Oct

2021

An Introduction to Midstream Energy Infrastructure

DIY Investor

18 October 2021

Introduction

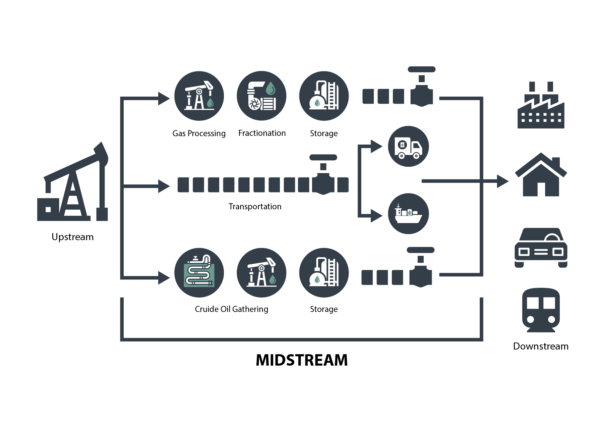

An investment in energy infrastructure is an investment in North America’s continued production and consumption of transportable energy over the next several decades. Energy infrastructure companies own the pipelines, storage tanks, and processing facilities that bring energy from the wellhead to America’s doorstep and increasingly to the coast to be exported internationally.

In the energy industry, these activities are typically described as “midstream”. This is the bridge between production (upstream) and consumption (downstream). While still related to the energy industry, most energy infrastructure business lines do not have direct exposure to commodity price fluctuations. Their businesses take place on a set fee per volume or fee for service basis. In short, the business model is driven by volumes.

The prices (or tariffs) that energy infrastructure companies can charge are determined either by negotiated contracts or are federally regulated. Typically, tariffs increase each year by a measure linked to inflation. In terms of volumes, the significant growth in North American oil and gas production has increased the need for energy infrastructure assets. While energy demand in North America has remained fairly steady in recent years, long-term global demand growth is expected to continue, particularly for emerging markets, creating opportunities for energy infrastructure companies. Increasingly, these companies are processing, transporting, and storing hydrocarbons that will ultimately be sent to locations worldwide.

Energy Infrastructure Overview

Energy infrastructure companies are involved in the transportation, processing, and storage of oil, natural gas, and natural gas liquids (NGLs). Historically, much of the midstream space has been structured as master limited partnerships, or MLPs. C-Corporations have also become more prominent in midstream in recent years.

Midstream Energy Infrastructure Business Models

Midstream MLPs and c-corps are involved in the transportation, processing, and storage of oil, natural gas, and natural gas liquids (NGLs).

1. Transportation: Transportation MLPs and c-corps move energy commodities like oil and natural gas from one place to another. In North America, most energy travels through a pipeline, but it can also move via truck, train, or ship. Pipelines are the cornerstone of energy infrastructure companies.

2. Processing: Processing encompasses any business that transforms a raw commodity into a usable form. It involves removing impurities like water and dirt from natural gas and separating the natural gas stream into pipeline-quality natural gas and natural gas liquids (NGLs), which are used as heating fuels and petrochemical feedstocks.

3. Storage: Storage includes tanks, wells, and other facilities both above and below ground. These assets provide flexibility to the energy economy, so there is propane available for winter heating, gasoline for summer driving, and jet fuel for the holidays.

What are MLPs?

MLP stands for Master Limited Partnership. You can think of MLPs as US energy pipeline companies with an advantageous tax structure. MLPs pay no income tax at the partnership (or company) level. Unlike most partnerships, MLPs are public companies, trading on U.S. stock exchanges and filing reports with the Securities and Exchange Commission (SEC).

What are C corporations?

A C corporation, under US federal income tax law is a corporation that is taxed separately from its owners. Many companies are treated as C corporations for US federal income tax purposes and are subject to corporate income tax.

How is an MLP Different Than a Traditional Corporation?

From a business perspective, MLPs limit themselves to handling natural resources and minerals, MLPs do not pay federal income tax at the entity level, meaning that they can pay out more of their cash flow to investors as dividends. Corporations, on the other hand, do pay federal income tax.

MLPs are also governed differently from regular corporations. Companies such as Exxon, Apple, and Ford are primarily owned by shareholders. Decisions are made by management teams as well as by shareholders at an annual meeting where major issues are decided by voting. A shareholder has one vote per share owned, and either a majority or a plurality of votes may be required for particular decisions.

Most MLPs, on the other hand, are governed by their general partner. MLPs generally have two classes of owners, the general partner (GP) and the limited partner (LP). The general partner interest of an MLP is typically owned by a major energy company, an investment fund, or the direct management of the MLP. The GP controls the operations and management of the MLP and typically owns some portion of the LP. Limited partners (aka people who own units) own the remainder of the partnership but have a limited role in its operations and management

How do Midstream Companies Make Money?

MLPs and energy infrastructure companies largely operate fee-based business models. They earn a set fee for each barrel of oil or unit of natural gas transported, stored, or processed. This is because these companies largely do not own the oil or gas. They generally sign long-term contracts (5 to 20 years in length) with their customers, which makes for stable cash flows.

Accordingly, the revenue equation for most business activities is fairly simple: fee multiplied by volume. As such, more volumes mean more cash flows. On the fee side, a federal agency sets the fee charged by interstate liquids pipelines, and the fee increases with inflation. Pipeline fees can also be negotiated with a customer based on the cost of operating the pipeline and market rates for liquids or natural gas pipelines.

On the volume side, growing production of US oil and natural gas over the last decade has necessitated more energy infrastructure such as pipelines, storage tanks, and processing plants.

