Oct

2021

Sustainable investing gets active

DIY Investor

18 October 2021

The world is facing major sustainability issues, from climate change to social inequalities. In order to make sound investment decisions and have a meaningful positive impact, we believe the complexity and nuance of environmental, social and governance (ESG) factors requires an active approach – particularly as a growing number of investors are seeking to align their personal values with their financial return objectives.

The world is facing major sustainability issues, from climate change to social inequalities. In order to make sound investment decisions and have a meaningful positive impact, we believe the complexity and nuance of environmental, social and governance (ESG) factors requires an active approach – particularly as a growing number of investors are seeking to align their personal values with their financial return objectives.

Key takeaways

- Investors are now able to choose from different approaches to suit their values and investment objectives, which has led to a steady rise in sustainable fund assets worldwide.

- We anticipate the transition to sustainability will be filled with new and ongoing challenges to navigate as well as opportunities to uncover.

- In our view, active managers are in a position to drive positive change amid the shift.

The public’s awareness of – and often first-hand experience with – ESG-related issues has propelled sustainability to the forefront of the global agenda. Whether due to increased media attention, record-setting temperatures in the American West fuelling droughts and wildfires, or unprecedented levels of rainfall leading to severe flooding in Europe, public interest in climate change has accelerated.

As these issues have come to the fore, the real-world implications of neglecting ESG factors have come sharply into focus and the sense of urgency to make transformational changes has increased. The result is a shift from voluntary participation to binding legislation, a substantial capital need to support sustainable development1 and increased acknowledgment of the crucial role sustainable finance can play in the transition.

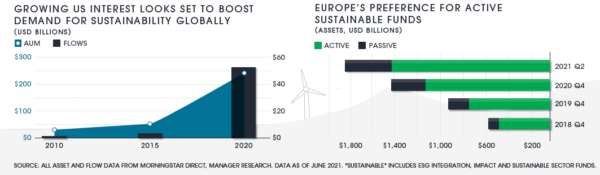

Responsible investing and the environmental, social and governance (ESG) considerations that inform it have had various names and drivers through the years. This evolution has given rise to investors motivated to align their personal values with their financial return objectives. Investors are now able to choose from different approaches to suit their values and investment objectives, which has led to a steady rise in sustainable fund assets worldwide.

Source: All asset and flow data from Morningstar Direct, Manager Research. Data as of June 2021. “Sustainable” includes ESG integration, impact and sustainable sector funds.

Sustainable investing through an active lens

Sustainable investing can be complex to implement given the challenges of measuring the impact of ESG factors. It is not simply an evaluation of a company’s products or services, but also its behaviour, conduct, supply chain and general business operations, as well as the impact of each on society and the environment. In order to make sound investment decisions and have a meaningful positive impact, we believe the complexity and nuance of ESG factors requires detailed analysis and ongoing interaction with companies.

The world is facing major sustainability issues, from climate change to an aging population and social inequalities, all of which require radical solutions that will bring vast, yet hard to predict, changes to the global financial system. We anticipate the transition to sustainability will be filled with new and ongoing challenges to navigate as well as opportunities to uncover. In our view, active managers are in a position to drive positive change amid the shift. Those with approaches built on multi-dimensional analysis, selective investment and direct engagement practices should be well positioned to identify companies on the right side of sustainable disruption, as well as those unable or unwilling to keep pace in this fast-evolving environment.

For more on the evolution of responsible investing and Janus Henderson’s commitment to ESG, download our infographic below.

1The UN estimates a need for $5 to $7 trillion annually until the year 2030 to meet their Sustainable Development Goals. UN Sustainable Development Goals, as of November 2017.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.