Mar

2024

Investing Basics: Can your ETF portfolio withstand a crisis?

DIY Investor

14 March 2024

Markets can crash 60% in extreme conditions. But you don’t have to endure losses this high if you build resilience into your ETF portfolio. Our six-step process shows you how By Dominique Riedl

As markets claw themselves back to where they were pre-Covid, if there’s one thing that all financial experts agree on, it’s that there will be another stock market crash. The problem is that nobody knows when it will happen.

Moreover, the shape of the next financial crisis is impossible to predict with certainty.

Very few foresaw that the seeds of destruction in 2008 were being sown in sub-prime; fewer still would have predicted the global economy being paralysed by a global pandemic; that’s why active managers fail to live up to their promises to switch out of risky assets at the vital moment. Most of them are like military chiefs planning for the last war.

Yes, fund managers make great play of their ability to hedge risk with financial instruments such as derivatives. But the cost of these strategies takes a huge bite out of investor returns.

There are also no guarantees that this extra complexity actually works. Many hedge fund managers haven’t been able to match the S&P 500’s post-2008 bull run, after fees. And will their strategies prove their worth in the next crash? The point of the ‘Black Swan phenomenon’, as described by crisis theorist Nassim Taleb, is that it is beyond the bounds of contemporary risk modelling. A Black Swan is an unknown unknown by definition.

Failing to plan for the next crisis is a mistake. Planning for the last crisis is a mistake. Therefore we need a plan that is resilient across as many dimensions of risk as possible without being ruinously expensive or excessively neurotic. The answer is as simple and wise as it is cost-effective.

A robust ETF portfolio strategy

A robust investment strategy accepts risk as part of life and builds it into your portfolio like an earthquake-resistant building flexes with a shockwave. ETF investors can similarly withstand a crisis by following the following six steps:

- How long can you keep your money invested?

- What are your sources of return?

- Is your ETF portfolio sufficiently diversified?

- Does your ETF portfolio have a defensive component?

- How much does your investment cost?

- Have you built in resilience?

How long can you keep your money invested?

The golden rule is to avoid selling at a loss. If you keep your money invested during a crisis then your losses only exist on paper – they are only realised if you sell. Therefore, the longer your time horizon, the greater your capacity to ride out any turmoil and allow the recovery to restore your portfolio’s value.

Over the long-term, the performance of your equities aligns with the economic growth of the markets you invest in. That’s why investing pays over the long-term. Inevitably the market regains its nerve and pricesrebound as growth continues.

You can deal with shorter time periods by allocating more to defensive assets. That way you have more crisis-resistant options to call upon while you wait for your riskier growth assets to recover. See step 4 below.

What are your sources of return?

Equities are the most powerful source of return available to investors. And of course, your equity ETFs depend on the fundamental performance of the underlying company shares that they track.

But share prices are often influenced more by the market’s expectations of future prospects, whether that be of the company, its sector, or the economy upon which it depends. Those expectations can become unmoored from the fundamentals which is why markets boom and bust.

In the long-run, equity prices return to the fundamentals, and you will profit more over time if you can buy more during the busts and sell during the booms. That’s the essence of ‘buy low and sell high’ – a discipline which is much easier to execute if you use rebalancing and pound-cost averaging techniques.

Strong equity returns also boost the compound interest effect that snowballs your wealth over the long-term. And part of the beauty of using low-cost ETFs is that the compound interest effect is magnified because you keep more of your investment returns every year.

Tip from John Bogle: Keep at least 50% of your portfolio in equities, the rest will be in low-risk assets like high-quality government bonds to even out volatility. Keep things simple, ignore the noise and trade as little as possible.

Is your ETF portfolio sufficiently diversified?

Diversification is known as the only free lunch in investing. The more widely you diversify, the less vulnerable you are to underperformance by any one company or asset class. It’s best to diversify across asset classes and within asset classes. ETFs enable you to do this at a cost and speed that was unimaginable in the past.

A few broad equity index ETFs (like the MSCI All-World) enable you to invest across thousands of companies from every region of the globe, including fast-growth regions like the emerging markets.

High-quality government bonds are the ideal defensive asset class to complement your riskier equity growth picks.

Other useful asset classes include REIT ETFs (good for growth and tend towards low correlations with equities) and gold ETCs (defensive and uncorrelated with equities or bonds).

High-yield bonds and commodities are another source of diversification but the jury is out on whether they offer sufficient benefits in the long-term.

Does your ETF portfolio have a defensive component?

The most critical step you can take to reinforce your portfolio is to create a strong defensive asset allocation. This allocation is not primarily designed to generate returns. Instead, it is built from assets that have historically weathered a crisis well in comparison to equities. When equities nosedive, your defensive assets provide a source of liquidity should you need to dip into your capital, and can even rise in value, thereby reducing portfolio volatility during market turmoil.

