Feb

2023

Lost in translation

DIY Investor

16 February 2023

We argue Japanese equities look attractive on both a short and long term view…by Thomas McMahon

Retail investors pulled £100m out of Japanese equity funds in December 2022, according to the Investment Association, making it one of the least favoured sectors. Most popular were North American funds, which saw net inflows of £358m. Retail investors also bought gilts, which probably gives an insight into the reasoning behind buying US equities too: it looks like investors are playing the duration trade, and piling into growth in anticipation of a reversal of course by central banks and an outperformance of high duration assets.

In our view, whether this is true or not, other developed world equity markets look more attractive than the USA for 2023. In particular, we think Japan could do well, and given how poor sentiment has been towards the country, this could be a powerful driver behind relative returns.

No interest

Japanese equities are very much unloved. The BofA Merrill Lynch Fund Managers’ survey shows global fund managers to be less enthusiastic about the US than UK retail punters, and indeed 39% are underweight the country, the highest proportion for many years.

The survey shows they are growing in optimism for 2023, but their preference is for Europe rather than Japan. Europe has been seeing strong inflows from professional investors which have helped push the region’s indices to world-leading returns in January. Japan, however, remains relatively forgotten. This lack of interest is evident in the valuation of the market.

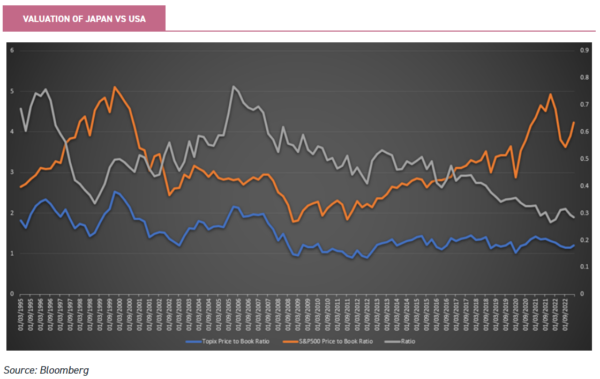

Below we show the price to book of Japan versus the US (P/Es seem tricky at the moment given the volatile outlook for inflation, growth and therefore earnings globally). In grey, we show the ratio between the multiple for Japan, in blue, and the USA, in orange.

It has plummeted in recent years. Partly, this is due to an expansion of multiples in the US, but evident is a step down in absolute valuations of the Japanese market following the financial crisis which has yet to correct.

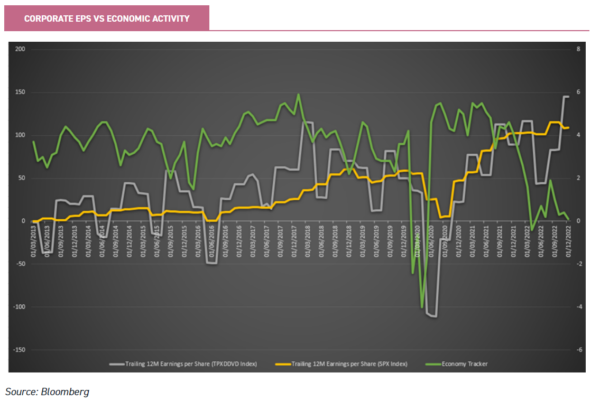

This isn’t to say that Japanese companies have delivered poor earnings growth. Some fund managers we speak to argue that Japan’s low economic growth fools investors into thinking that its companies are performing poorly. In fact, over the past ten years, EPS in Japan has kept pace with the US. In grey below, we show EPS on the Topix and in yellow EPS on the S&P 500.

We have also plotted Bloomberg’s global economy tracker, a proprietary average of various leading indicators. Notable to us is how Japanese EPS follows the indicator with a lag, with quite violent movements. This suggests there could be a substantial boost to Japan plc if investors’ renewed optimism about 2023 proves correct.

Japan’s currency is also cheap on several metrics, compounding the discount the market is on for overseas investors. The yen/USD chart below shows that the US dollar has only given back a small amount of the gains it made against the yen over 2022, and the yen remains near the cheapest levels it has been at over the past thirty years. We think this should be highly attractive to foreign investors, particularly if risk appetite returns.

A key driver behind currency moves is interest rate differentials and, given that Japan is at a different point of the cycle than the US and UK, the outlook is for a closing of the differential in Japan’s favour and an unwinding of the speculation in the US dollar, as the Fed raised rates aggressively. In sterling terms, the historic story isn’t quite the same – sterling has had a few periods of extreme weakness since the early 1990s, but the yen is still substantially weaker than its five-year average against the pound and is therefore potentially looking good value.

Domestic recovery

Japan certainly has the potential to do very well if global sentiment picks up, but there are also a number of domestic factors which give us reasons to be optimistic about the short-term future for its market. Many UK investors are probably not aware that Japan has only recently released the last of its pandemic restrictions, with a wave of infections over the summer having led to caution. Japan is now experiencing a significant bounce back in consumer activity which should boost domestic-facing businesses.

These considerations have led Richard Aston, manager of CC Japan Income & Growth (CCJI), to tilt his portfolio towards domestic-facing small and mid-caps over 2022. One example is DIP, the recruitment agency. DIP concentrates on part-time and lower value labour.

This means it is well-placed to benefit from any reopening trade, while over the long run it should benefit from the Japanese government’s drive to bring more women into the workplace for the first time. We have published an update on CCJI this week.

Another positive factor for Japan is its relatively benign inflation outlook. The Japanese government has been battling to generate inflation for years and, as such, the latest CPI print of 4% is arguably welcome. Inflation has been lower across Asia for a number of reasons, some pertaining to the pandemic response.

