Jun

2023

Three ways in which the energy industry must change and what this could mean for investors

DIY Investor

24 June 2023

We look at three ways in which the energy industry has to evolve in order for the energy transition to materialise, and how equity investors could benefit…by Mark Lacey

It is well known that the energy transition – the shift from fossil fuel to renewable energy – needs to take place urgently in order to save the planet from the dire effects of climate change.

But what does this mean for the energy industry? In our view, it has to undergo three structural changes in order to reduce carbon emissions.

Decarbonisation of power generation

Power production needs to become less carbon-intensive.; in fact, a ‘virtually full’ decarbonisation of the power sector needs to happen by 2050 in order for the world to meet the Paris Agreement’s 2oC target, according to the Intergovernmental Panel on Climate Change (IPCC).

This means that the share of power generated from renewables has to increase. It’s estimated that it will rise from 20% to 80% by 2050 as decarbonisation efforts are undertaken. The majority of this increase will come from wind, solar and small molecular reactor energy.

But this growth doesn’t take into account that the population will grow between now and 2050, likely to 9.5 billion then. Energy consumption is also forecast to grow at around 4% per annum.

What does this mean? It means we could see renewables taking up an even greater share of electricity generation. Add to this the fact that renewables are now cheaper than coal and gas power across two-thirds of the world, and there’s a compelling case to argue that there’s going to be more and more demand for renewable energy between now and 2050.

Electrification of energy use

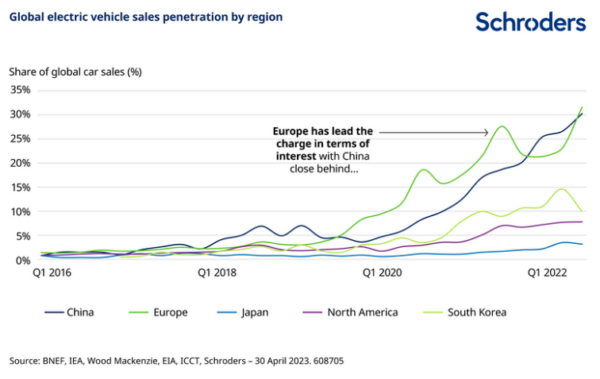

At the moment, the majority of the energy we consume is not electricity – it’s gas to heat homes (particularly in Western Europe and North America) and oil to power vehicles. However, new policies around the world are starting to prevent the use of fossil fuels in power production and transportation which means electric vehicles are going to become more prevalent. Indeed penetration rates of electric vehicles are already starting to increase. As this happens, the share of electricity in final energy consumption is going to grow from 20% to 45% by 2050.

Increased efficiency of energy consumption

Increased demand for electric vehicles, alongside higher demand for residential solar and storage, and energy efficient appliances should drive down the energy intensity of the global economy. This is a good thing because the energy intensity of the global economy must fall by nearly two-thirds by 2050 to limit the growth in overall power consumption that will necessarily arise from factors such as population growth and the ongoing industrialisation of developing economies.

What does this mean for investors?

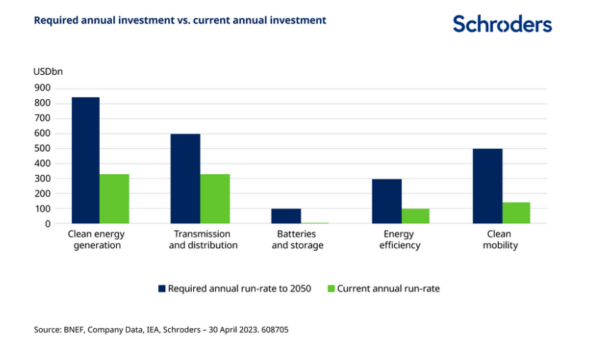

In a nutshell, it means there is going to be a significant amount invested into energy, whether that’s to produce renewable power or improve grid infrastructure to handle new sources of power. It’s estimated that $100 trillion needs to be spent across the energy industry by 2050 in order to achieve the required carbon emissions reductions. We are nowhere near that currently, so investment rates need to increase substantially.

For example, India wants to generate 450 gigawatts of renewable power between now and 2030. The entire global offshore wind market is currently about 18 gigawatts per annum. That’s a significant amount of investment into renewable power by India alone.

But investment isn’t just going to be made into renewables like wind and solar. Investment is needed across the value chain.

New transmission and distribution mechanisms are going to be needed. New renewable assets must be connected to the grid with new transmission lines, which will create new demand for cables and electrical equipment. As more and more people use clean electricity, local electrical distribution grids will also need to be upgraded to prevent blackouts.

Electric vehicles will also need charging points and buildings will need to become less energy-intensive and more efficient, whether that’s through smart meters or energy control management solutions.

Energy storage solutions across different parts of the electricity system will be critical, given the intermittent nature of renewable sources like wind and solar.

The bottom line is that we are about to enter into a period of net energy investment. While the past shouldn’t be relied upon as a predictor of the future, the good news for equity investors is that energy equities have outperformed other equities during prior such net energy investment periods.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Alternative investments Commentary » Commentary » Investment trusts Commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.