Useful defensive assets are:

Cash – up to £85,000 is currently protected by the FSCS deposit guarantee scheme for every authorised financial institution you hold money with. Cash is king in a crisis thanks to its liquidity and that government-backed guarantee.

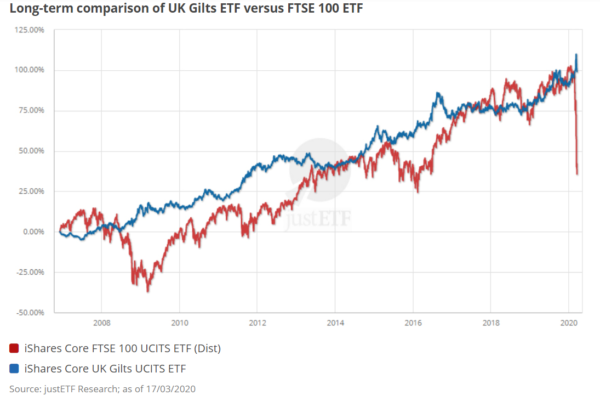

High-quality government bonds – historically this asset class has been a good counterweight to falling equities. Long-dated bonds performed best during the 2008 financial crisis as investors fled to quality. You can see in the chart below that while equities crashed (red line), bonds pulled in the opposite direction at the right moment.

Not all bonds are equal during a crisis. Make sure that your defensive bonds are held in your home currency (i.e. UK investors should hold gilt ETFs), or are hedged back to your home currency if you prefer to diversify into global government bonds.

High-yield bonds are vulnerable in a crisis as they have riskier credit ratings and index-linked bonds did not perform particularly well during the Credit Crunch either due to fears of deflation.

Yet, index-linked bonds can be expected to perform during periods of high unexpected inflation that are liable to hurt other asset classes.

A gold ETC can also form part of your defensive allocation. Gold tends to perform when the market fears a systematic meltdown or currency debasement, which is why it spiked in value during and after the 2008 crisis. Gold is a highly volatile asset class though and doesn’t pay income, hence it should be a minor holding.

Remember, the shorter your time-horizon, the more you should hold in defensive assets so you can weather a financial crisis without selling your equities.

Ultimately, your defensive mix is something of a balancing act. Low-risk assets usually deliver a low return, so they dampen your performance when the economy booms and equities are flying.

Moreover, different defensive assets will come to your rescue during different types of crisis. So you must balance your need for growth versus your personal risk tolerance and accept that diversification means that something will always underperform. Investing for all weathers means that your portfolio will rarely shoot out the lights, but you will never be completely caught out either.

How much does your investment cost?

The lower your costs, the more return goes into your pocket rather than a fund manager’s. It’s that simple. That makes you better off with ETFs because, as independent analysis shows, expensive investment products do not outperform on average. A robust, crisis-resistant strategy does not rely on higher cost smart beta or dividend products either. Low-cost, plain vanilla ETFs do the job perfectly well. Better still, intense industry competition reduces ETF costs year-on-year.

Our tip: Use the justETF strategy builder and ETF screener to quickly find and compare the cheapest products for your investment strategy.

Have you built in resilience?

The less your plan relies on everything working perfectly, the more resilient it will be in a crisis. For example, jumbo jets can suffer multiple engine failure and still fly because critical component redundancy is built in.

The point that optimisers miss is that a good investment strategy also features component redundancy. The optimisers urge to fine-tune makes them fragile when the markets stubbornly refuse to go along with their plans. All the incremental gains they’ve made can be undone by one downturn they weren’t prepared for.

Therefore it’s best to look at your plan in the round and not expect too high a rate of return. Stress test every component. You may have invested in a second property as part of a diversified portfolio. Physical property can be an excellent complement to bonds or gold but bear in mind it may well be illiquid in a crisis.

If you’re leveraging your returns by hoping to use stock market gains to pay back a loan, consider what might happen if things don’t go according to plan. Leverage magnifies losses, so it may pay to be cautious and pay back your loan in cash.

What about your investment platform? How would you manage if it went into administration and it took six months to recover your assets? Consider diversifying across platforms too. A financial advisor can provide a useful independent perspective on these issues.

Making your ETF portfolio anti-fragile

Remember that it’s human nature to be optimistic about our personal futures. It’s all too easy to forget the lessons of the past and to project the current bull market into the far future.

That cognitive blindspot can lead us into trouble when financial markets turn nasty. Lateral thinkers like Nassim Taleb recommend hacking your human nature by using anti-fragility strategies. Anti-fragility means rejecting optimisation and building a plan that’s resilient under stress. Following the six-steps above will help you do that for your ETF portfolio.

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education » Latest » Take control of your finances commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.