Jan

2021

The next big thing: two mega-trends that everyone should own

DIY Investor

17 January 2021

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Tech seems to beat every other sector hands down – in both up and down markets – but nothing lasts forever. Where else should investors be looking for secular growth themes?

2020 has so far proven to be the latest episode in a long period of technology outperformance, as we observed in this article.

Over the past decade, technology-related companies have tended to perform like consumer staples or defensives on the downside, and like high-growth discretionary stocks on the upside: an ideal combination from the investor’s point of view.

As a result the indices (and fund managers’ portfolios) are increasingly correlated to ‘big tech’.

How do investors who want a diversified portfolio deal with this, and how can they introduce more diversification into their portfolios, without reducing the potential for growth?

The first step, of course, is to use specialist funds to diversify one’s holdings of individual technology stocks. Allianz Technology Trust (ATT) and Polar Capital Technology Trust (PCT), for instance, are both run by tech specialist managers.

But ATT differs from PCT in that the portfolio is significantly more concentrated and, at times, has greater exposure to mid-caps. This combination of features means that ATT can be more volatile and deviate from the benchmark to a greater extent, from time to time.

Nonetheless over the last five years, these two aspects of ATT have paid off for its shareholders – having outperformed PCT by a total of 15% in NAV terms.

While both trusts have delivered strong returns relative to their Dow Jones World Technology benchmark, both of their fortunes are also inextricably linked to big tech.

If the biggest technology companies catch a cold, then the wider technology sector will likely catch it in the short term. At the same time, as we conclude in this article, there are good reasons why the quality characteristics which technology stocks display give them the potential to outperform for years to come.

But nothing lasts forever and, while we wouldn’t bet against technology performing strongly in absolute terms over the medium term, it might be that sector leadership could pass elsewhere.

Where should one turn?

Value managers, as a foil against excess exuberance in technology stocks, have been a much heralded strategy. But aside from small bursts, this approach has run into problems.

Value managers – despite the ‘margin of safety’ that low valuations promise when faced with the prospect of a market crash – have foundered hopelessly during 2020.

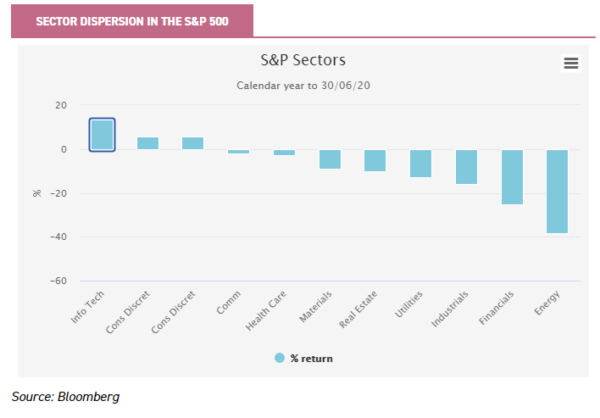

Their underperformance this year has been extraordinary. The main reason for this plunge in performance is the extreme sector dispersion exhibited so far this year, which we illustrate in the graph below.

In trying to profit from this dispersion, we believe that viewing potential opportunities on a sectoral or geographic basis may miss the point.

What has transpired in the technology sector has actually occurred in a relatively wide range of different businesses; which are loosely defined as being technology businesses.

One might just as easily describe the FAANG theme as the ability of platform companies to distribute products globally, with almost zero marginal cost; or perhaps, as James Anderson of Ballie Gifford recently described them on an update call, companies which derive increasing returns to scale.

In his view investors have been slow to recognise this phenomenon, and this is one of the reasons (as we discuss in this recently updated profile) that Scottish Mortgage (SMT) has achieved such strong returns over the last decade.

So if one wants to remain exposed to secular growth, but diversify on a thematic basis, where should one turn? Secular trends are defined as being neither seasonal nor cyclical.

Instead they are a constant tailwind over time – often defined as five years or more – which should persist, regardless of the economic path of the global economy.

The theory behind thematic investing in this way is that companies which are operationally exposed to secular growth should provide stronger returns than wider markets. Many trust managers look for themes within their portfolio.

However we would argue that it is only global managers who have the framework to do a thematic job properly. Assuming one has ‘full’ exposures to the increasing returns to scale theme, what other secular growth themes are there, and which trusts offer the best exposure to them?

There are clearly many investment themes, which may or may not represent secular growth trends. Some of them are highly specific and narrow.

n our view the themes which best suit an investment strategy are those secular growth themes which themselves wrap around several other secular themes.

It is only these themes that will offer enough of a broad spectrum of opportunities to allow a manager to hedge some of the risk that – even while betting in the right race – they have not chosen the wrong horse. Surely it is much better to have an interest in not just the horse, but also the racetrack owner, the bookies, and perhaps even the saddle maker?

We believe that there are two broad secular growth themes that are likely to persist for the next decade at the very least. Both of them are truly global, and both are likely to directly involve a significant proportion of the global population.

Healthcare

We believe that healthcare, as a secular growth theme, offers a sparkling investment prospect. It could complement existing technology trusts, given it has significant growth prospects, but also has an increasingly global audience for its products.

