May

2022

In and out of two funds and finding shelter amid a financial storm

DIY Investor

30 May 2022

Saltydog’s cash pile has increased further after disposing of two funds that have seen their short-term performance reverse.

Both of our demonstration portfolios have gone up in the last month, but we have to accept that we are unlikely to see any major gains when we are holding so much cash (currently 77% of the Tugboat portfolio is cash and 59% of the Ocean Liner portfolio). The advantage is that it protects us from potential losses, and that seems a bigger concern at the moment.

We have not held our current selection of funds for that long. Our oldest holdings only go back to 20 January 2022, and they are JPM Natural Resources in Tugboat (currently up 19%) and TB Guinness Global Energy in Ocean Liner (up 29%). They had a big fall a few weeks ago, but seem to be back on track.

Most of the other funds we are holding have also risen since we first bought them. When we reviewed the portfolios last week, there were two exception; HSBC Balanced fund, in Tugboat, and M&G Episode Growth, in Ocean Liner. They have now been sold.

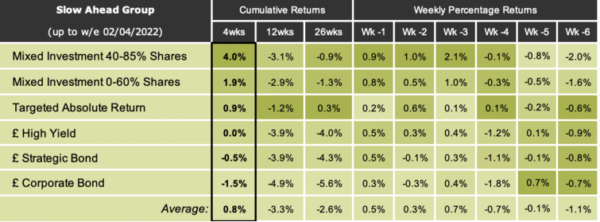

They were both from the Mixed Investment 40-85% Shares sector, in our ‘Slow Ahead’ Group. We went into one of them at the end of March and the other at the beginning of April. At the time, the Mixed Investment 40-85% Shares sector was at the top of the ‘Slow Ahead’ performance table. In the data published on 5 April, looking at performance up until the end of the previous week, it was showing a four-week return of 4%.

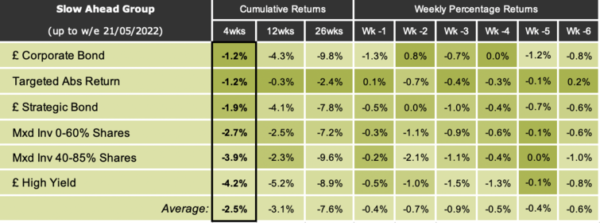

In the end, that rally was short-lived. All the sectors in this group are now showing losses over four, 12 and 26 weeks. Here is the table that we published last week.

It is a shame because these tend to be the least volatile sectors and in the past some of the funds have performed well for us. Unfortunately, that is not the case at the moment.

With inflation at record highs, it does not feel great holding so much cash, but there do not appear to be too many other options. We could invest more into the energy funds, which would certainly have given us greater returns over the past few months, but that would break our portfolio rules and increase their overall volatility. We know these funds can be volatile – a few weeks ago, the TB Guinness Global Energy fund went down by 6.6% in a day – and then there is the issue of having all our eggs in one basket.

We could have used an exchange-traded fund (ETF) to ‘short’ the market, but that is beyond the remit of our demonstration portfolios. They are designed to be relatively low-risk, easy to understand, and a guide to help new members start to get to grips with the data that we provide each week. Investing in almost anything else would just have led to losses.

It is frustrating sitting in cash, however at the moment I would rather be protected in a safe haven than stuck out in the storm waiting to be rescued. Having said that, we are keen to get back to sea when conditions improve.

Over the past 12 months, more than 70% of the funds we analyse have gone down. So far this year, the only sectors that have made any real progress are infrastructure, Latin America and natural resources.

This reflects what we are seeing in global stock markets. Since the beginning of January, the S&P 500, probably the most followed stock market index in the world, is down 13%. The tech-heavy Nasdaq has fallen more, by 22%.

Elsewhere, the Shanghai Composite is down 13%, and the French and German markets are down 8%.

The FTSE 100 is currently up 2.9%, but the FTSE 250, which is probably a better reflection of the UK economy, is down 12%.

Sometimes when conditions are unfavourable, the best option is to just sit tight. As Jesse Livermore said, “What beat me was not having brains enough to stick to my own game – that is to play the market only when I was satisfied that precedents favoured my play“. He was one of the greatest traders of all time. At his peak in 1929, he was worth $100 million, that is around $1.5 billion in today’s money.

We have a similar philosophy. Invest only when recent performance suggests the reward is worth the risk. We then go on to say that we should only invest in the more volatile sectors if the recent returns are higher than we would have achieved in the less volatile sectors.

Bearing this in mind, it is not surprising that we are predominantly in cash, but with some exposure to the energy and natural resources funds.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.