Oct

2021

October market: The UK Stock Market Almanac

DIY Investor

19 October 2021

The latest edition of Stephen Eckett’s fascinating reference book may have you scratching your head in search of a rational explanation for what is presented, but one thing is for sure, you’ll return to it again and again

Eckett’s fascinating reference book may have you scratching your head in search of a rational explanation for what is presented, but one thing is for sure, you’ll return to it again and again

Market performance this month

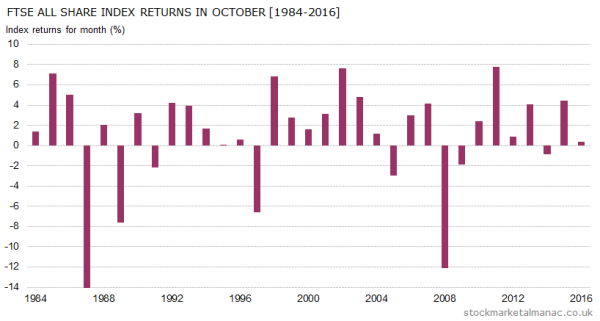

October has a bad reputation among investors. Partly justified, one might think: in 1987 the FTSE All-Share Index fell 27% in the one month of October, and then in 2008 the index fell 12% in the month.

However, a glance at the accompanying chart tells a different story.

In the 27 years since 1970, the UK stock market has only seen negative returns in October in six years – a record second only to December. And in recent years equities have remained strong in October, only falling in one year since 2010.

But, while average equity market returns in October may be better than thought, the month does have a deserved reputation for volatility. Only September can challenge it for share price fluctuations.

Sell in May/Halloween effects

The strength of equities in October may not be unconnected with the fact that the strong six-month period of the year starts at the end of October (part of the Sell in May effect) and investors may be anticipating this by increasing their weighting in equities during October.

The last day of the month also tends to be strong, in fact it has the best record of any month’s last trading day – which, again, may be related to the Sell in May effect.

But while October, therefore, should be regarded as a good month for shares, any occasional weakness in the month can be severe.

The average October

In an average month for October the market tends to rise in the first two weeks, then to fall back, before a surge in prices in the last few days of the month (Sell in May effect akaHalloween effect again!)

Shares

In the last ten years, shares that have the strongest record in October are: Diageo [DGE], Tate & Lyle [TATE], and Whitbread[WTB]. Especially strong has been Diageo, which has seen positive returns in October in every year since 2006, with an average return in the month of 3.1%; however it will be interesting to see if ‘Stoptover’ has any impact as people give up the booze for a month to support cancer patients.

By contrast, weak shares in October over the last ten years have been: Marshalls [MSLH], William Hill [WMH], and UDG Healthcare [UDG].

Large v mid caps

The month is one of only two months (the other is September) that FTSE 100 stocks tend to out-perform the mid-cap FTSE 250 stocks – since 1986 the FTSE 100 Index has on average out-performed the FTSE 250 Index by 0.7 percentage points in October.

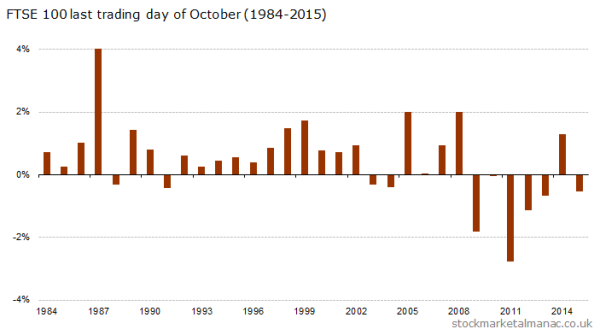

Last trading day of October

Historically, the last trading day of October has been the strongest LTD of any month in the year. Since 1984 the market has on average risen 0.46% on the LTD of October, with positive returns in 69% of all years.

The following chart shows the FTSE 100 Index returns for every October LTD since 1984

As can be seen on the chart the market only fell twice on the October LTD in the 19 years from 1984 to 2002. One possible reason for this may have been that November is the start of the strong six month period of the year (this is part of the Sell in May effect), and investors could have been buying equities at this time in anticipation of that.

However, in recent years this pattern of behaviour has changed. Quite dramatically so – in the last seven years the market has only risen once on the October LTD. Last year the FTSE 100 Index was down 0.5% on the last trading day of October.

Leave a Reply

You must be logged in to post a comment.