Nov

2023

The UK fund we’ve bought that’s in fine form

DIY Investor

30 November 2023

Consistent performance over the last three years has prompted Saltydog Investor to buy in

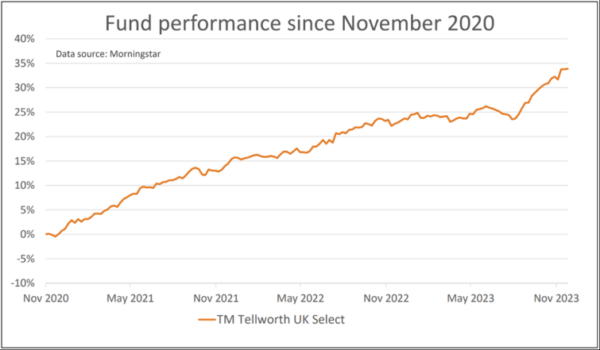

As I mentioned last week, only four of the funds that we monitor have gone up in each of the last six six-month periods. They are MI Thornbridge Global Opps, Aviva Investors Global Equity Income, BlackRock US Dynamic, and TM Tellworth UK Select.

One of our demonstration portfolios has now invested in the TM Tellworth UK Select fund.

It is in the Investment Association’s Targeted Absolute Return sector which is for “funds managed with the aim of delivering positive returns in any market conditions, but returns are not guaranteed”.

Most sectors specify what the fund must invest in. For example, funds in the UK All Companies sector must invest at least 80% of their assets in UK equities which have a primary objective of achieving capital growth. The Targeted Absolute Return sector is different as it is only the outcome that is important, i.e. to generate positive returns regardless of the market conditions. This gives the fund manager much more leeway when it comes to deciding what to invest in and which strategy to employ. Some funds in the sector have the ability to short stocks – profit from declines in share prices.

Due to the different investment approaches, the performance of the funds in the Targeted Absolute Return sector can vary widely, which is why the Investment Association does not provide overall sector performance data for this sector.

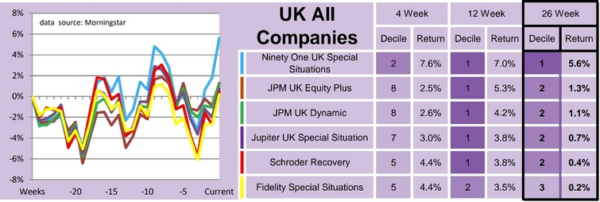

In the weekly reports we generate, we highlight the best-performing funds from each sector over varying time frames. Here is an excerpt from last week’s data showing the leading funds in the UK All Companies sector over the past 26 weeks. Although the overall returns do vary quite significantly, you can see from the graph that all the funds follow a very similar pattern.

Past performance is not a guide to future performance.

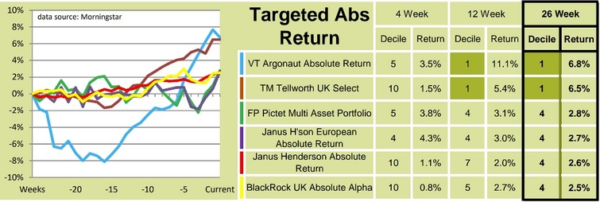

If you look at the top funds from the Targeted Absolute Returns sector over the same period, you can see that the funds are far less closely correlated.

Past performance is not a guide to future performance.

The worst-performing fund in this sector, over the same time frame, had gone down by 5%.

The TM Tellworth Select fund is second in the table, with a 26-week return of 6.5%, but the main reason why we have selected it is because of its consistent performance over the last three years. Markets have been volatile over the last few months and hopefully the funds that have weathered previous storms will be well placed to hold their own in the current environment.

Past performance is not a guide to future performance.

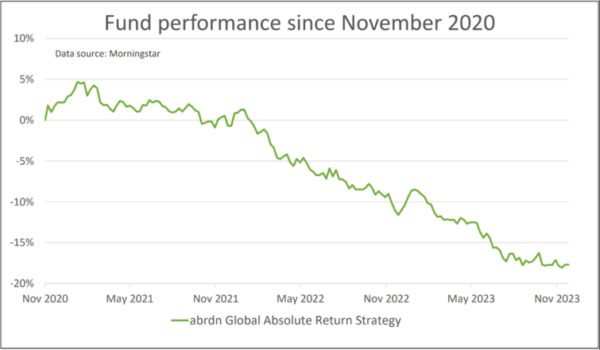

The Targeted Absolute funds typically have a strong focus on risk management and can use various strategies, including hedging, to mitigate downside risk and protect capital during market downturns. However, some fund managers seem to be better at it than others. Although the funds aim to make positive returns over three years or less, not all do. The abrdn Global Absolute Ret Strategy fund seems to have gone steadily in the wrong direction.

Past performance is not a guide to future performance.

Having selected a fund, for whatever reason, it always makes sense to monitor it to make sure it is doing what you expected it to do. Although we are hoping that the Tellworth UK Select fund continues on its current trajectory, we will be keeping a close eye on it.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com

Brokers Commentary » Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.