Jun

2023

Investing in funds using charts

DIY Investor

25 June 2023

I simply do not pretend to understand how to do fundamental analysis. I’ve tried, I really have. I’ve read books on the subject, looked at the excellent on-line articles on the subject by Phil Oakley at Sharescope, read Paul Scott’s daily share briefing on Stockopedia and even spent over three thousand pounds going on four Robbie Burns courses, writes Humbug

All to no avail. Is it cos I is stupid? Well maybe I am, but I think not.

I totally get the principles and understand the various ratios but when I try to put it into practice and use it to predict future price movements I fail totally.

What is the point of buying into something that you’re fairly confident is undervalued…if no one else agrees and it remains undervalued and not going upwards towards fair value?

For almost all of the past twenty years that I’ve ‘played’ the markets I’ve been a short term trader, and a reasonably successful one. But a health scare last year made me question the risk/reward elements of what I was doing.

To cut a long story short, my trading partner Fagin felt strongly that I was making a mistake changing from trading to investing.

We talked at length about the different issues and in the end challenged each other to see which method would generate a better rate of return.

The rest is history really. The idea got picked up by the investment site www.diyinvestor.net and The Great British Trade Off was born.

Over it’s duration, Fagin walked it; in the final year of the competition, he made £34k on a £100k of capital, I had a hopeless time and lost £7.5k.

Without wanting to take anything away from a brilliant performance on his part, I found the change in discipline very difficult to adapt to and spent a lot of time kicking the ball into my own goal. DUH.

However I’m a quick learner and I hate losing my hard earned money. Last Autumn I took radical action. I went away sailing on my own and spent hours and hours away from all distractions thinking about what I was trying to do.

‘I hate losing my hard earned money’

The Great British Trade Off is one small part of my drive to achieve financial independence, perhaps saying financial freedom might be a better way of putting it.

I like nice things, so for me having enough money to say to myself that I have complete financial independence or freedom involves having assets with a lot of noughts on the end of them.

To state the bleeding obvious, you don’t achieve that by incorrectly investing in things that fall in value do you? I really did need a rethink.

With either trading or investing you have to use a style that suits your personality. I do like the fast moving action that trading produces, but I’d lost my nerve with the risks associated with large positions in volatile companies like gold miners.

It’s strange how our sub-conscious mind works is it not. Set it a task and it beavers away in the background without any conscious effort. One evening on the boat it suddenly came to me.

‘You’re crap at fundamental analysis, so outsource it by buying funds not individual shares’

‘You’re quite good with charts, so use them to spot momentum and invest when you see it’ ‘Use your traders eye to spot entry and exit points and use stop loss’s.

‘You’re crap at fundamental analysis, so outsource it by buying funds not individual shares’

I’ve normally not got a lot of time for ticking boxes, but these ideas ticked all my boxes. I was going to invest my money with the mindset of a trader, but I wasn’t going to be trading. Sure I would cut things quickly if the momentum I thought I’d spotted didn’t materialise, but I was after the big money that comes from the big move.

Wow, I thought how simple an idea is this. Now its far too early to be counting my chickens, but my GBTO portfolio is up almost £5k.

Investing in funds has got a lot cheaper in recent years, certainly there are extra costs on top of the market but they’re not as onerous as they once were. A number of the fund supermarkets no longer charge an upfront percentage fee to invest, there are no obvious buying/selling spreads on most funds, there is no stamp duty on the purchase price and you can take a position on any number of sectors in any part of the world and generally with most funds liquidity isn’t an issue.

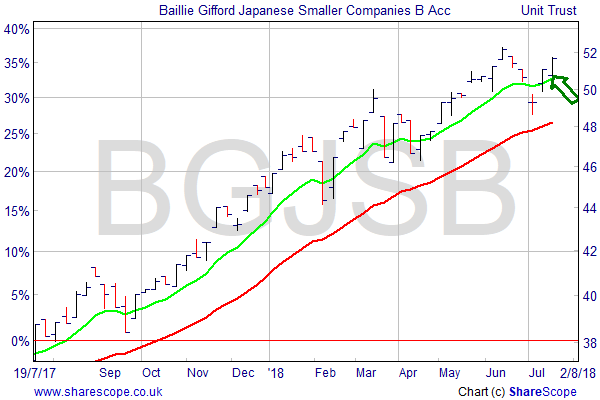

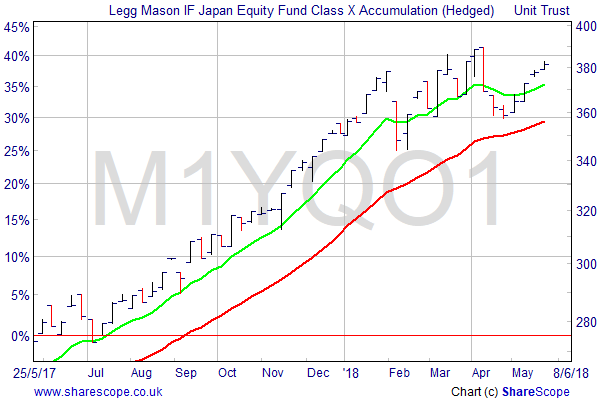

This chart of the Legg Mason Japan Equity Fund that I hold illustrates the sort of momentum I search for.

I’m using the simplest chart structure I could think of. The red line which is a six week moving average doubles as my take profit point if that’s the case or my stop loss point if the investment simply hasn’t worked.

In this next chart of the Sarisin Food & Agriculture Fund the green circle marks the purchase action. There is a year long price up trend in place, a correction down below the red six week moving average, this pivots round and reverses up through the red moving average, by which time it has my full attention. It then crosses up through the green two week moving average which is my buying signal.

Iwill hold until such time as the price closes out a week below the red moving average.

And that incredibly simple system is how I now invest my money not just in my Great British Trade Off portfolio but also my other portfolios.

‘that incredibly simple system is how I now invest my money’

There are a number of rules and percentage allocations that also apply, I’ll cover them in detail another day.

The easiest way of investing is simply to buy an index tracker and check how its doing once a year. Simple though that idea is, its only going to produce market returns less the costs of holding it.

My idea is way more complicated than that, but is still such a simple easy to drive method and one that should produce market beating returns, all for less than an hour’s work a week.

Will it be good enough to beat Fagin over the five year duration of Great British Trade Off?

To be frank with you I doubt it; I think a trader who is right on top of his game will produce better returns than an investor, however he will have to spend twenty or thirty hours a week at it while I’ll spend one, and I believe he is taking on a great deal more risk in the process.

So on balance I’m happy about my decision to only invest and if I do achieve market beating returns, then over the next ten years I will realise my goal of financial independence or financial freedom with enough noughts on the end to make it fun.

First published in August 2018

Brokers Commentary » Commentary » Financial Education » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.