How Investors May Make Money With Midstream Companies?

If you own a stock, there are two potential ways to make money.

1) The price of the stock increases and you can sell it for more than you bought it.

2) The stock can also pay you dividends.

MLP dividends are called distributions because of the partnership structure. The amount of distributions relative to the unit (or share) price is known as yield.

MLP distributions are not guaranteed and vary depending on the MLP. The partnership agreements of individual MLPs determine the level of distributions.

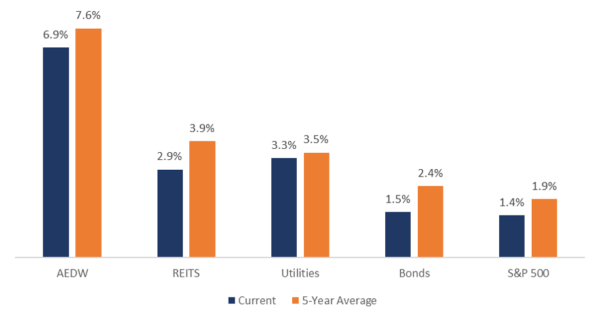

The historical average yield of energy infrastructure companies over the past 5 years has been around 7.6%, which means that if you invested $100, on average, you would be paid $7.60 each year. The chart below shows yields for energy infrastructure companies, represented by the Alerian Midstream Energy Dividend Index -AEDW ), compared to other asset classes. Midstream companies yield 7.6% and boast a higher yield than Utilities and Real Estate Investment Trusts (REITs), which are asset classes known for their income potential.

YIELD %

Past performance is no guarantee of future returns. Source: Alerian, Bloomberg. Data as of 30/06/21. US Bonds = US Bloomberg Barclays Aggregate Bond Index.

REITS = FTSE NAREIT Real Estate 50 Index. Utilities = S&P 500 Utilities Index. Please note that all performance figures are showing net data.

MLP Distributions and Midstream Dividends

Stable distributions were historically a hallmark of the MLP and energy infrastructure space, though the energy downturn that began in the second half of 2014 blemished that track record and additional distribution cuts have been announced in the wake of oil’s price collapse in 2020. When an MLP is going through financial difficulties, it can free up cash by reducing or, in rare cases, eliminating its distribution. While some MLPs continued to grow and maintain their distributions through the downturn, other MLPs cut their distributions. The same can be said of midstream corporations, with some growing their dividends and others cutting.

MLP distributions are not guaranteed and depend on each partnership’s ability to generate adequate cash flow. Unlike Real Estate Investment Trusts (REITs) that must distribute a certain percentage of their cash flow each quarter in order to retain their tax-advantaged designations, MLPs have no such requirements. Like REITs, MLPs pay no taxes at the entity level, so they can distribute much more of their cash flow to investors. Typically, the partnership agreements of individual MLPs determine how cash distributions will be made to GPs and LPs.

Classification of Energy Infrastructure Companies and MLPs

Under the Energy Midstream Classification Standard (EMCS), midstream companies are classified according to their primary business activity:

- Pipeline Transportation: Transportation by large diameter pipeline of crude oil, refined petroleum products, natural gas and natural gas liquids.

- Storage: Storage of crude oil refined petroleum, natural gas and natural gas liquids in above ground tanks, depleted gas reservoirs, aquifers and salt caverns

- Gathering and Processing: Transportation of petroleum or natural gas from the wellhead to processing plants

- Liquefaction: Supercooling natural gas and transforming it from a gaseous state into a liquid, which can be shipped overseas

- Marketing: Retail distribution of heating fuels and wholesale distribution of motor fuels

- Services: Provision of field services to the midstream and upstream sectors, including offshore drilling, compression and saltwater disposal

- Mineral Interest: Ownership of mineral interests leased to third parties that develop, mine and sell reserves

- Regasification: Conversion of natural gas from a liquid to a gas

The Alerian Midstream Energy Dividend UCITS ETF Dist

In July 2020, HANetf and Alerian launched the Alerian Midstream Energy Dividend UCITS ETF Dist (MMLP)which seeks to track the price and yield performance , before fees and expenses, of the Alerian Midstream Energy Dividend IndexTM (Total Return).

The fund offers diversified exposure to energy companies involved in the processing, transportation and storage of oil, natural gas and natural gas liquids in the US and Canadian market and includes MLPs and C-corps.

It is the first UCITS ETF to provide exposure to the energy infrastructure sector via an Alerian index. By employing a synthetic strategy, MMLP enables efficient replication of the index.

The index is fundamentally-weighted by dividends in a transparent, straightforward process. Each company’s total distribution is calculated as shares outstanding multiplied by its annualized dividend based on the most recent dividend.

Each constituent’s weight is then calculated by taking its total distribution and dividing by the sum of all in index constituent distributions. Finally, a 10% cap is applied to constituent weights.

Simply put, companies that pay out more cash flow per share are weighted higher relative to peers that distribute less. MMLP is rebalanced quarterly and reconstituted annually. Quarterly re-balances occur in January, April, July, and October, with only the weightings of constituents adjusted.

Excluding spin-offs, companies can only be added to Alerian Midstream Energy Dividend UCITS ETF during the annual reconstitution in October. However, constituents can be removed from the index between reconstitutions due to special situations such as mergers, acquisitions, or bankruptcies.

Download the PDF.

Alternative investments Commentary » Commentary » Exchange traded products Commentary » Exchange traded products Latest » Latest

Leave a Reply

You must be logged in to post a comment.