Feb

2024

Investing Basics: Building Assets With ETFs

DIY Investor

28 February 2024

DIY Investing is Easy With ETFs

With cash earning derisory interest rates, smart investors are growing their wealth by investing in the stock market with Exchange Traded Funds (ETFs). ETFs democratise investing because they’re an easy-to-use, cost-efficient way to reap the rewards of the market. This is what you need to know…

ETFs: In a nutshell

- ETFs enable you to control and build your own asset base. You can do this extremely cost-effectively because ETFs allow you to dispense with expensive fund management and financial advisors.

- ETFs are funds that track popular stock market indexes such as the S&P 500, FTSE 100, and MSCI World. That positions you to participate in the future growth of the world’s leading companies in just a few trades.

- Stocks have earned the highest returns of the main asset classes over time. ETFs capture those profits by holding the same stocks as the market and reducing fees that active funds deduct from your wealth.

- ETFs are as safe as actively managed funds. Your wealth is protected by segregated asset regulations that ring-fence your money should the ETF provider go bust.

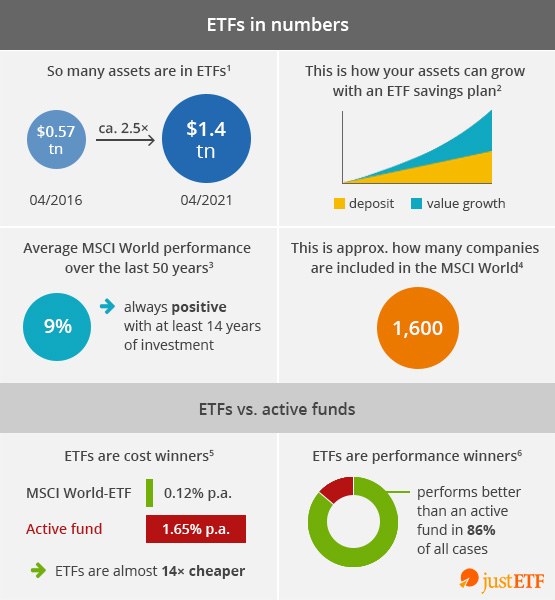

1: ETF assets under management (Europe). Source: Financial Times; as of 05/2021 2: Growth in wealth at average annual global equity return of 5% (Monthly

investment: £300, compounded for 30 years, OCF: 0.2%). Source: justETF Research; as of 10/2021 3: Return MSCI World Net in EUR (1969-2019), dividends reinvested. Sources: justETF Research, MSCI; as of 01/2021 4: Source: MSCI; as of 07/2021 5: Cheapest MSCI World ETF vs the average cost of active equity funds. Sources: justETF Research; as of 07/2021, Morningstar Active-Passive-Barometer; as of 2019 6: 15-year performance, active US equity funds vs corresponding indices. Source: S&P SPIVA Scorecard US Funds; as of 06/2020

You have probably heard of ETFs at some point. You are probably also aware that in times of low interest rates, you should come up with something else than traditional ways of saving if you want to do something useful with your money.

Perhaps you, as a newcomer to investing money, have – like many other people all over the world – had experiences with investment advisors and asset managers who promise to invest your money profitably, but collect substantial commissions in return. And poof, there’s not much left of the return you’ve earned. So actively managed funds are not the real deal either.

So you are faced with the question of what else you can do with your money. The stock market may seem too risky to you. Moreover, you have never been particularly interested in financial topics and don’t have the time to spend on them yourself! Well, you are not alone with this mindset.

The good news is that ETF investing is not complicated or time-consuming. It’s a game-changing way to reach your financial goals because:

- ETFs make your money work harder than cash in the bank – which is losing value after inflation.

- Low charges protect your profits from the high percentage creamed off by financial advisors and active fund managers in excessive fees.

- ETFs hold hundreds or even thousands of stocks in a single fund. That spreads your risk so you’re not over-exposed when a company goes bankrupt.

- A portfolio of ETFs can diversify you across the global economy so you net the rewards of long-term growth.

- That means you’ll benefit from the exciting prospects of new technologies from clean energy to AI.

What are ETFs?

ETFs are index-tracking funds that trade on the stock exchange. The tracking feature means that ETFs hold baskets of shares that match the composition of leading stock market indices such as the S&P 500 and FTSE All-Share. You can buy and sell ETFs in real-time on the London Stock Exchange (LSE) just like shares, except you don’t have to pay stamp duty on ETFs. There are over 1,200 ETFs listed on the LSE (as of 10/2021). This ecosystem enables you to invest in markets and asset classes that were the preserve of high-net-worth individuals and professional traders before the advent of ETFs. Find out more about how ETFs work in our investment guides.

Exchange-Traded Funds: What is an ETF? >

The Advantages of ETF Investing >

Seven Investment Tips From John Bogle >

Don’t Fear the Stock Market

Many people shy away from the volatility of the stock market because they fear high losses. However, you can overcome stock market crashes and lower your risks by investing for the long term. Our analysis shows that you would always have achieved a positive return, if you invested in the MSCI World for at least 14 years, over any period since records began in 1970. Discover why ETF investing works even during economic crises and market crashes.

How Much Risk Should you Take? >

Is Criticism of ETFs Justified? >

Getting Started With ETFs

You can trade ETFs via most online brokers and trading apps. UK brokers are regulated by the Financial Conduct Authority (FCA) and you can confirm their status here. Trading is easy and you can start with as little as £25. Your assets are held on your behalf by a financial custodian company, and you can check your portfolio at any time by logging into your brokerage account.

Your First Steps

- Choose your online broker.

- Open your online investment account. A tax-efficient stock and shares ISA is a great choice. Use a SIPP for pension savings. Opt for a General Investment Account if you’ve filled your cash ISA already and aren’t investing for your pension.

- Fund your account with a cash transfer from your debit card. You will be able to invest straight away.

- Select a diversified ETF (see the next section) that automatically reinvests your dividends. That enables you to take full advantage of the compound interest effect.

- Set up a regular investment plan with your broker, funded by direct debit, to automate the process on a monthly basis.

How to buy an ETF: Frequently Asked Questions >

The Best ETFs for Beginners

You can find the best ETF for you by following a few straightforward guidelines. Click on the links below to read our most important tips for beginners. The justETF search tool also helps you find the right ETF quickly. Just have a play with the filters to get the hang of it.

How to get a Globally Diversified Portfolio With Just one ETF >

Make the Right ETF Selection: Tips and Tricks >

Distributing or Accumulating ETFs: How to Handle Investment Income >

Investing Strategy Tips

A golden rule of investing is: Don’t put all your eggs in one basket. Spreading your risk across stocks, markets, and asset classes is both essential and easy with ETFs. You can ride out – and even benefit from – market turbulence by combining diversification with a long-term perspective, plus a buy and hold strategy. These quick and easy guides reveal more:

Diversification Protects Your Portfolio >

How Buy and Hold Works With ETFs >

Create a Diversified, Low-cost ETF Portfolio

You can build your own global stock market portfolio using a single ETF. As your confidence grows, you can add asset classes conveniently and cheaply due to the low-cost accessibility of ETFs.

ETF Portfolio Management: DIY or Outsource it? >

Can Your ETF Portfolio Withstand a Crisis: Follow These six Steps to Build in Resilience >

Brokers Commentary » Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.