Feb

2023

Why we’re ignoring tech and sticking with these unloved markets

DIY Investor

15 February 2023

Saltydog Investor is cautiously watching the tech rebound and investing in these funds instead as it reduces its cash positions.

The top 10 funds in our analysis, based on their returns in January, came from four different Investment Association (IA) sectors.

There are four funds from the Technology and Technology Innovations sector, three from the Global sector, two from North America, and one from China/Greater China. They all made one-month gains of over 10%, not a bad way to start the year.

Saltydog’s top 10 funds in January 2023

| Fund name | Investment Association sector | Monthly return |

| Baillie Gifford American | North America | 12.5 |

| Templeton China | China/Greater China | 12.0 |

| Fidelity Global Technology | Technology & Technology Innovation | 11.9 |

| Pictet-Digital | Technology & Technology Innovation | 11.8 |

| T. Rowe Price Global Tech Equity | Technology & Technology Innovation | 11.6 |

| Pictet – Robotics | Technology & Technology Innovation | 11.1 |

| Baillie Gifford Long Term Global Growth | Global | 10.9 |

| Baillie Gifford Global Discovery | Global | 10.8 |

| New Capital US Growth | North America | 10.7 |

| Liontrust Global Innovation | Global | 10.7 |

Data source: Morningstar. Past performance is not a guide to future performance.

We have seen the funds that invest in technology stocks do spectacularly well in the past, but we also know how volatile they can be. The Technology and Technology Innovations sector was the best-performing sector in 2020, rising by 45%, and in 2021 it gained a further 16%. However, last year it fell by 27%.

To combat the coronavirus pandemic, the world’s central banks came to the rescue in 2020, injecting huge amounts of money and keeping interest rates at record lows – a financial environment that had suited the high-growth technology stocks since the financial crisis of 2007-08.

Saltydog’s top 10 funds in January 2023

| Fund name | Investment Association sector | Monthly return |

| Baillie Gifford American | North America | 12.5 |

| Templeton China | China/Greater China | 12.0 |

| Fidelity Global Technology | Technology & Technology Innovation | 11.9 |

| Pictet-Digital | Technology & Technology Innovation | 11.8 |

| T. Rowe Price Global Tech Equity | Technology & Technology Innovation | 11.6 |

| Pictet – Robotics | Technology & Technology Innovation | 11.1 |

| Baillie Gifford Long Term Global Growth | Global | 10.9 |

| Baillie Gifford Global Discovery | Global | 10.8 |

| New Capital US Growth | North America | 10.7 |

| Liontrust Global Innovation | Global | 10.7 |

Data source: Morningstar. Past performance is not a guide to future performance.

We have seen the funds that invest in technology stocks do spectacularly well in the past, but we also know how volatile they can be. The Technology and Technology Innovations sector was the best-performing sector in 2020, rising by 45%, and in 2021 it gained a further 16%. However, last year it fell by 27%.

To combat the coronavirus pandemic, the world’s central banks came to the rescue in 2020, injecting huge amounts of money and keeping interest rates at record lows – a financial environment that had suited the high-growth technology stocks since the financial crisis of 2007-08.

Countries around the world went into lockdown, changing the way people worked and interacted. The major US technology stocks such as Microsoft Corp – MSFT – 0.31%, Apple Inc – AAPL – 0.42%, Amazon.com Inc – AMZN – 0.16%, Alphabet Inc Class A – GOOGL – 0.07% (the parent company of Google), Netflix Inc – NFLX – 0.39%, and Meta Platforms Inc Class A – META – 0.03% (previously Facebook) soared in value, and smaller companies such as Zoom Video Communications Inc – ZM –1.86% and Peloton Interactive Inc – PTON – 0.51% became household names.

It felt unsustainable and in 2022 we saw a major correction. Tesla Inc – TSLA – 7.51% shares, which at one point had been trading at over $400, were down at $100 at the end of last year, a drop of 75%. I admit that Tesla might be one of the more extreme cases, but even Amazon’s shares fell by nearly 50% in 2022.

