Jan

2024

Investing Basics: How Buy and Hold Works for ETFs

DIY Investor

17 January 2024

Buy and hold investing is a simple and effective strategy that saves investors from damaging their returns by market-timing and stock-picking. This perspective from Dominique Riedl describes how it can be used with ETFs but it can also be used as a strategy for other investment types such as index trackers

There is now overwhelming evidence that attempting to predict which securities will outperform, and when, is a losing strategy for the vast majority of investors. Even the most skilled fund managers can rarely do this with any long-term consistency. The few that do beat the market can have years of gains wiped out when their luck runs out or confer no actual benefit to ordinary investors once their fees and dealing costs are deducted.

The alternative to accepting sub-average returns in a doomed attempt to beat the market is to accept the market return by investing in ETFs using a Buy and Hold strategy.

Buy

You base your asset allocation on the principles of modern portfolio theory: choosing a diversified asset mix that maximises your expected return for your chosen level of risk. You then continue to buy ETFs in line with your asset allocation, using pound-cost averaging to ensure that you buy more shares when markets are down and profit when they bounce back up. You reinvest all dividends to leverage compound interest and rebalance periodically to manage your risk.

Hold

You ignore market upheaval and never commit the cardinal sin of locking in losses by selling when your assets are down. You don’t churn your assets and rack up dealing costs by constantly chasing the next ‘hot’ asset class or fund. You understand that investors are rewarded for taking a risk over the long-term, so you sit tight during volatile periods and resist the urge to join the stampede when other investors lose their heads.

By investing in broad-market, low-cost ETFs, you are able to diversify conveniently and cheaply and ensure that you hold on to as much of the market return as possible – unlike active fund investors whose profits are drained by excessive fees.

Great investors favour Buy and Hold

Benjamin Graham – one of the most influential investors of all time and mentor to Warren Buffet – laid down the founding principles of Buy and Hold in his book, “The Intelligent Investor.”

Graham counselled against trying to predict future performance or using stock selection to beat the market. He believed that even large institutions should be content with the market return as measured by a broad index. Graham also explained that irrational price fluctuations in the market were caused by the tendency of people to speculate and that these signals could be safely ignored as the value of your securities would eventually be realised through the compounding of reinvested dividends.

Warren Buffet, world-famous investor, philanthropist and one of the richest men on the planet, gave his seal of approval to Buy and Hold when he said: “Our favourite holding period is forever.” Meanwhile, German investing legend André Kostolany described the effect of over-trading on investors when he commented, “Back and forth makes pockets empty.”

John Bogle, the founder of Vanguard and godfather of index investing, pioneered and popularised index funds as the perfect vehicle to execute Buy and Hold strategies. Bogle’s work meant that investors could cheaply invest in a diversified, index-tracking fund that delivered the market return instead of laboriously assembling portfolios that are concentrated in individual stocks.

Though it took over 30 years to gain widespread recognition, Bogle’s message eventually broke through into the investing mainstream, especially in the US. Vanguard’s commitment to low costs and the overwhelming evidence in favour of index investing means it is now the largest provider of mutual funds in the world today. By charging an average expense ratio of 0.18% it has forced competitors to slash costs too – benefitting passive investors everywhere.

Why Buy and Hold can be challenging

Buy and hold means hanging on to an asset during its inevitable periods of underperformance and trusting that it will rise again. That can test the nerve, patience and discipline of any investor especially because markets can be driven away from their fundamentals by fear and greed for a long time.

Fear

Panic-selling is common in down-markets as investors can’t stand to see the value of their assets fall and extrapolate temporary crises into permanent nightmare scenarios. Ironically, this is the kind of behaviour that does inflict genuine loss upon investors. They sell out at a market low and only buy back in after the recovery is underway – when assets must be bought at a higher price. This is the very behaviour that Buy and Hold guards against.

Greed

The other side of the bad-behaviour coin is chasing performance and buying overvalued assets. In this case, investors pile into markets that have recently outperformed. All too often this means buying securities at inflated prices when most of the gains have already been made. Eventually, the market runs out of steam, or the bubble pops, when investors realise their optimism is misplaced. Prices plummet and late-comers who paid too much get burned. Just think of the recent rise and fall of Bitcoin.

The forces of fear and greed feed into each other and trap many a market-timer / stockpicker in a cycle of buying high and selling low. Of course, your investment strategy is most likely to be profitable when you buy low and sell high, and this is the virtuous cycle that Buy and Hold promotes through rebalancing, pound-cost averaging and reinvesting dividends.

Recent advances in Behavioural Economics help explain why investing tends to confound our natural human instincts. Investing success mostly occurs over time-frames that are too long to be adequately managed by our standard cognitive responses that rely on short-term feedback. This is why a rules-based strategy like Buy and Hold can be instrumental in keeping investors on track and in protecting them from self-destructive urges.

Buy and Hold fundamentals

The best way to handle market uncertainty is a properly diversified asset allocation. All Buy and Hold champions from Benjamin Graham to John Bogle recommend investing in stocks for long-term growth and in high-quality bonds to reduce the risk of panic-selling during bouts of volatility.

To put it simply, the less risk tolerant you are, the more high-quality bonds you should hold. That’s because these defensive assets are most likely to protect your portfolio from a frightening drop in value during a bad financial crisis such as the Great Recession in 2008.

