Sep

2018

Wonga? Pah! Here comes Student Loans Company

DIY Investor

17 September 2018

As interest rates applied to student loans hits a whopping 6.3%, Muckler makes no apology for returning to the subject as thousands of young people are now graduating with levels of student debt that could deliver a headwind to their financial hopes and aspirations for at least the next thirty years.

However much the government wants to engage young people with savings and investment, and foster a culture of financial self reliance, there’s no question that it’s harder to achieve financial independence when you start off fifty grand down.

With universities set to increase their fees to more than £10,000 a year by 2020, widespread discontent about spiralling student debt looks unlikely to abate, and leading academics are warning that the government could be forced into a U-turn on fees.

As can be seen below, Muckler’s previous missives have been pretty forthright, but in his third examination of the subject he takes a more measured view, positing that in many ways the biggest damage of student loans is psychological, not financial. Many are petrified of the huge ‘debt hanging over me’, although the reality may be slightly different.

It is now almost two years since Muckler highlighted the double whammy of increasing tuition fees and interest rates applied at levels way above the Bank of England base rate – ‘£50,000 of debt at 18x base rate – loan sharks? No, student finance’ – DIY Investor October 2016

This time last year as interest rates hit 6.1% Muckler highlighted the inherent unfairness of a system that since the abolition of the last maintenance grants in 2015 had disproportionately affected the poorest students ‘The inequity of soaring student debt’ – DIY Investor July 2017

Leading economic think tank, the Institute for Fiscal Studies, has said that students from the poorest 40% of families entering university in England for the first time this September will emerge with an average debt of around £57,000 whereas those from the richest 30% of households would run up lower average borrowings of £43,000.

‘in many ways the biggest damage of student loans is psychological, not financial’

If it rankled at 6.1%, student debt at 6.3% from September 2018 is hardly likely to improve the mood of those wrestling with squeezed wages and the exorbitant cost of accommodation.

This latest hike is because the rate of the Retail Price Index (RPI) hit 3.3% in March and interest on student loans is applied on a sliding scale up to RPI + 3%.

It has also been announced that from April 2019 the earnings threshold at which graduates start to pay back their loan will be raised from £25,000 to £25,725; small comfort.

‘83% of those with English student loans won’t clear the debt’

Maybe he’s mellowing in his old age, but it would be churlish of Muckler not to acknowledge some of the points made by proponents of the scheme.

Firstly, the Institute For Fiscal Studies estimates that 83% of those with English student loans won’t clear the debt (including interest) within 30 years, after which it is written off.

In truth, only those with smaller loans or those achieving consistently high earnings are likely to pay off their loans in full inside 30 years; whilst some may consider that to be a failure of the so called ‘graduate premium’ there will be very many in well paid jobs that will not pay off their loans because of the way the system works.

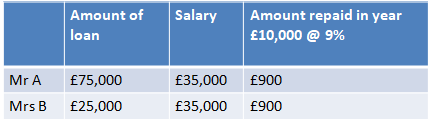

Secondly, the amount repaid each year relates only to earnings, not the size of the loan; 9% is paid on the amount earned above the threshold:

In this example, each pays back the same amount, based upon their earnings in excess of the threshold; clearly the bigger the loan, the longer it will take to pay back, or perhaps more likely, the more slight the chance that it will ever be paid back.

Also, however headline-grabbing a rate of 6.3% may be, if such a small proportion of loans are likely to be repaid, would it be too cavalier to say ‘does it really matter?’

For many that pay back less over 30 years than the amount they originally borrowed, their student loan was effectively interest free.

‘their student loan was effectively interest free’

An area in which to tread very carefully is whether or not you should pay off a chunk of your outstanding loan should you suddenly come into or accumulate a lump sum; in most circumstances the received wisdom would be to pay off any expensive debt.

However if, for example, you were to pay off £10,000 of a £50,000 loan that will be written off after 30 years anyway, all it means is that £40,000 will be written off and you won’t have your £10,000 – possibly compounding away in an investment account.

This is a subject with very many variables and it is worth spending some time getting to grips with; for some, getting rid of the ‘debt hanging over you’ may be of paramount importance, but for those able to view it effectively as a 9% additional graduate tax, collected through payroll all of a sudden it doesn’t seem quite so scary.

With interest rates changing annually, thresholds moving and your earnings likely to change over time, it’s a moving feast, but to get a feel for how your personal circumstances may play out here is a Student Loan Calculator from Money Saving Expert.

However unpopular it may have made Nick Clegg back in 2010 when he supported university tuition fees being trebled to £9,000, many students remained sanguine about the fee and loan regime on the basis that they would only have to pay back a student loan when they reached a certain earnings threshold; loans would be written off if they never earned at that level and many may have dismissed the interest charged on the loans as unimportant.