Restrictions were never quite as extreme in Japan as they were in the UK, and hence there has not been the same stop-start nature to domestic pricing pressures and employment. Notably, the employment ratio in Japan has already recovered to pre-pandemic levels, unlike in the UK.

This reflects the fact that there is more slack in the Japanese labour market to absorb demand for labour. Masaki Taketsume, manager of Schroder Japan Growth (SJG), tells us he expects modest wage inflation to emerge from the union negotiations this spring. Inflation in Japan has been due more to raw material costs and to the weak yen than labour’s bargaining power.

The yen seems to have stabilised and looks, in our view, likely to appreciate versus the dollar. Meanwhile, Japanese companies are frequently in strong positions to pass on higher prices. As we discuss more below, Japan is home to many high-quality companies with strong competitive positions, which should allow them to be price-makers.

Additionally, when it comes to domestic-focussed companies, the benign inflation outlook should increase their chances of being able to pass on modest price increases to customers. Masaki has also been tilting his portfolio towards domestic companies, examples including Fukushima Galilei, a manufacturer of refrigeration equipment, industrial machinery supplier Hosokawa Micron and chemicals manufacturer Kureha.

Masaki notes these tend to trade at lower valuations than their large-cap or overseas peers, reflecting the relatively low levels of analyst coverage. He also believes that high-quality Japanese banks like Sumitomo Mitsui are in a good place to benefit from an increasing interest rate regime, having used the period of negative interest rates to improve efficiencies. We have published an updated note on SJG this week.

Another under-the-radar reason to be positive on Japan in 2023 is the reopening of China after the abandonment of its zero-COVID policy. China is Japan’s largest export market, just edging out the USA (by 21% to 20%, according to 2022 figures). Investors have been piling into Chinese equities at the start of the year, but perhaps forgetting how positive its reopening will be for Japan.

This could benefit consumer goods and services firms as travel reopens, with Japan being a key destination for Chinese tourists. It will also benefit industry. For example, China is the largest customer for Keyence, the leader in robotics and factory automation, accounting for 29% of its sales over the past two years.

Any increase in economic activity in China, boosted by loose monetary policy, would benefit Japan plc. Indeed, the second chart above illustrates how Japanese corporate earnings have typically done very well very quickly when global economic activity has picked up.

Keyence is the largest holding in JPMorgan Japanese (JFJ). Managers Nicholas Weindling and Miyako Urabe highlight its exceptional operating margins and strong balance sheet which they believe put it in a strong position for long-term success in a secular growth industry.

Keyence sold off over 2022 along with growth and technology stocks globally. In our view, investors looking to play a recovery in duration-sensitive equities (as we suspect retail investors are) might have more success with Keyence than the US giants, which are reporting poor earnings figures and mass layoffs.

They are also likely to be more exposed to the slowing US economy rather than the reopening Chinese and Japanese economies. Nicholas and Miyako argue that the outlook for Keyence has actually improved over the past year or so, while the share price has sunk: the deglobalisation trend only increases demand for automation, while high wage inflation is an incentive to buy robots.

Conclusions

Simon Edelsten, manager of the global equity trust Mid Wynd International (MWY), has significantly increased his portfolio’s position in Japan in recent months. MWY’s 12.7% position, as at the end of January, compares to a weighting of just 5.5% in the MSCI ACWI Index. Simon argues that the changes made to the BoJ’s interest rate cap recently indicate there could be a shift in policy which would see Japanese interest rates rise.

Modestly higher interest rates could encourage Japanese investors to move cash back to Japan, boosting Japanese assets. This is potentially one cause of the long-term decline in valuations of Japanese assets: domestic investors seeking higher interest rates abroad. We note there are already some indications that a reversal is happening as Japanese financial institutions have started to run down the massive overseas bond holdings they have built up over the past decade.

Style factors have been key to generating alpha in recent years, first the long period of growth outperformance and then the rebound in value after the reopening of Western economies. We find it hard to gain conviction in either going forward, and we suspect style will be less important over the coming year or so. Hedging your bets with managers exposed to different styles seems a wise approach to us. It is true that growth seems on sale in Japan after severe falls over 2022.

Portfolios with greater exposure here include JFJ, discussed above, where the managers look for high quality growth companies. Another option is Baillie Gifford Japan (BGFD). We reported in our November note that Matt Brett had been gearing up his portfolio, finding exciting opportunities to buy into growth opportunities on cheaper valuations.

BGFD has a greater mid and small cap focus than JFJ and the majority of trusts in the AIC Japan sector. For more value-tilted exposure, CCJI and SJG make more sense. Neither are value strategies, but valuation plays a greater role in stock selection and both have done well relative to the sector as growth has fallen out of favour.

One factor we haven’t discussed is corporate governance reform. This is now a deeply entrenched trend in Japanese corporate culture. Historically, companies had built up large cash balances and holdings in each others’ shares. These cross-holdings contributed to a closed mentality amongst corporate management.

There has been a culture shift in recent years, with former prime minister Abe’s reforms being critical, and this is leading to increased dividends, buybacks and more professional corporate governance, with minority investors increasingly listened to.

This is throwing up opportunities for managers who can do the stock-specific work and find companies that are likely to change and enjoy the subsequent re-rating, particularly in the less well-researched small and mid cap segments. Both CCJI and SJG have benefitted from this trend. We would also highlight AVI Japan Opportunity Trust (AJOT) in this context.

AJOT was set up precisely to benefit from these corporate reforms and indeed encourage them through shareholder activism. We think it is a highly attractive way to access domestic Japanese opportunities over the long term with the potential for idiosyncratic growth not dependent on market direction.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Brokers Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.