suited to their areas of expertise, overall our people come together as a team. This is reflected in our Knowledge. Shared ethos, which informs the dialogue across the business and drives our commitment to empowering clients to make better investment and business decisions.

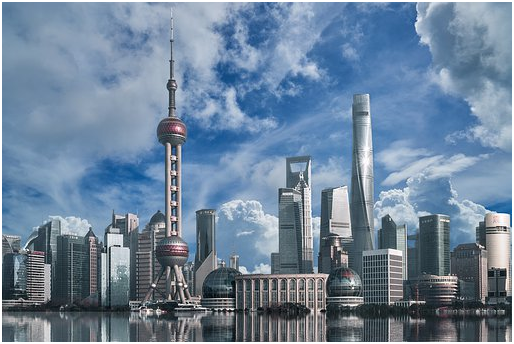

We are proud to offer a highly diversified range of products, harnessing the intellectual capital of some of the industry’s most innovative and formative thinkers. Our expertise encompasses the major asset classes, we have investment teams situated around the world, and we serve individual and institutional investors globally. We have £274.2bn in assets under management, more than 2000 employees and offices in 28 cities worldwide*. Headquartered in London, we are an independent asset manager that is dual-listed on the New York Stock Exchange and the Australian Securities Exchange.

*As of 31st March 2019.

What we Offer

Today investors rightly expect more. Many want the quality and reach of a larger global firm without sacrificing the intimacy and entrepreneurial ideas they might get from a smaller partner. Janus Henderson is committed to offering both.

As a leading global manager, we have the reach and range to offer actively managed solutions to diverse investment goals and seek to deliver exceptional service to clients. At the core of our offering are three key factors:

- World-class investment professionals: Our high calibre teams of investment managers, experienced analysts and other subject matter experts channel their ideas to help clients move towards their investment goals. These teams are ever ready to share their views.

- Ideas and innovation: Our entrepreneurial and open-minded culture encourages fresh thinking. We provide a framework that allows our investment teams to act quickly on their insight, while cross-pollinating ideas where appropriate, to maximise opportunities. This approach is reflected in our Knowledge. Shared ethos.

- Strong client relationships: Our investment strategies are developed to allow clients to benefit from our unique perspectives and techniques. All of our colleagues are empowered to deliver the high level of support and service that clients should expect.

What we offer

How we Work

At Janus Henderson, we blend human insight, originality and instinct with rigorous analysis, structured processes and risk management. It is this creative mix that we believe allows us to best deliver on client goals.

Put simply, our role is to deliver superior long-term investment performance by taking investment risk appropriate to client expectations. To do this, we provide a supportive framework that allows our skilful investment managers to perform to the best of their ability.

Our dynamic teams are structured and operate in ways that are best suited to their asset classes. This results in certain teams tapping into the fundamentals-based insight provided by our experienced analysts, while others base investment decisions solely on their own research and views. We do not impose top-down house views; instead we allow an appropriate level of flexibility within a controlled environment.

Everything is shaped with the client in mind. Products are developed to meet evolving needs and investment managers operate within clearly articulated parameters to achieve stated and/or agreed upon objectives. Transparency of process, positioning and progress towards meeting objectives are central to our approach and our investment and distribution teams seek to keep clients informed at every stage.

Risk management and controls are given the highest priority. While we encourage fresh thinking and creativity, we ensure this is actioned at all times in a measurable and regulated way. We recognise that risk has to be taken to generate outperformance, and our controls ensure that this risk is in accordance with client expectations and investment manager intentions.

Knowledge. Shared

At Janus Henderson, we believe in the sharing of expert insight for better investment and business decisions. We call this ethos Knowledge. Shared.

Knowledge. Shared is reflected both in how our investment teams interact and in our commitment to empowering clients in their decision-making.

Knowledge shapes the forward-looking views of our investment teams and how they position their portfolios. It is built upon their experience and reflected in their unique perspectives of how the world is changing and where opportunities lie. We believe that, where appropriate, our teams benefit from sharing and debating these views, and this dialogue frequently results in richer and more rounded investment theses.

We also strongly believe in the importance of sharing, and shaping, our knowledge by interacting with clients. This means explaining the opportunities and risks identified by our investment teams and exploring how they can be applied to address the challenges faced by clients. Building strong relationships and sharing views helps clients make informed decisions and supports the development of innovative products.

Central to this approach is making the intellectual capital of our investment teams and subject matter experts readily available. By providing timely reactions to market-moving events, candid manager views on investment trends and a wide curriculum of education and support at the appropriate level, we seek to empower our clients and give them an advantage. We value knowledge highly, and seek to deliver it in as relevant, timely and useful a manner as possible.