However, whilst this may hold true for many, there are a number for whom the interest rate will matter a great deal and this hike in the rate due to a link to RPI could add years, and tens of thousands of pounds, to their repayments.

Seen by many as a tax on aspiration, current levels of debt are approximately double what a student may have faced before the changes and many will carry the burden of debt with them for decades.

‘Seen by many as a tax on aspiration’

During the 2017 election campaign the Labour party curried favour with younger voters by pledging to abolish tuition fees and help those with existing debt; however ‘unaffordable’ the Tories declared Labour plans, there will be considerable political pressure for the Government to at least make some effort to alleviate some of the burden.

Figures from the Student Loan Company show that student loan debt has been soaring – up 16.6% in a year – rising above £100bn for the first time, underlining the rising cost of a university education; ironically, universities have never had it so good – university income from teaching is up 25% per student since 2012, and some humanities subjects have seen an increase of 47%.

See how student loans work here

However much Muckler may have mellowed, critics of the regime believe the interest charges are exorbitant and are forcing a generation to start adult life ‘on the back foot’; unsurprisingly the Bank of Mum and Dad is being pressed into action as parents have reportedly re-mortgaged their homes or cashed in their pension pots to help their children avoid taking out student loans.

Nathan Long, from Hargreaves Lansdown, said: ‘For many people, if they make the minimum repayments on their student loans, their debts will only get bigger and bigger. Many may never be able to pay them off at all.’

With interest applied to the debt even as the graduate makes repayments, it will be difficult for those on modest incomes to ever reduce their debt; Hargreaves Lansdown estimate that those starting on a not inconsiderable £30,000 salary and achieving good annual pay rises will take 28 years to pay off their loan.

The Government has said that loans remaining outstanding after 30 years will be written off – leaving taxpayers to pick up the bill, although if that were reneged upon, graduates could well carry this debt well into old age

Through no fault of their own, students will not have worked sufficiently to establish a credit score in their own right and are therefore obliged to accept whatever terms the student loan scheme dictates; the way the interest on student loans is structured keeps borrowers paying for as long as possible.

A Department for Education spokesman told Muckler: ‘Student loans are different from commercial loans, as they are based on income, not the amount borrowed.

‘On average, graduates enjoy a considerable wage premium. Our system is fair’

‘Interest is linked to RPI to ensure that student funding remains sustainable. On average, graduates enjoy a considerable wage premium. Our system is fair.’

RPI will fluctuate throughout the duration of the loan, and critics consider student debt a burden to be carried by low, middle and high earners alike and a significant drag on those looking to purchase a property, or navigate the choppy financial waters of later life.

This interest system may have slipped through with little attention at a time when RPI was at historic lows and the focus was on the tripling of tuition fees; however, RPI was 5% as recently as March 2011 and one of the predicted consequences of Brexit is expected to be a hike in the cost of living – yet another blow to those that would have been inclined to vote remain. Had they been inclined to vote.

‘in fact for the majority the only material difference will be to the amount that is written off’

Admittedly the student loan system is no less transparent than, for example a variable rate loan or mortgage, but Muckler remains concerned at the number of students that may have signed on the dotted without ever having been aware of the fact that wildly fluctuating interest rates could add years and thousands of pounds to their repayments. Supporters would say that in fact for the majority the only material difference will be to the amount that is written off.

Future increases to tuition fees are planned to be based upon the achievement of rigorous ‘gold, silver and bronze’ standards of education, but having reneged on its promise to not retrospectively increase student loan payments and withdrawing maintenance grants, trust in the Government in this area is not high.

One thing is for sure, the decision to take on such a significant student loan is not an easy one and those universities deemed to be in the ‘bronze’ category when grading begins, may well struggle to attract students, particularly to courses that deliver little in terms of employability; however difficult it is to plough a furrow armed only with a BA (Hons) Golf Management, it could be even more so with a fifty-grand monkey on your back.

This is a topic to which we will return, particularly is inflation becomes more significant; it is certainly time for parents and grandparents to consider some of the options that exist in terms of establishing investment plans aimed at giving children a financial head start.

Many are explored elsewhere on DIY Investor, and those considering an automated solution may be interested to learn of the next generation of automated investment managers – robo advisors – at sister site Muckle

It’s all a far cry from when Muckler gratefully received his beer tokens from the local authority and immersed himself in all of the hedonistic and mind-expanding experiences that university life could serve up – achieving a perfectly respectable ‘Desmond’ along the way.

Leave a Reply

You must be logged in to post a comment.