May

2022

Reality strikes Global markets

DIY Investor

29 May 2022

Summary

In the face of a mix of pressures, markets are demonstrating that they can no longer defy gravity. Amid intensifying inflation pressures, investors are starting to challenge valuations and earning expectations – and they should alter their positioning accordingly – by Gregor Hirt

Key takeaways

|

What has happened?

Equity markets have started the week on a gloomy note. Until now, European stockmarkets have seen the biggest impact of the invasion of Ukraine. On Monday, it was the turn of US equity indices to play catch up, as the S&P 500 slid more than 3% during the day’s trading. It seems the markets realise that the US Federal Reserve’s famous “put” – its historical pledge to step in to support asset markets when needed – is definitively now history, or at least has a lower “strike price” than previously.

The central bank is using multiple channels to cool the broiling inflation pressures, and this will come at the cost of financial assets if necessary. Indeed, with real yields now in positive territory, the attractiveness of stocks – both on an absolute and relative basis – is starting to be challenged.

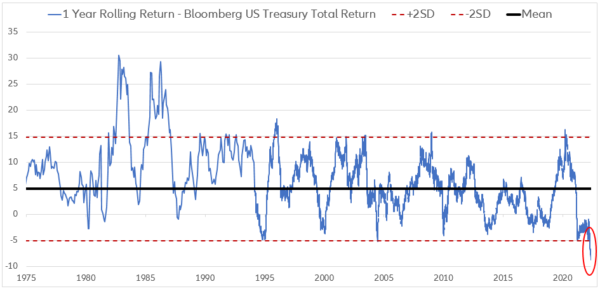

As for government bonds, it seems that risk-off is starting to trump inflation fears – at least in investors’ minds. While US government bonds have been seriously under pressure in recent months, the situation seems to have stabilised – at least temporarily – in recent days (see Exhibit 1).

Exhibit 1: US government bonds are the most oversold in at least 50 years

Alongside the Fed’s decisive action to curb inflation, which will likely hit the economy over time, international factors could also lead to a weaker global economy. Our assumption that Omicron would be hard to control in China is unfortunately materialising. Outbreaks are leading to further shutdowns of cities and productive activity in the world’s second-largest economy. This could lead to another round of international supply shocks, negatively impacting a global economy already disrupted by the attack on Ukraine.

Against this backdrop of inflation stresses and geopolitical uncertainty, investors have finally started to question valuations and earning expectations that have remained relatively lofty. In particular, they are challenging still optimistic assumptions concerning the solidity of margins in an environment of rising input prices, whether these are wages or energy prices. This reassessment of the economic situation also starts to spill over into credit spreads, which have crept up in the past few weeks. While not dramatic, this trend will further stress companies’ margins by increasing refinancing costs.

All in all, we are entering a difficult period where still worrying inflation rates will require central banks to reduce overall liquidity, while higher yields, input prices and supply shocks affect companies’ margins. The good news is that investor positioning is moving back to more attractive levels, while valuations have started to come down from what were too rich levels.

What this means for investors

In recent months, our Multi Asset view has been cautious on both fixed income and equity markets while favouring commodity markets. We continue to be positive on energy prices – a view supported by systemic under-investments in the sector.

From a tactical perspective, we expect the market negativity to roll over from bonds into equities in an even bigger way. We remain essentially cautious on bonds, amid worries that interest rates will trend higher over the long term. But we think much of these concerns are priced in in the short term. Therefore we have tactically reduced our underweights in US treasuries and UK gilts – shifting to a neutral stance – while remaining underweight on eurozone bonds and strong underweight on eurozone-periphery bonds.

We are adding to our negative view on equities. Having been very cautious on eurozone and emerging-market equities for some time, we have also moved US equities into negative territory in the past week. The only equity market where we still see some potential is the UK, which benefits from its exposure to energy and healthcare, and its defensive bias.

On emerging-market debt hard currency, our view is negative overall. This hides a split assessment due to the heterogeneity of the index: energy producers like Qatar, Saudi Arabia and even Mexico could prove resilient, while energy importers will increasingly feel the brunt of a stronger US dollar, rising energy prices and slowing global activity. Considering the potential for political disruptions due to higher agricultural prices, we would recommend only investments in actively managed solutions, not index-based ones.

Be ready for long-term opportunities amid the selloffs

Finally, we can only repeat our preference for adding alternative beta-type strategies that may profit from this type of environment. While commodity investments are an obvious choice to protect against rising inflation, commodity trading advisors (CTAs) are having an excellent run year-to-date as they can also short markets. We also see value in volatility investments in the kind of rapidly moving markets that we are currently experiencing. Finally, it may be wise to keep some cash on the sidelines as larger selloffs can open opportunities for longer-term investments at attractive levels.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication’s sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).

2194177

Leave a Reply

You must be logged in to post a comment.