Mar

2021

Emerging market equities: same storm, different boats

DIY Investor

18 March 2021

Portfolio Manager Daniel Graña explains how north Asia countries were able to navigate the COVID-19 pandemic with relative success while other emerging markets (EM) entered the crisis ill-prepared, especially with respect to government finances.

Key takeaways

- China, Taiwan, South Korea and Vietnam were among the few success stories during the global pandemic as they could leverage their experience with previous health crises in marshalling an effective response.

- While some laggard EM countries may play catch-up as vaccinations are administered, it is more likely that well-managed countries with economies increasingly reliant upon intellectual property for future growth will ultimately be the secular winners in EM equities.

- This bifurcation of performance highlights the importance of applying a country filter to EM equities in order to identify countries with sound macroeconomic management and reformist policies that empower the private sector to help advance economies.

The roughly one-year anniversary of the COVID-19 pandemic offers an opportune time to assess how emerging market (EM) countries have weathered this challenge.

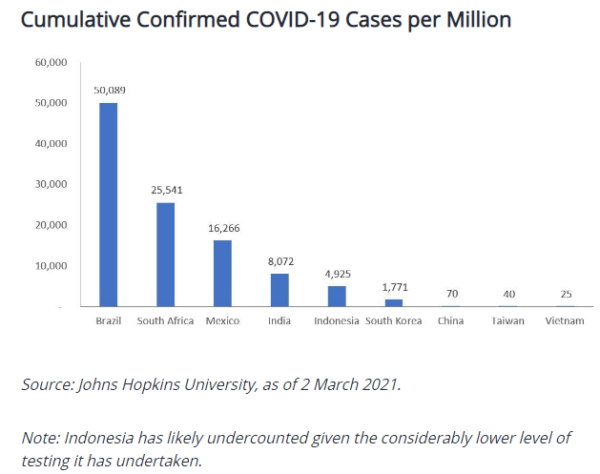

When measured by health outcomes, economic resilience or equity market performance, it’s clear that there is considerable dispersion in how various countries have fared.

By each of these benchmarks, the north Asia region of China, South Korea and Taiwan – along with their southern neighbor Vietnam – have managed the crisis with greater astuteness than other EM regions.

These diverging fortunes are likely to have lasting effects. Certain trends – such as the growth in e-commerce – have accelerated. On the other hand, existing vulnerabilities have likely been exacerbated.

Chief among these were the already tenuous fiscal positions of many EM countries that left them no room to absorb the hit to government finances caused by shuttered economies.

Not Just Luck

The relative success of north Asia and Vietnam in managing COVID-19 was no accident. Unlike many EM– and developed market – peers, these countries have had recent experience with major disease outbreaks and were able to rely upon the lessons learned during those periods.

Both SARS and 2009’s H1N1 flu taught these countries that time was of the essence in containing pathogenic threats. This awareness produced a second factor in their successful management of COVID-19: a willingness – and the ability – to act.

These countries had a combination of political structures and cultural factors that proved essential in the early days of the pandemic to help limit the virus’ spread. Importantly, the right mix of these conditions was largely absent in other parts of the world.

North Asia and Vietnam – in contrast to other EMs – also benefited from a lack of a sizable informal economy. Cities in India, the Philippines and other emerging countries often attract workers from the countryside who perform tasks such as street vending and menial labor.

As these cities’ economies shut down and in the absence of a social safety net, many workers returned to their home regions, bringing the coronavirus with them. This method of spread put additional strain on regional authorities that had little recent history in managing health crises.

A Tidy Fiscal House

The pandemic delivered an unprecedented shock to most countries’ economies and fiscal positions. Shuttered businesses constricted government revenues at the exact time when additional outlays were required to deliver health resources and support idled workers.

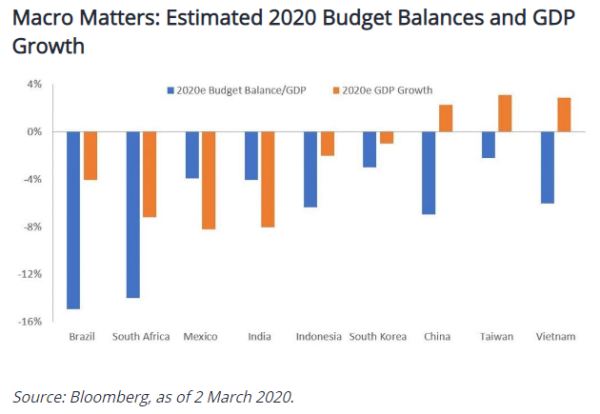

Unfortunately, heading into the crisis, the fiscal imbalances of several EM countries were already nearing treacherous territory.

