Mar

2023

When the REIT opportunity knocks

DIY Investor

24 March 2023

Be sure your door is open to possibilities, says Hemant Kotak

To say we’re living in very uncertain times may be a gross understatement. A lot has happened in the last few years politically, macro-economically and within financial markets to name a few in the business sphere.

Big structural changes in the way we shop, work and interact have long been underway, but Covid has expedited years into months and left market participants guessing what normality will look like as the dust settles. The fact we’re shopping ever more online, not fully returned to the office, and have greater flexibility about where we live is – to varying extent – priced in.

What is interesting is just how quickly (or slowly) the price signals manifest themselves. For example, private market transactions can be lumpy (especially in commercial property) and take several months to close. Adding to this, properties are heterogenous and deal specific dynamics are concealed in pricing metrics.

Valuers take these transactions with a lag, often wait for a trend to emerge with ‘comparable evidence’, and then overlay their judgement to arrive at estimated valuations which is usually plus/minus 10% of what may be achieved under normal market conditions (under volatile conditions, such as Covid-19, uncertainty clauses are temporarily inserted which retire the 10% buffer). The valuations are then published with a lag or often not available for public consumption. For publicly listed companies (often structured as Real Estate Investment Trusts in most markets) the lag between valuation date and reporting is usually one or two months.

By contrast, observing REIT pricing provides real time pricing signals, albeit these require a filtering system that can cut through the noise.

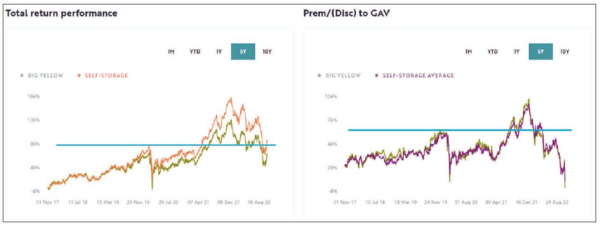

In the example for Self-Storage (see graphs top of opposite page), current total return is close to the pre-Covid peak, however, the substantial premium of the pre-Covid era and recent peak has fully evaporated.

There is no doubt there’s noise in the signal, but the magnitude of the signal is loud and clear – the collective wisdom of the market is steering towards a combination of 1) meaningfully less favourable operating conditions for self-storage and 2) an adjustment to reflect increasing cost of capital.

The history of REIT pricing shows that with greater amplitude and persistence of premiums or discounts, the better the signal as an indicator. This was evident in recent years, as the significant premium to gross asset value (GAV) was an excellent indicator of future return prospects in the private markets. The REIT crystal ball worked well for other sectors trading at premium to GAV, such as industrial and student accommodation, while sectors such as retail and offices trading at deep discounts foresaw valuation declines.

Share prices are impacted by a range of factors. A powerful one of late has been the impact of rising borrowing costs driven by higher Government bonds yields and spreads charged by banks. To add fuel to the fire, the Truss Government spooked the markets with plans for largescale unfunded spending. A full-blown liquidity crisis was narrowly averted only when the Bank of England backstopped the markets with unlimited purchases, which bought time for ill-prepared pension funds to recalibrate their risk positions.

This backdrop led to indiscriminate selling of listed real estate and the sector materially underperformed broader equity markets. The darling sectors of real estate were not spared. In fact, in many cases, were hit even harder because they were coming off a high base.

While the increased volatility is undesirable, it does provide rare buying/repositioning opportunities for those well informed and able to keep a level head. During bear markets, investing is scary, but sowing the seeds in such times yields the best risk-adjusted returns.

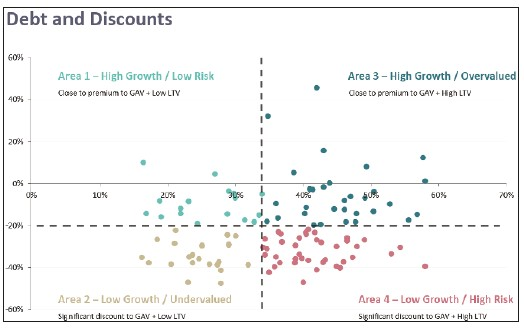

The Debt and Discounts chart (above right) shows the first basic filter when hunting for opportunities. We believe capital preservation (managing downside risks) is of paramount importance. There are four groupings which distinguish between premiums/discounts and balance-sheet resiliency. We’d rarely consider overweighting to a company in group four, and group three companies need to clear a higher bar as there is little margin of safety. Groups one and two is where we’d focus on – financial and valuation risk is lower, while resiliency and a rebound in ratings offer potential upside.

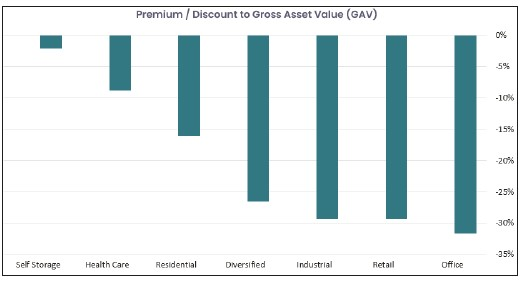

UK REIT valuations as of Q3-2022 showed material discounts across the board, ‘fresh’ appraisals were reported in November by many REITs and showed flat or modest declines in most cases. To be fair, private market transactions that closed in recent months were relatively high – two UK REITs, Great Portland Estates and Landsec, sold office buildings that were valued between £1,400-£1,500sqf, while their c30% discount to GAV implied by the share price pegs its office values at ~£700sqf. There are modest quality differences between what was sold and REIT average portfolios, but most of the gap cannot be explained away.

It’s also noteworthy that despite these REITs having conservative balance sheets and low-cost debt fixed for about eight years, they trade at about a 30-40% discount to replacement cost.

The article was written in Nov-22; while specific data points may be different in Mar-23, the themes highlighted remain relevant.

Published by our friends at:

Alternative investments Commentary » Alternative investments Latest » Brokers Commentary » Commentary » Investment trusts Commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.