May

2023

The global funds delivering the best and most consistent returns

DIY Investor

11 May 2023

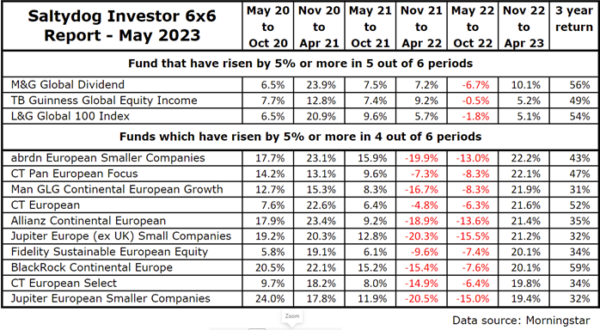

Saltydog Investor’s latest ‘6 x 6’ report reveals three funds that stand out from the crowd.

During the last three years there has been a dramatic change in the investment landscape. We have gone from being in lockdown, when many economies almost came to a grinding halt, through a period of recovery, driven by government support and low interest rates, into the current high inflation, low-growth period.

Over the last year central banks have been forced to raise interest rates, to try to bring down inflation, but that could also lead us into recession. It is a difficult balancing act.

At Saltydog Investor we believe that as market conditions shift, new trends will develop, and different sectors of the market will perform well. That is why we think it is so important to track what is going on and be prepared to change course when necessary.

We provide our members with fund and sector performance each week and at the same time review our demonstration portfolios.

However, we appreciate that there are people who do not have the time, or inclination, to review their investments on a weekly or even monthly basis. That is why we also run our “6 x 6” report every three months.

This is where we are highlighting funds that have performed consistently well over the last six six-month periods. We are looking for funds that have made at least 5% in each six-month period. It is a tough challenge, but we do sometimes find some. The last time was 18 months ago, in our November 2021 report, when seven funds achieved the elusive six out of six.

In our latest report, which covers the three years from the beginning of May 2020 to the end of April 2023, the best we could find were three funds which had reached the target in five out of the six periods.

The table below shows these three funds at the top, followed by the top ten funds that achieved the target in four out of the six periods, ranked by their latest six-month returns.

The top three funds come from the Global and Global Equity Income sectors.

Funds from these sectors have the advantage that they can invest in companies from all across the world. In fact, one of the sector requirements is that they must be diversified by geographic region. Having said that, they tend to focus on the US and to a lesser extent Europe.

The M&G Global Dividend fund has around 50% invested in North America, 25% in Europe (excluding UK), 10% in the UK, and 5% in Australia.

The TB Guinness Global Equity Income fund has a similar mix with 55% in North America, 30% in Europe (excluding UK), and 10% in the UK.

The L&G 100 Index is more concentrated with 70% in North America. It has 15% in Europe (excluding UK), and 7.5% in the UK.

The balance of their investments is split across Africa, Asia and the Middle East.

The next ten funds in the table are all from the European sectors, which we know from our regular weekly analysis have performed particularly well over the last six months. We currently hold the Man GLG Continental European Growth fund and the M&G European Sust Paris Aligned fund in our portfolios.

There has been quite a significant change over the last six months. In our November 2022 report only one fund, AXA Framlington Biotech, had made 5% in five out of six periods, and the leading funds which had achieved it four times were the energy funds, BGF World Energy and TB Guinness Global Energy. Schroder ISF Global Energy and Guinness Sustainable Energy were also in the top ten.

Three months ago, six funds had gone up by 5% in five out of six periods. Five were either energy or natural resources funds. The sixth was BNY Mellon Global Income.

Since then, the energy funds have struggled. Over the last six months, BGF World Energy has lost 11.4% and TB Guinness is down 8.9%. It just goes to show how difficult it is to find any funds performing consistently well in the current environment.

It will be interesting to see if the global and European funds that are currently at the top of the table are still there in three months’ time.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Brokers Commentary » Brokers Latest » Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.