Dec

2022

The multi-trillion dollar crypto bubble

DIY Investor

10 December 2022

Since first espousing it, I have not wavered in my view of the crypto marché. To wit, it is a fiction that ill inevitably be exposed – by Savvas Savouri

Now, while the crashing down of the crypto fiction will shock many, it should not come as a surprise at all. That’s because it merely continues a time-honoured tradition of how all momentary financial frenzies end. Of course, my use of inevitable exposes me to the ridicule of hiding behind an economist’s predictable indeterminacy. Ridicule, moreover, that I am so dogged by traditional financial thinking that I cannot see this brave new dawn. Dismissive too, because, as a old-out, I have missed out financially. Or further still, that it is my attempt to stand in the way of financial ‘democratisation’.

Let me be clear, far from objecting to the ‘masses’ being financially empowered, I simply want to warn those who treat investing as a game that losing has real costs. Last year’s GameStop ‘win’, and the ‘victories’ seen in Tesla, cryptos, NFTs and so on, are perilous, as these episodes only act to embolden those otherwise inexperienced in investing to ‘repeat the feat’, and to commit ever more of their money. The result of this escalation is that when boom turns to bust, the cost is very, very dear.

So, claiming the crypto market is worth zero comes down(sic) to two angles, the first of which is actually linked to Blockchain, the roll-out of CBDCs.

- China last year banned crypto exchanges and mining. And the reason for this is the People’s Bank of China is the first major central bank to announce that the very blockchain technology that enabled cryptos can be used to digitalise their currency, the e-CNY. Other central bankers globally are now making steps towards resulted in considerable misunderstanding by some, who suggest this is central banks ‘capitulating to cryptos’. This is utter nonsense. What we have been hearing is a clarion call that the end looms for the long-established tradition of currency fiats to exist almost entirely in bearer-form, leaving no discernible footprints. CBDCs mean the tracking and tracing of traditional money using the blockchain, so that the central bank can monitor every transaction in a way such that evading tax becomes practically impossible. Crucially, to achieve a CBDC you must first ban cryptos. Ban them to prevent a form of Gresham’s Law, where bad money (read anonymous cryptos) drives out good (read traceable by the state). Now, while some object to the CBDC roll-out being another step toward ‘Big Brother‘ state monitoring, my view is that there is nothing to fear from our money being chipped’ for those with nothing to hide.

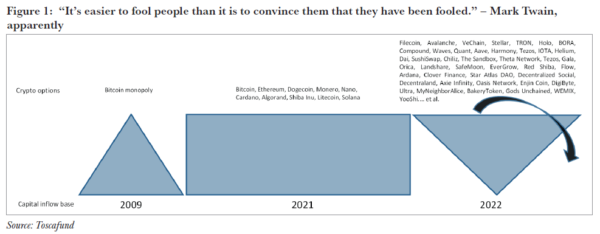

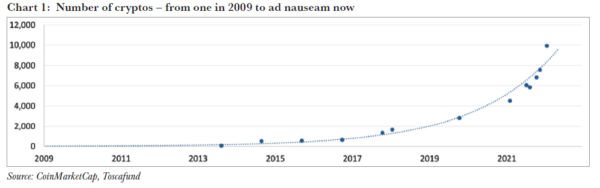

- The growth in the plethora of cryptos and their derivatives is proving exponential relative to which demand cannot hope to keep pace – see figure 1 and chart 1. The simple truth is that as other central banks follow the PBOC and close in on the crypto market, demand for these ‘instruments’ will become ever more constrained. Moreover, far from concerns over the ‘energy’ intensity of crypto mining constraining supply to lift prices, this will work in reverse and accelerate the banning of carbon-creating financial fakes.

To those who have investments in the crypto house of cards who have yet to cash out, I say your card is marked and you will not be saved by any bailout. Unlike the sub-prime crisis of the mid-2000s, when central banks and governments could bail out institutions, viz nationalise banks, when the crypto market goes to zero, who do you bail out? After all, you cannot reward speculators by giving them their moneyback. And arguably no country is more exposed to the crypto market being zeroed than the US. To repeat, it will be zeroed. Do not imagine that somehow there will be a ‘price correction’ that takes the ‘market cap’ of these coins to some fraction of what they are now. When the dust is settled, they are zero – think Wirecard or Enron.

Those who are still ‘invested’ in the crypto fiction in any of its forms should read Charles Mackay’s brilliant Extraordinary Popular Delusions and the Madness of Crowds which, though published in 1841, has never been more relevant.

Published by our friends at The Property Chronicle >

Leave a Reply

You must be logged in to post a comment.