Jan

2021

The Long Game – Historical Market Returns and 2021 Expectations

DIY Investor

17 January 2021

In 2020, the market has spoken and again, taught even some the sharpest minds on Wall Street to stay humble.

Don’t look at the markets daily, other things in life, including cycling are more exciting. But once a year it may be a good moment to evaluate the State of Play.

And if you took the plunge and invested in Stocks the dreams may be closer than expected. Over the past decade holding a World ETF (VT) returned, in USD, 9.3% per year!

It’s also time to spend a few minutes to (i) learn and acknowledge the limits of our ability to predict the markets (ii) evaluate how much you contributed to the portfolio but most importantly (iii) how far are you from achieving your goals and (iv) setting the right expectations

It’s probably also time to rebalance your portfolio – sell some of the winners, buy some losers?

Some exceptional returns below may inspire you to ride a momentum wave and while this is great for learning with some small allocation do not to forget the rules of the game and remain forecast-free.

If there is one take-away that is valid most of the time, it would be that the level of interest rates explains most of the behavior of asset classes – inflated NASDAQ given lower discounting factors, low opportunity costs in holding Gold or Bitcoin, low performance of Value Stocks and decreasing appeal of Bonds amongst others.

Winners rotated but Tech didn’t

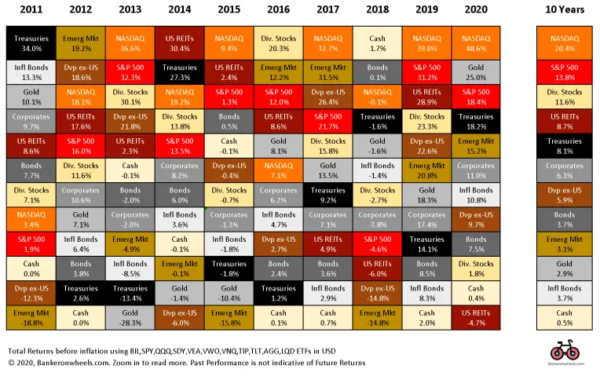

Asset Classes sorted by performance and 10-year average

- REITs, Dividend Stocks and broader Value (Vanguard Value ETF is up only 2.3%) underperformed significantly in 2020, even though some of these assets (e.g. REITs) have good risk/reward over the past 20-year (see below)

- Unless you really didn’t look at the markets for years you know that, Growth as illustrated by NASDAQ outperformed over the past decade (Vanguard Growth ETF up 40% in 2020). What’s more, Apple, Amazon and Microsoft accounted for more than half of the S&P 500′s return this year. Absent the top 24 companies, the S&P 500 return would be negative in 2020

- Despite not generating any income it was another great year for Gold and an exceptional one for Bitcoin (up 300%). Overall Bitcoin is up c.140% annually since 2011 but the volatility is extremely high (e.g. in 2018 the digital currency was down 73%).

- I see a significant amount of wise-money retail investors contemplating a small allocation e.g. 1% of their portfolio to Bitcoin. A Bitcoin ETF may be coming at some point in 2021 to make this easier.

- Emerging Markets do seem to gather momentum after a decade of relative underperformance

- As a side note, the biggest star on Wall Street was Catherine Wood and her active-managed ARK ETFs – if you have access to these funds in Europe (only professional broker clients do), remember that winners end up rotating. These asset classes are by nature very risky – it is not uncommon for some top holdings (e.g. in ARKG) to drop 65% in a few days if a drug trial doesn’t go as well as planned. This is also a good transition to talk about Risk in general.

To see the full article visit:

Commentary » Equities » Equities Commentary » Equities Latest » Fixed income Commentary » Fixed income Latest » Latest » Take control of your finances commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.