Feb

2023

Guest post: Trading Gold? Runaround Now!

DIY Investor

16 February 2023

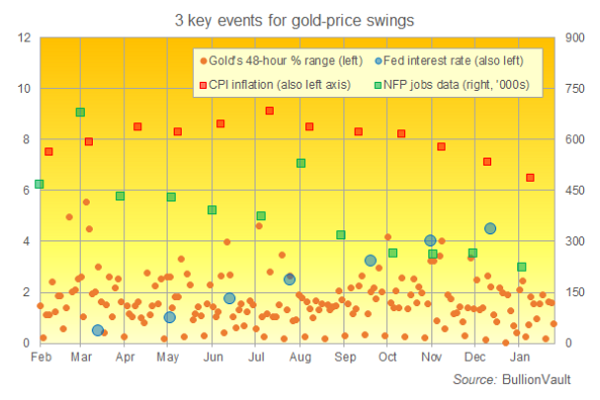

How the Fed, CPI inflation and NFP jobs data spur gold-price volatility…by Adrian Ash

For investors trading the gold market, the US Fed’s first interest-rate decision of 2023, and crucial jobs data from the world’s largest economy repeatedly mark sudden volatility in prices, giving active traders the opportunity to sell a spike or buy a dip. So too can US inflation data, next due on Valentine’s Day.

Longer term? Active traders in gold know that a single Fed decision or key data release is unlikely to change the underlying direction of prices by itself. But gold tends to become more volatile around those events, often falling or rising ahead of the fact before reversing or extending that move as ‘hot money’ betting jumps in or out in a game of Runaround.

US Fed decisions top the table, because gold pays no income, and so it’s natural to expect that rising US interest rates would see gold prices fall and vice versa. But with the Federal Reserve clearly telegraphing its moves in advance, the gold market looks further ahead, jumping or falling on the accompanying Fed comments or projections as the real source of volatility.

That’s also why gold tends to move sharply around the monthly release of US inflation and jobs data, because they affect how the markets think the Fed may act to meet its dual mandate of ‘maximum employment’ and ‘stable prices’.

Here’s how these 3 key events impact volatility in precious metal trading.

#1. Federal Reserve interest-rate announcements

Looking at all 48-hour timeframes across the last 12 months, gold priced in the Dollar typically moved by 1.5% high-to-low. But around all 7 of the Fed announcements, gold swung by 2% or more – coming in the top 30% of 48-hour volatility.

Together, those seven Fed announcements across the last 12 months saw gold move 2.6% on average, led by March with a 3.0% swing low-to-high – back when the Fed sharply hiked its projections for where interest rates would rise over the next 2 years but only raised by 0.25 points – and November, when the precious metal swung 3.2% high-to-low, taking gold back to 2.5-year lows against the Dollar when the Fed hiked rates by 0.75 points for a record 4th time in a row and repeated that it was “strongly committed” to beating inflation.

#2. Inflation on the Consumer Price Index (CPI)

Many people were confused in 2022 by gold’s failure to set new all-time Dollar highs in the face of inflation running at 4-decade highs.

But with the Fed repeating its commitment to fighting inflation with strong interest-rate hikes, higher readings actually worked against gold’s underlying direction, and shorter term, 7 of the last 12 monthly CPI releases saw gold prices move by 2.0% or more.

Those moves were led by March – when gold fell 4.5% high-to-low as inflation at 7.9% beat forecasts of 7.5% – and November, when gold extended the autumn’s rebound by 4.0% low-to-high as inflation slowed to 7.7%, below analysts’ consensus forecasts of 8.0%.

#3. Non-Farm Payrolls growth (NFP)

Released on the first working Friday of the month, the Bureau of Labor Statistics’ first estimate for US jobs growth repeatedly spurs swift and sharp swings in the gold price as well as in other markets such as the Dollar-Euro FX rate, government bonds, and New York-listed equities.

While the 48-hour swing around the last 12 months’ NFP releases only saw gold move by 2.0% or more 3 times, those 3 all came as the data beat Wall Street forecasts for the number of jobs added the prior month, spurring speculation that the Fed might feel more confident in continuing to hike rates without hurting the economy.

So the outlook for this week and 2023 as a whole?

Interest-rate traders now universally expect the Fed to raise by just 0.25 points this Wednesday, the smallest hike since it began raising rates from zero in February last year. With no update to the Fed’s longer-term projections accompanying this week’s announcement, gold traders will be focused on chairman Jerome Powell’s post-decision press conference instead, listening for clues about when the US central bank will stop raising and perhaps start cutting the cost of borrowing.

Anticipation of that ‘pivot’ has already helped boost gold prices in New Year 2023 to the highest since last March’s peak around Russia’s invasion of Ukraine. Delays or disappointment for that expectation would very likely widen the swings around US Fed and key data events still further as the year unfolds.

Adrian Ash is director of research at BullionVault, the world-leading physical gold, silver and platinum market for private investors online

One response to “Guest post: Trading Gold? Runaround Now!”

Leave a Reply

You must be logged in to post a comment.

[…] post Guest post: Trading Gold? Runaround Now! appeared first on DIY […]