Feb

2024

What can investors learn from the Rugby World Cup?

DIY Investor

10 February 2024

Schroder Income Growth Fund plc: establishing a balanced squad of companies poised for victory – by James Wright

We recently saw the culmination of nearly two months of fierce competition between the world’s biggest rugby nations as New Zealand and South Africa battled it out in Paris in the final of the 2023 Rugby World Cup. Both teams had to navigate a multitude of obstacles to get to the final through a display of skill, power, and endurance. Ultimate success came to South Africa who proved to be the best at balancing the strengths of all team members into a cohesive unit prepared to tackle any challenge New Zealand threw at them.

Investors looking to construct a diversified equity portfolio capable of delivering both real growth of income and attractive capital returns can learn a great deal from rugby managers assembling teams for the world cup. Both require careful consideration of specific roles, diversity, collaboration, adaptability, and leadership. A successful portfolio (team) will rely on the manager selecting the best combination of companies (players). The art of assembling a high performing team shares many similarities with the delicate task of portfolio construction.

One can draw many parallels with rugby management and the management team at the Schroder Income Growth Fund plc. The investment company’s principal objectives are to provide growth in income that exceeds the rate of inflation and capital growth as a consequence of rising income. The Trust takes a pragmatic, long-term approach to income investing. It seeks to blend companies with high, sustainable yields today with those that have lower yields today but the potential for future growth. The Trust also makes prudent use of its robust revenue reserves. Investment Trusts can retain up to 15% of their income annually, allowing them to build up reserves during plentiful years of dividend growth to bolster payouts during leaner periods.

The forwards – high dividend yield companies

Forwards in rugby are typically known for their strength and stability in the scrum, providing a solid foundation for the team. Similarly, higher dividend yield stocks are usually associated with established, financially stable companies that have a track record of consistently distributing a significant portion of their profits as dividends to shareholders.

These companies are often found in more mature industries and may have a history of generating steady cash flows. Investing in higher dividend stocks can provide investors with a reliable stream of income and contribute to the stability of a diversified portfolio. A company that can be compared to a rugby forward is National Grid, an energy company operating from the UK and US.

The imperative to transition to a low carbon economy to achieve net zero will require significant infrastructure investment from both governments and companies, the electrification of the grid will be a key component of this. This provides an exciting growth backdrop for National Grid. In addition to this attractive growth outlook, the company has strong asset backing, inflation protection and cash generation in its core business which results in it being a dependable, higher dividend paying component of the Trust’s portfolio.

High dividend yield companies and rugby forwards also share defensive qualities. Forwards provide solidity and help to protect the team from large losses. During periods of market volatility or economic downturns, defensive companies tend to be more resilient compared to their growth-oriented counterparts. Their stable cash flows and dividend payments can provide a buffer against market fluctuations and help protect the value of an investment portfolio.

The backs – lower yield but higher growth companies

The backs are known for their speed and agility, which allows them to manoeuvre through the defence and create scoring opportunities. Equally, lower yield growth companies are often characterised by their potential for above-average growth. These companies may be in their early stages of development or operate in industries with significant growth prospects. They may reinvest a large portion of their earnings back into the business to fund expansion, research and development, or acquisitions. As a result, these companies may offer lower dividend yields compared to more established companies but have the potential for higher capital appreciation.

Backs in rugby take calculated risks to outmanoeuvre the opposition and score tries. Likewise, investing in lower yield growth companies involves taking on a certain level of risk. These companies may face challenges such as increased competition, regulatory changes, or technological disruptions. However, if successful, their growth trajectory can lead to substantial returns for investors. The Trust has exposure to one of the fastest growing major global pharma groups in AstraZeneca.

The company has developed an impressive pipeline of new products in major therapeutic areas, notably oncology (breast, lung, prostate, and ovarian cancers), diabetes and cardiovascular disease. Hollywood Bowl is another portfolio company that can be likened to a back. The international leisure operator has been a long-standing position in the portfolio. While it faced operational setbacks during the pandemic as its alleys were forced to shut these challenges were dealt with agility.

When allowed to reopen it experienced strong trading, gained share and benefited from a reworked and repriced menu. The team believe the company is a market winner that can cope no matter what the environment throws at it. It has self-funded growth in UK, finding more sites recently and has expanded operations in Canada. Hollywood Bowl is appealing from an income perspective, with an attractive dividend yield, boosted by special dividends.

Backs are often the star players, grabbing the headlines by scoring the important tries that win games. For this reason, the best backs are highly sought after, demanding the highest salaries. Similarly, the best growth companies will trade at higher valuations as more investors seek exposure to the future earnings of these exciting companies.

It is paramount that managers don’t get carried away amongst the excitement and euphoria associated with high growth companies. The best portfolio managers maintain a disciplined approach to valuations, knowing that overpaying for even the best company can have detrimental effects on the wider portfolio.

The Schroder Income Growth Fund plc investment team deliberately take a long-term view of the prospects for companies in which they invest and have a strong valuation discipline. Its manager Sue Noffke has spent her entire investment career of more than 30 years specialising in UK equities at Schroders. She became head of UK equities in 2019. The wider team has more than 90 years’ investment experience and includes fund managers Andy Simpson and Matt Bennison, as well as dedicated analysts James Goodman and Tom Grady. The team are prepared to be patient and contrarian and typically have modest turnover.

The substitutions – important sources of diversification

Rugby matches can be intense and unpredictable, with momentum swinging from one team to another. Equally, equity markets can be volatile, experiencing periods of extended growth and dramatic crashes. Diversification is the key to managing this unpredictability, it helps to soften the effects of volatility by spreading risk across many assets in different areas.