Equity ETFs drive growth

Equities are more volatile than bonds but you have to accept that risk in order to benefit from their powerful long-term return potential.

Which equities should you buy? Well, the wisdom of the crowd tells us to buy the global equity portfolio. The best and brightest investing brains in the world decide how much capital should be allocated to shares such as Apple versus Amazon; sectors such as tech versus retail, and regions such as the US versus Europe.

The aggregate of these opinions is expressed in the performance of the markets every single day, and you can buy into that performance by investing in a global portfolio. This is a highly diversified, low-cost portfolio which is perfect for the Buy and Hold strategy and means that you’ll always have exposure to the best-performing parts of the world economy.

Extra diversification

Going beyond a basic equity/bond split, you can fine-tune your holdings with a mix of assets that can deal with a wider range of financial conditions:

- Gold ETF/ETCs – A good diversifier because their performance is usually uncorrelated with equities and bonds. Gold performed well during 2008 because it’s seen as a safe haven by many investors who fear financial collapse or currency debasement.

- Global REIT ETFs – Commercial real-estate holdings are a useful diversifier as they are expected to deliver performance somewhere between equities and bonds.

- Long-term, high-quality government bonds – Flight-to-quality means these assets can be expected to cope well in deflationary recessions like 2008. However, they are risky when interest rates rise.

- Intermediate, investment-grade bonds – A useful compromise because they can hold up during deflationary recessions but are less risky than long bonds in rising interest rate environments, especially if your time horizon is a decade or more.

- Cash or money market ETFs – Recommended for those with short-time horizons and during a liquidity crisis.

Costs with buy and hold

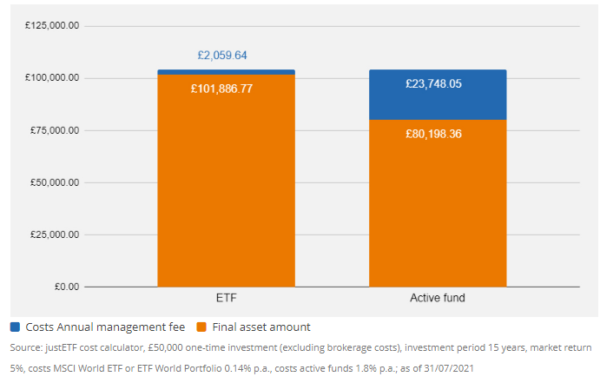

If you implement a buy and hold strategy with the help of ETFs, only the costs for the initial investment and the management costs for the ETF are incurred. These management costs are permanent and amount to less than 0.20% over one year for a low-cost, broadly diversified world ETF. Over a period of 15 years and an initial investment of £50,000, such costs add up to more than £2,000 for a low-cost world ETF, which is at the expense of your asset development. For these costs, the ETF is constantly kept at the latest level of the index.

In the case of active investment funds, the costs quickly reach unexpected heights, as trading takes place in the active fund. In addition, a large part of the estimated management fees flows back to the fund broker. These costs can amount to 1.8% per year, for example. With the help of our ETF cost calculator, it can be determined that with an assumed market return of 5.0%, more than £23,000 in costs would have been incurred. The difference of more than £21,000 would ultimately be missing from your capital accumulation. We have assumed that the active fund generates the same return as the world ETF, which only very few active funds achieve over a period of 15 years.

Cost comparison one-off investment £50,000 ETF vs. active fund

Rebalancing

Rebalancing ensures your portfolio stays diversified and helps you buy low and sell high.

Outperforming assets can end up occupying a greater proportion of your portfolio than intended by your asset allocation. For example, imagine that you set an allocation of 10% for Emerging Markets but after years of blistering returns they now account for 20% of your portfolio. That exposes your portfolio to double the amount of Emerging Market risk and there’s an increased chance that the asset could fall in value due to mean-reversion.

Rebalancing enables you to control this risk and take some profits by trimming your outperforming assets back to your original asset allocation target – in this case, 10%. The rebalancing mechanism also means you plough your profits back into a lower performing asset, so ensuring you buy low and sell high.

Buy and hold investing with ETFs

justETF offers you a range of useful tools to implement a Buy and Hold investment strategy with ETFs.

The Strategy Builder helps you settle upon a diversified asset allocation and choose your ETFs while the Order List makes rebalancing easy. You do not need to be an economist or a hedge fund manager to run your own portfolio.

Start now with the justETF Strategy Builder to create your own ETF Buy and Hold portfolio.

Good to know: The low-cost, index-tracking properties of ETFs make them ideal for Buy and Hold investors. Learn more about the benefits of ETFs now.

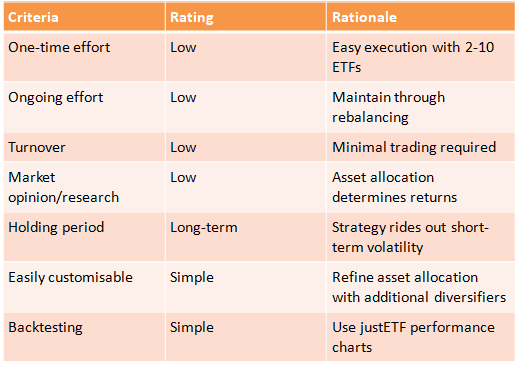

Buy and Hold pros and cons at a glance:

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education » Isas commentary » Latest » Pensions commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.