Aside from benefitting from innovation and R&D spend – a convergence of big data, technology and AI could mean the next decade is as transformative as any – healthcare also encompasses two mega themes often quoted by many managers: that of ageing populations in the west (demographics), and the rise of the middle classes in emerging markets.

Both themes are likely to lead to an increased requirement for healthcare services over time. The pandemic we are experiencing serves to reinforce that message.

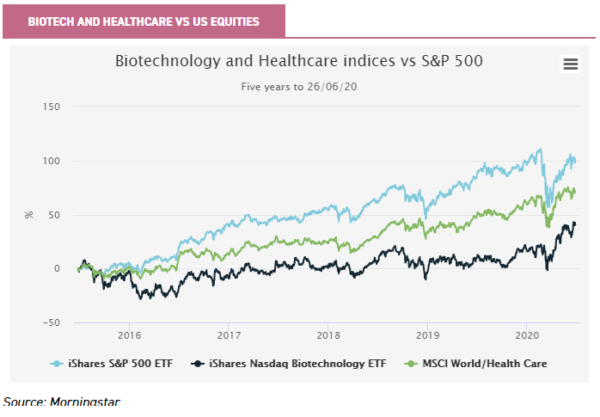

Over the long term, healthcare has delivered handsome returns to investors. However, since the run-up to the last US election, the healthcare indices (such as the MSCI World Healthcare and Nasdaq Biotechnology indices) have underperformed global equity indices.

To some extent, this underperformance is because of the political risk first properly seized on by the market with Hilary Clinton’s Democratic Party presidential nomination. Uncertainty has persisted since then.

But with Joe Biden as the current likely Democratic candidate, representing a continuation of the status quo with regard to healthcare, some of the ‘left-tail’ risks seem to have reduced. As a result the healthcare sector offers the prospect of mean reversion, at the very least.

One trust which we initiated coverage on recently, and which is fully exposed to the healthcare theme, is BB Healthcare (BBH). BBH’s managers take the view that healthcare systems around the world are fundamentally broken.

Consequently the managers seek to identify companies which offer a new approach for governments, recognising that simply pumping more money into the existing system is not going to solve the ‘care crisis’ over the medium to long term.

They see the entire industry as their universe, including as it does companies in a range of different industries: pharmaceuticals; biotechnology; medical devices and equipment; healthcare insurers and facility operators; information technology (where the product or service supports, supplies or services the delivery of healthcare); drug retail; consumer healthcare; and distribution.

BBH’s managers have a concentrated, multi-cap approach. Having launched in late 2016, the trust doesn’t have a particularly long track record.

However BBH has come out of the blocks fast, and has put in a strong performance so far. In our opinion BBH is very much worthy of consideration for investors wanting a differentiated high-growth exposure to what we view as a secular growth story.

International Biotechnology Trust (IBT), on the other hand, invests in biotechnology companies around the world which are working to provide solutions to unmet medical needs.

This is a specialist area, but one that exhibits strong trends which are unlikely to be blown off track by COVID-19. IBT has a unique position in the trust universe, given that it invests in both listed and unlisted companies.

Within the listed equities portfolio, the team take a highly active multi-cap approach. Within the biotechnology sector, M&A has a persistent presence.

Firstly, because of patent or exclusivity expiries, larger companies need to constantly reinvent themselves, in terms of their product portfolio. Secondly, efficient global distribution networks are essential to maximise the financial benefit of any product.

These networks provide a tailwind for valuations, something that IBT has been a beneficiary of in the past; having had 11 completed acquisitions from the portfolio since December 2017, at an average premium of 63%.

A key part of the investment philosophy is to manage risks, by de-risking exposures to companies in the run-up to significant drug trial results announcements.

This de-risking shows up in the lower NAV volatility over five years relative to the benchmark, but the trust is still showing outperformance. IBT pays a dividend of 4% of NAV each year (as at end August) from capital.

Given it employs a growth strategy, this dividend provides a very different, potentially diversifying, underlying exposure to that provided by equity income funds.

The end of carbon

We believe the other theme that will affect billions of people, and is set to run for many decades, is ‘the end of carbon’.

This theme is clearly a multi-faceted investment opportunity. It is an investment opportunity because no one is under the misapprehension that it will not require many billions of dollars to wean the global economy off fossil fuels.

Of course there is plenty of debate, and it is a subject that invokes many passions on both sides. However BP’s announcement in mid-June was, for us, a watershed moment.

Stranded carbon assets is a topic that has been discussed for many years, but it is the first time that an oil major has formally recognised that all its assets may not be exploited. Aside from big oil, the repercussions of the end of carbon are wide ranging.

Q1 2020 was the first time that more than 50% of German energy needs were met by renewables. But it was also during the same period that Tesla’s all-electric car was the best-selling car in the US.

There are many ways that one might attempt to incorporate this theme in a portfolio. The likes of Greencoat UK Wind (UKW)and The Renewables Infrastructure Group (TRIG)are perhaps among the more obvious.

