Dec

2022

The UK’s ‘Ridiculous Price Index’

DIY Investor

10 December 2022

It began in 1947 as a refreshing new measure, but has long since become a Ridiculously poor price index; unless, that is, you own what it links to and/or happen to like antiquities by Savvas Savouri

It is full of relics we no longer buy or those we still do in nothing like the volume we once did, or at the prices it claims, for the RPI fails to draw data from the tech-driven arrivistes who have been more than welcomed disinflationary invaders to our consumer lives.

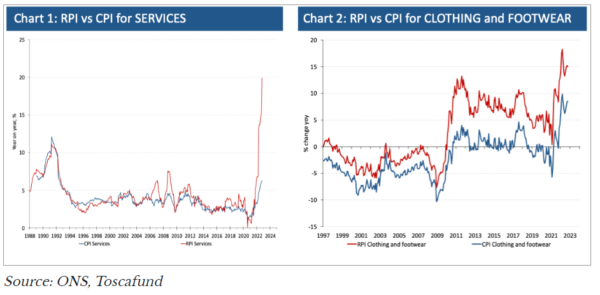

I will not curate the antiques included in the RPI’s ‘museum of deceitful decrepit stuff’. Rather than take my word for it, this is what the ONS has warned for nigh on 10 years: the RPI is “a very poor measure of general inflation, at times greatly overestimating prices and how these are experienced” (see chart 1).

Now, what makes the Ridiculously poor price index presently far from funny is that it is the basis for payments to those who – during such overestimating times – are the lucky holders of the winning tickets that are Index-Linked Gilts. Lucky because at its last print, the RPI recorded inflation of 14.2%. It is also the fortunate reference used for those who use it for their pay demands. Lucky too for those in receipt of defined pensions that rise in line with it. Also welcomed by businesses – notably across telecoms – whose prices index to it. And, to repeat, since the RPI grossly exaggerates genuine inflation, those whose income is linked to it are being overpaid.

Let me return to those lucky owners of the UK’s half a trillion pounds of oh-so-treasured ‘Linkies’. This asset class was first introduced in 1981, when the UK truly had a stubborn inflation problem; wages and prices playing a game of leapfrog. To those who doubt how prized ‘Linkies’ are, try prizing them from their owners. As for who pays out these winnings? The taxpayer. The reality is that taxpayers and, even more so, those paying student loans on top of tax, see RPI indexation as an unjust sentence in a debtor’s prison.

So why do we persist with the criminally comical anachronism that is the RPI? Well, as with so much else – ie, NIMBYism – its use is defended by those serving their self rather than the national interest; forcing The State to pay exaggerated interest.

Whilst our inflationary environment is far better measured by the CPI (Consumer Price Index) than the RPI (chart 2), it too is exaggeratedly flawed. The reality is that the most accurate metric will only come when sterling is digitalised. When this certainty happens, we will have such precise data that we will realise there is less inflation than we have been led to believe. We will also awaken to a UK economy larger and more vibrant than we are being misled into thinking. With these revelations will come greater annual exchequer receipts, c£40bn. We will wake to national output which is at least 10% greater (c£240bn), thus revealing UK debt to GDP is commensurately at least 1,000 basis points lower than the ratio so many are revelling in talking up. As for legacy ‘Linkies’, their exorbitantly generous coupons will make them priceless.

Published by our friends at:

Brokers Commentary » Brokers Latest » Commentary » Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.