In rugby, having squad depth means having a strong bench of players who can step in and perform when needed, reducing the impact of injuries or fatigue on the overall team’s performance. Similarly, when investing, having a deep and diverse portfolio provides a level of resilience and flexibility to navigate market fluctuations and unexpected events.

Just as a rugby team diversifies its squad by having players with different skills and positions, investors can manage risk by diversifying their portfolio across sector, market capitalisation and region. A rugby team’s depth and diversity contribute to its resilience and ability to overcome challenges on the field, a well-diversified investment portfolio helps a portfolio manager navigate headwinds in the market.

The Trust’s investment team maintain a subs bench of stocks they can call on to add to the portfolio when an opportunity arises. They maintain a watchlist of potential investments that have been carefully considered, with detailed due diligence, that they believe could make the cut when the conditions are right. Premium food producer and supplier Cranswick is one such example.

The company has industry leading capabilities and continues to invest at pace into a broad range of growth opportunities for attractive returns. The shares have derated over the past three years whilst the business has grown, expanded new facilities (pork and poultry), developed new capabilities (breaded chicken) and diversified into new areas (pet foods). The derating was an opportunity for the team to introduce the company into the portfolio at an attractive price.

The Schroder Income Growth Fund plc team believes it is important to diversify the sources of income in the portfolio. Low but secure yielding stocks today, typically from stable and growth areas of the market balanced by higher yielding companies in the portfolio that the team believe, following significant research, are more sustainable than the market is giving them credit for. The team believes that this balanced approach provides a good level of income and investment style diversification to meet income objectives.

Form is temporary, class is permanent

The best rugby managers closely monitor the performance and fitness of their players, adjusting the squad when necessary. Likewise, investors should regularly review and monitor their portfolio to ensure it remains aligned with their investment objectives.

This involves assessing the underlying fundamentals of portfolio companies, considering changes in market conditions, and adjusting as needed. By actively managing their portfolio, investors can respond to evolving market dynamics and optimise their risk management strategies.

The Schroder Income Growth Fund plc team believe management of a relatively concentrated portfolio requires a rigorous sell discipline enforced by competition for capital. There are several reasons that the team will sell a stock. Where the valuation is overly discounting the growth potential in the team’s view they will sell. In addition, the team will sell when the investment thesis has played out, for example a successful business turnaround, restructuring or where there are better ideas elsewhere.

The team integrates environmental, social and governance (ESG) factors into its investment decisions. Assessing the management of potential ESG issues informs an assessment of both the upside opportunity and downside protection of an investment. The managers are prepared to invest in companies that are in the process of improving their ESG profile, as they believe this if often a powerful way of unlocking value and having impact.

The best rugby managers understand that players will inevitably have bad games, but ability shouldn’t be assessed in the short-term, as form is temporary. Likewise, successful portfolio managers look beyond near-term earnings and maintain a long-term view of a company’s earnings potential, as well as assessing the quality and quantity of said earnings. Extensive engagement with companies is a key part of the investment team’s process. As one of the UK’s largest investors, Schroders has substantial access to companies’ management teams. It meets with company management teams in advance of investing and thereafter at least once a year, but often on numerous occasions. It is by taking this long-term and direct approach that investors can filter out the market noise and find the long-term winners.

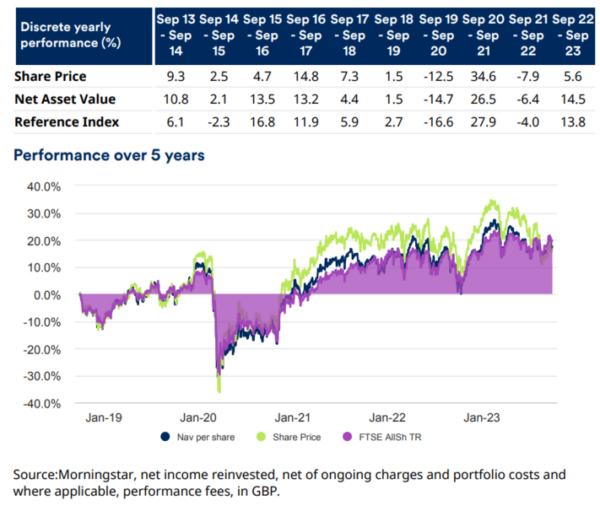

Form and class can also be attributed to the managers, the Schroder Income Growth Fund plc team have demonstrated consistent long-term results by delivering 1.1% annualised outperformance versus the FTSE All Share Index since the lead manager Sue Noffke assumed management in 2011. (Morningstar, net income reinvested, net of the ongoing charges and portfolio costs, as at end-September 2023). This dedication to the Trust’s principal investment objective has enabled an unbroken 28-year record of annual distribution increases for shareholders, earning recognition as a “Dividend Hero” by the Association of Investment Companies.

Click here to find out more about the Schroder Income Growth Fund plc >

Important information

Performance to September 2023

Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise.

Risk considerations

- Concentration risk: The company may be concentrated in a limited number of geographical regions, industry sectors, markets and/or individual positions. This may result in large changes in the value of the company, both up or down, which may adversely impact the performance of the company.

- Distribution risk: As a result of fees being charged to capital, the distributable income of the company may be higher but there is the potential that performance or capital value may be eroded.

- Gearing risk: The company may borrow money to invest in further investments, this is known as gearing. Gearing will increase returns if the value of the investments purchased increase in value by more than the cost of borrowing, or reduce returns if they fail to do so.

Brokers Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.