Dec

2020

Are Asian equities set for change in 2021?

DIY Investor

12 December 2020

Andrew Gillan, Head of Asia ex Japan Equities, reviews what has been an eventful year for Asian markets and discusses how his portfolios are positioned for uncertainty in 2021.

Key takeaways:

- Andrew believes that in 2021 it will be key to strike the right balance between the structural winners and cyclical stocks that would more likely be supported by relatively stronger economic data.

- A constructive view is maintained on China, but there may be a possibility that the region underperforms the rest of Asia in 2021 given significant recent outperformance.

As 2020 draws to a close, we are beginning to see some changing dynamics and the big question is whether this builds momentum and accelerates into 2021.

Let me start with a recap. 2020 began with positive consensus expectations for Asian equities and other asset classes in general, encouraged both by some progress in the high-profile US-China trade dispute in addition to continued positive macroeconomic data.

Stock market leadership came from US equities and, in particular, growth and technology shares continued their relative outperformance. Then we had the emergence and shock of COVID-19 and its impact on economic growth globally.

There was an initial panic and sell-off in stock markets in March 2020 and this led to the underperformance of perceived higher risk assets including Asian equities. But markets later recovered, supported by a significant amount of economic and monetary stimulus.

Technology stocks continued to outperform

At first, this recovery continued and in fact accelerated previous trends, notably the outperformance of technology and e-commerce stocks within Asia, while other more economically-sensitive cyclical sectors such as financials underperformed.

China’s outperformance relative to the rest of the region continued as the virus was contained relatively quickly there, while stock markets in Southeast Asia and India lagged.

There was a more subtle change in the third quarter of 2020, with Asia beginning to outperform relative to global equities.

However, equity flows remained subdued; North Asia (the more technology heavy China, Taiwan and South Korea) continued to lead. India also enjoyed a strong rebound despite a worsening virus situation.

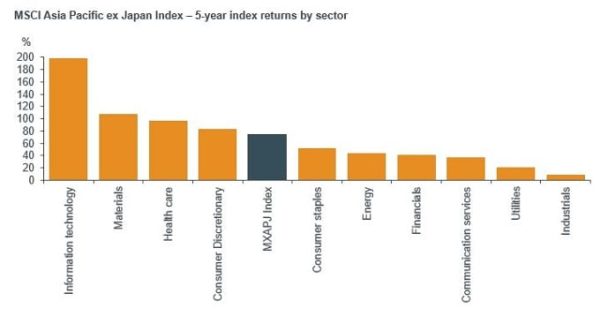

Technology sector has led returns in Asia ex Japan

Source: Factset, as at 30 November 2020, cumulative total returns in US dollars. MXAPJ Index = MSCI AC Asia Pacific ex Japan Index. Past performance is not a guide to future performance.

November 2020 proved to be another significant turning point with the US presidential election and news of significant progress on the development of a COVID-19 vaccine resulting in one of the strongest months on record for global equities, Asia included.

Within Asia, we witnessed quite a sharp rotation with internet and e-commerce-related companies (pandemic beneficiaries) underperforming.

More economically sensitive cyclical stocks outperformed and China lagged. Interestingly, we also witnessed several weeks of inflows towards emerging markets and Asian equities after significant outflows for the sectors through the first 10 months of the year.

Balancing act

The key for 2021 should be striking the right balance between the structural and the cyclical. Within the structural winners, ie. those companies that are the beneficiaries of long-term growth trends such as rising consumption and tech adoption, some areas of the market may be overvalued in the short term.

But we think many of these businesses continue to offer attractive growth prospects and can take significant market share over time. Whereas more cyclical sectors, such as financials and real estate, will likely be assisted by stronger economic data in 2021 relative to 2020’s weakness.

Valuations in some cyclical sectors still appear attractive to us. Our aim is to have both structural and cyclical exposure but remain more skewed to higher return-on-equity (ROE) businesses.

This has typically led us more towards structural winners, particularly in the technology and consumer discretionary sectors.

Our view on financials remains consistent and influenced by current low interest rates globally.

Our preference is for banks in those emerging markets, such as Indonesia and India, with higher interest rates and net interest margins, and also life insurance companies, which offer attractive structural growth as wealth levels increase across the region.

China remains key to the region because it is such a significant part of the MSCI All Countries Asia Pacific ex Japan Index, and in terms of consumption strength and trade flows.

We remain constructive on China given the wide choice of companies and sheer size of the market but it would not be a surprise to see Chinese stocks lagging the rest of Asia in 2021 given the significant recent outperformance of both the stock market and economic data relative to the rest of the region.

Glossary

Return-on-equity (ROE): a measure of financial performance calculated by dividing net income by shareholders’ equity (company’s assets minus debt).

Monetary stimulus: central bank action to increase the supply of money and lower borrowing costs to influence the level of inflation and growth in the economy.

Emerging markets: countries that are transitioning away from having a low income, less developed economy to being more integrated with the global economy and is developing modern financial and regulatory institutions. Emerging markets typically are more volatile and have a greater risk of loss than developed markets.

Net interest margin (NIM): compares the net interest income a financial firm generates from credit products like loans and mortgages, with the outgoing interest it pays holders of savings accounts and certificates of deposit (CDs). A higher NIM is an indicator that the financial firm is operating profitably.

Asia Pacific Capital Growth Fund >

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.

Commentary » Equities » Equities Commentary » Equities Latest » Henderson Partner Page » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.