May

2022

Focus on Funds: What enables an investment fund to outperform in difficult markets?

DIY Investor

31 May 2022

With the ripples still spreading from the Woodford debacle, Hannah Barnaby believes that well run funds can outperform without punting on illiquid assets.

Part of the special sauce of successful funds is the ability to adapt to the market environment – the ability to tilt or flex investment styles when required; this can avoid the pitfalls associated with static or concentrated style exposure, typically embedded in some established investment processes.

Such funds are unconstrained by a single investment style – be it value, growth, quality or momentum – rather adopting an unbiased and flexible approach to selecting stocks; the ability to employ a robust and forensic selection process across multiple style exposures, permits investments based on their relevance to the prevailing market environment.

By way of an example, those seeking to achieve long term growth from North American equities have faced the perennial challenge of value stocks (those trading at a discount to peers) and growth stocks (companies with the best prospect for business growth) vying for their attention.

This has caused some investors to experience long periods of underperformance when one style eclipses the other; the disruptive nature of the market fluctuating between value and growth also caused pronounced drawdowns from funds whose style was out of favour.

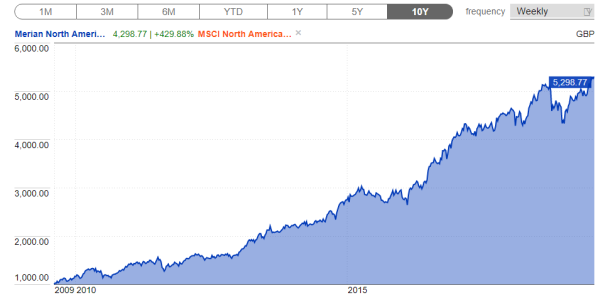

In recent years many growth-oriented managers in the US have outperformed those with a preference for value stocks; this is the performance of the Merian North American Equity Fund since the global crisis

Its portfolio’s construction is driven by structured analyses of companies, including stock-price valuation, balance-sheet quality, growth characteristics, capital efficiency, analyst sentiment and market trends.

It believes that the North American equities universe is broad enough and sufficiently diverse to continuously offer opportunities for active stock selection, independent of the state of the market; its diverse stock selection allowed it to navigate the impact of style rotations.

ETFs have been increasingly popular for those wanting US equity exposure based on the perception that it’s difficult for active managers to outperform the S&P 500, or reasons of cost.

That may resonate after a protracted bull market but with increased volatility indices such as S&P 500 and MSCI North America may be skewed toward a particular style.

Its flexibility has allowed MNAEF to deliver returns that are less correlated with peers that have a more static style exposure – specifically value- or growth-orientated funds.

Such funds believe that the prospects of outperforming in good times while providing downside protection in more challenging environments may be enhanced by using an investment process that’s inherently flexible.

MNAEF has proven through consistent performance, capable of adapting to changes in the market, thereby avoiding the pitfalls of overly persistent biases, while enhancing the overall risk-adjusted return profile of investor portfolios – and there should be few concerns about the liquidity of the stock it holds.

First published in August 2019

Leave a Reply

You must be logged in to post a comment.