Mar

2022

Ukraine investment considerations: time in the market beats market-timing

DIY Investor

12 March 2022

While the Russia-Ukraine conflict will likely remain uncertain for some time, we believe situations like this require cool heads from an investment perspective. Lara Reinhard and Sabrina Geppert from the Janus Henderson Portfolio Construction and Strategy Team explain what history can teach us about the potentially costly effects of making drastic portfolio changes during times like these.

In periods of significant uncertainty, it is important to stay the course, however hard that may be. History has shown us that attempting to time the market is a nearly impossible task … we must continue to focus on the longer term.

Investors woke up to the news last Thursday that Russia had launched military activities in Ukraine, resulting in fear sweeping across global markets. When this fear is added to the existing challenges of rising rates and high inflation, it quite logically leads to questions about the implications for investment portfolios.

When emotions are high and portfolio returns are in the red, it is very easy for that fear and panic to lead investors to make drastic decisions about their investments.

While of course it’s important to consider the current risks and, if necessary, make portfolio adjustments, we believe it’s important to first stop, take a step back and pause before making potential changes out of emotion or fear of loss.

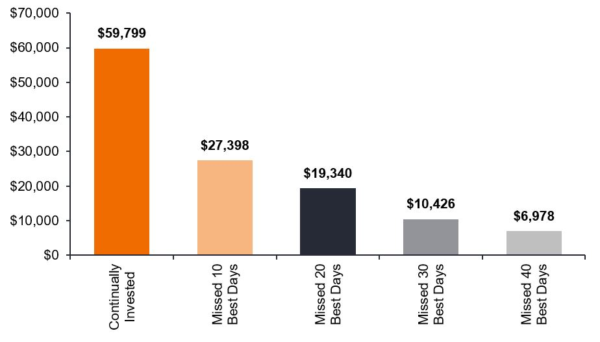

Value of a Hypothetical $10,000 Investment in the S&P 500® Index from 1999 – 2021

Source: Bloomberg. This shows the hypothetical return of a $10,000 investment in the S&P 500 Total Return Index between 1 January 1999 to 31 December 2021, not including taxes, fees or costs. It has been adjusted to show the impact on overall performance if that investment was taken out of the market after significant periods of volatility, thereby missing the subsequent market rebounds. Note: Hypothetical performance shown here is for illustrative purposes only and does not represent actual performance of any client account. No representation is made that hypothetical returns would be similar to actual performance. Past performance does not predict future returns.

The reality is, timing the market rarely works, and more often it comes at a high cost to investors. For example, a hypothetical $10,000 portfolio invested in the S&P 500® Index on 1 January 1999 would have grown to $59,799 on 31 December 2021, a return of close to 600% (not including any applicable fees, taxes or costs). If you were to remove the S&P 500’s best 10 days of performance during that period, you would have missed out on $32,401 of compounded return, which for many is an amount that can make a real-life impact.

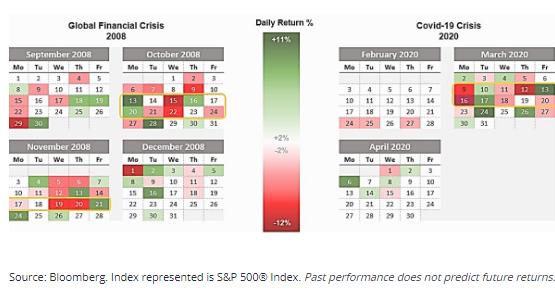

The reason it has been so notoriously difficult to time the market is that some of the worst short-term market fluctuations and losses are immediately followed by days or periods of the best recoveries. That’s not to say that a significant decline will always be followed by a quick and sharp recovery. However, it is a reminder that markets can be fickle and quickly reverse previous days’ moves.

Source: Bloomberg. Index represented is S&P 500® Index. Past performance does not predict future returns.

While the Russia-Ukraine conflict will likely remain uncertain in the days and weeks ahead, we believe situations like this require cool heads from an investment perspective. And while it is far too early to predict the long-term impacts of Russian military action in Ukraine, what we can do right now is learn from history while continuing to monitor the situation.

In an already volatile year, we on the Portfolio Construction and Strategy team have been touting the importance of having a balanced, flexible and diversified portfolio to help smooth the ride through the volatility. Recent events only further emphasize this disciplined approach, which can help investors, as emotional individuals, have more willpower to stay invested through the upcoming uncertainty while remembering the main goal: time in the market, not market-timing.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

C-0222-42365 03-15-23

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Brokers Commentary » Commentary » Henderson Partner Page » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » News

Leave a Reply

You must be logged in to post a comment.