As seen above, the budget balances of Brazil and South Africa are estimated to finish 2020 at a level of roughly 15% of GDP. While fiscal expansion was necessary in South Korea, China, Taiwan and Vietnam as well, they were all expected to finish the year with a deficit of less than 8% of GDP.

The longer economies remain hobbled, the more persistent budget deficits become, which, in turn, leads to uncomfortably higher government debt burdens.

Estimates indicate Brazil’s government debt to GDP may remain above 100% for at least the next three years and that of South Africa is forecast to climb above 80%.

For countries that must tap international markets for funding needs, debt at these levels risk spooking investors, which could result in unwelcome knock-on effects for interest rates, currencies and equities. These potential outcomes illustrate our view that the failure to contain the pandemic has consequences.

The challenge is already evident in 2021 GDP growth projections. While most major EMs are expected to return to growth in this year (China, Taiwan and Vietnam managed to produce positive growth in 2020), this year’s expected gains in Mexico, South Africa, Brazil and India still likely won’t be enough to compensate for 2020’s losses.

The breadth of trajectories for countries exiting the pandemic, in our view, proves that in EM investing, the macro matters. While identifying promising companies is important, the impact that government-level decisions has on the investable universe should not be underestimated.

Accelerating Trends

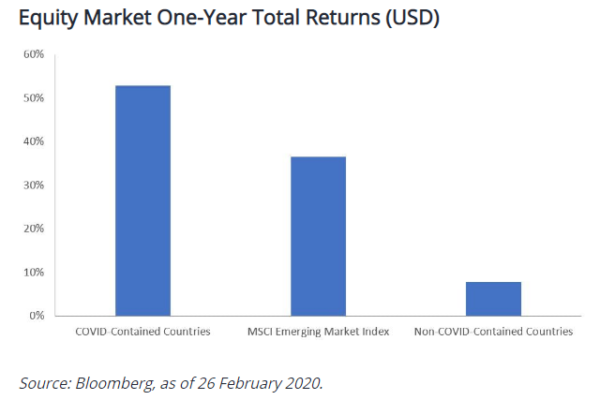

Investors have already taken notice of north Asia’s and Vietnam’s track record in managing the pandemic. As seen below, their equity market performance has far outpaced that of countries with much less success in containing the coronavirus.

Note: COVID-Contained Countries a simple average of China, Taiwan, South Korea and Vietnam MSCI indices. Non-COVID-Contained Countries is a simple average of the remaining countries in MSCI Emerging Market Index.

This differential in returns bodes the question of whether laggard countries can play catch-up as vaccines get administered and global economic activity resumes. We believe that over the near term this is a distinct (and welcome) possibility.

However, we believe that focusing a cyclical rotation from leaders to laggards and growth to value underestimates the power of the secular themes that have been on display over the past year: Value-added products and services leveraging intellectual property, in our view, are primed to displace exports as the primary source of EM earnings growth in the years to come.

This is best illustrated by the acceleration in e-commerce during the pandemic. Similarly, countries that exercise fiscal discipline and tend to have reformist, market-friendly policies will likely remain the ripest environment for growing companies.

This is why we believe that a country-level lens is an effective tool in complementing securities selection when constructing EM equities portfolios.

On the other hand, the past year exposed the vulnerabilities of EM countries that have failed to get their economic house in order. These countries underperformed for a reason.

Their prospects have only diminished as potential crushing debt loads may ignite a wave of capital flight and tumult in interest rates and currency markets.

Click to visit:

Gross domestic product (GDP): The value of all finished goods and services produced by a country, within a specific time period (usually quarterly or annually). It is usually expressed as a percentage comparison to a previous time period, and is a broad measure of a country’s overall economic activity.

Emerging market: Countries that are transitioning away from being a low income, less developed economy to one that is more integrated with the global economy and is making progress in areas such as depth and access to bond and equity markets and development of modern financial and regulatory institutions.

Fiscal policy: Government policy relating to setting tax rates and spending levels. It is separate from monetary policy, which is typically set by a central bank. Fiscal austerity refers to raising taxes and/or cutting spending in an attempt to reduce government debt. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.

Commentary » Henderson Partner Page » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.