Both of these trusts have delivered (UK equity) market beating returns since launch on a total return basis, through investing in renewable energy generating infrastructure. UKW’s model is relatively simple.

It owns UK wind farms directly, and uses the cash generated to pay a high dividend; as well as reinvesting the surplus into other wind farm assets with the ambition to grow both the NAV and dividend by at least inflation.

TRIG has a broader mandate, investing in wind, solar, and a small battery storage asset in the UK, and increasingly in Europe. Both trusts employ structural gearing to boost returns.

UKW has long-term structural leverage which enables a higher level of dividend cover, but also increases shareholder exposure to repayment risk when the loans become due. TRIG, on the other hand, employs the majority of its gearing through project finance.

Each loan is secured on specific assets which are amortised over the life of the specific subsidy regime for each asset. Over time this strategy represents a de-risking exercise, but it does mean there is less cash left over to pay dividends than with UKW. Both offer exposure to high-quality assets, and have so far delivered strong returns to shareholders.

Reducing our use of fossil fuels will require us to be significantly less profligate with energy. Menhaden (MHN) is a relatively less well-known trust, which was set up specifically with the aim of investing in companies that benefit from increased efficiency in the use of energy and resources.

The current management team took the reins in March 2016, following a difficult start to life (MHN IPO’d in 2015). The portfolio is highly concentrated, with only 14 holdings currently, and encompasses businesses which, at first glance, one might not associate with a strategy targeting resource efficiency.

However, holdings like Safran (an aircraft engine manufacturer) recognise the necessity for air travel, but are at the forefront of making engines significantly more efficient.

The team aim to identify companies which have the opposite characteristics of ‘commoditised businesses’, exhibiting strong pricing power and high barriers to entry.

Having a closed-end structure allows the managers to invest in both private and publicly listed businesses. In our view, the discount of 23.4% reflects the trust’s past.

The track record has improved significantly under the new team, and the proportion of the trust invested in private investment has now reduced to only 20% of the portfolio (vs 50% at the beginning of 2020).

Impax Environmental Markets (IEM) remains, in our view, a marquee fund in the investment trust sector; especially for investors wanting a differentiated exposure to companies that will profit from the transition to a more sustainable economy.

One might say that Impax Asset Management – a specialist asset manager founded over 20 years ago – ploughed a rather lonely furrow for a number of years; with its core investment thesis being that the global economy needed to transition from a depletive economic model, to a sustainable one in which growth is achieved with improved social and environmental outcomes.

This is a concept that seems now firmly accepted, but has not always been so. The managers are small and mid-cap specialists, and around the world there seems a desire from electorates that COVID-19 should provide an opportunity to ‘Build Back Better’, and seek to embed low carbon energy systems and cleaner air in cities.

Many of the specialist companies that help achieve this can be found in IEM’s diverse portfolio. Because of its mid and small-cap focus, IEM offers exposures that are unlikely to be found in generalist global funds or trusts. With strong performance from the manager, and a good alpha score over five years, IEM is an obvious candidate for consideration when it comes to this theme.

One trust which is starting to align its portfolio more closely towards what we term the ‘end of carbon’ theme, is BlackRock Energy and Resources Income (BERI). Starting from 1 June 2020, BERI will have a neutral sector weight of 40%:30%:30% between mining, traditional energy and energy transition stocks.

Clearly, with BERI’s own journey towards energy transition stocks only just started, the underlying portfolio doesn’t quite qualify fully yet. Although it is worth noting that electrification and batteries will require continued investment in mines for copper and other metals.

However, with the discount to NAV of c. 17% and the board having stated that it is prepared to use capital to support the 4p dividend (which yields 7% at the current share price), BERI is perhaps worth taking a closer look at.

While BERI doesn’t fit our theme within a strictly defined view, it is clear that its portfolio does fit within a more real-world and constructive view of the long-term transition to a low carbon economy.

Aside from mitigating risks by investing a significant proportion of the portfolio in energy transition companies, the managers also remain at the table and constructively engaged with the managers of traditional energy companies; the kinds of companies that will need to change their business models if the world is to successfully evolve to a low carbon economy.

For investors who wish to diversify their exposure to themes within one trust, Mid Wynd International (MWY) offers access to a global stock picking team.

It aims to grow investors’ real wealth by investing in a portfolio of high-quality companies around the world. The team take a long-term view to investing, identifying themes that will develop over the next three to five years.

They aim to build a portfolio which includes several themes that are less correlated to each other, which will enable them to perform well on a relative basis when markets fall.

This outcome has proved to have been the case since the team took over running the trust, and MWY has outperformed the benchmark in three of the past five positive years; while outperforming in both years in which markets have fallen.

As at 30/4/2020, the portfolio had 10.7% exposure to what the managers call the ‘low carbon world’ theme, and 21.7% of NAV exposed to healthcare, comprising the themes of scientific equipment and healthcare costs. Other themes include: online services (20.8%), automation (12.4%), emerging market consumer (14.8%) and screen time (8.1%).

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Commentary » Investment trusts Commentary » Investment trusts Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.