After such an extended downturn, it’s not unusual to see prices rally and that’s exactly what happened last month. The Technology and Technology Innovations sector went from being the worst-performing sector in December, down 6%, to being the best in January, up 9.3%. What I am not so sure about is how long it will last.

These companies may be a good long-term bet, and could look cheap in hindsight, but in the short term they face some serious headwinds. Last year, inflation hit 40-year highs and, although it is starting to fall, it is still much higher than central banks’ target, especially in developed economies. As a result, interest rates have risen significantly and will probably have to go even higher.

The US and other Western economies are now on the brink of a recession that could last into 2024. It would not be a shock if this latest rebound soon runs out of steam.

The funds in the Technology & Technology Innovations sector have benefited from the latest surge in the technology stocks, but they are not the only ones. These are enormous international companies, some of the largest in the world, and funds in the North America, Global, and Mixed Investment sectors can legitimately invest in them. I am not surprised that the Baillie Gifford American, Baillie Gifford Long Term Global Growth, Baillie Gifford Global Discovery, and Liontrust Global Innovation funds are in our top 10, along with the technology funds. I’m not familiar with the New Capital US Growth fund, but checked its largest holdings and guess what? They are Apple, Amazon, Alphabet and Tesla.

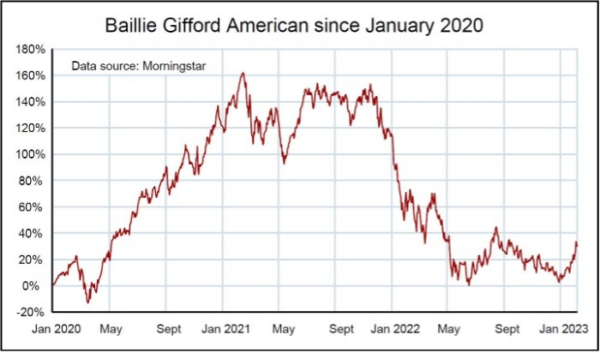

At the top of the table is the Baillie Gifford American fund. Although it is in the North America sector, it invests heavily in the Technology and Biotech sectors. Its largest holdings are Shopify Inc Registered Shs -A- Subord Vtg – SHOP – 2.90%, Moderna Inc – MRNA – 2.41%, The Trade Desk Inc Class A – TTD – 2.65%, Tesla, Amazon, Netflix, CoStar Group Inc – CSGP – 0.39%, NVIDIA Corp – NVDA – 5.43%, Alnylam Pharmaceuticals Inc – ALNY – 1.16% and Watsco Inc Class A – WSO – 0.75%.

Like the technology stocks, it performed fantastically well during the pandemic, but had a difficult 2022.

It has had a strong January, but we saw a similar rebound last summer which reversed at the end of the year.

When we reviewed our portfolios last week, we were tempted to invest in some of the North America, Global, or Technology and Technology Innovations funds, but in the end decided to stick with what has been working for us over the past couple of months. Our demonstration portfolios continue to make steady progress and since Christmas have both risen by around 2%.

For most of last year, they were holding significant amounts of cash. At the end of December, the Tugboat, our most cautious portfolio, had 90% in cash or money market funds, and in the more adventurous Ocean Liner, that figure only dropped to 80%. Since then, we have increased our stock market exposure and Tugboat now has 60% in cash or money market funds, and in Ocean Liner it has dropped to 40%.

In mid-November we invested in a few funds from the Mixed Investment 40-85% Shares, UK equity, and European sectors. They have started well for us …

- Liontrust Sustainable Future Managed, up 3.8%

- Baillie Gifford Managed, up 6.6%

- Janus Henderson UK Smaller Companies, up 6.7%

- Baillie Gifford UK Equity Alpha, up 6.2%

- Man GLG Continental European Growth, up 6.5%

Since then, we have increased our holdings in these funds and added a few more. When we reviewed them last week, they were all showing gains.

We are not completely ruling out the Technology funds but are treating them with caution.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

Leave a Reply

You must be logged in to post a comment.