Jan

2020

The outlook for healthcare stocks in 2020

DIY Investor

30 January 2020

In the US, healthcare was a political focal point in 2019, and will likely remain so in 2020. But amid impeachment proceedings and rampant discord in Washington, the odds that the US Congress will pass sweeping healthcare legislation look low, says Portfolio Manager Andy Acker. Meanwhile, the threat of reform is prompting more innovation, which could help drive growth over the long term.

In the US, healthcare was a political focal point in 2019, and will likely remain so in 2020. But amid impeachment proceedings and rampant discord in Washington, the odds that the US Congress will pass sweeping healthcare legislation look low, says Portfolio Manager Andy Acker. Meanwhile, the threat of reform is prompting more innovation, which could help drive growth over the long term.

Key Takeaways

- Healthcare stocks lagged the broad equity market in 2019, largely as a result of uncertainty about potential reform.

- We believe the sector will continue to see volatility in 2020, but that sweeping changes to the US healthcare system or drug pricing are unlikely in the coming year.

- However, a focus on reducing costs and improving patient outcomes is unlikely to diminish. Consequently, companies are taking steps to improve operations or deliver innovation, all of which could drive long-term growth for the sector.

Healthcare stocks trailed the broad market in 2019 due to worries about US drug pricing reform and calls for a single-payer healthcare system.

So while the S&P 500 Index returned 27% year to date in 2019, the S&P Health Care sector was up only 17%.1

‘Healthcare stocks trailed the broad market in 2019 due to worries about US drug pricing reform and calls for a single-payer healthcare system’

Heading into 2020, investors may wonder if they should expect more of the same, especially since healthcare costs remain a political focal point in the US. Indeed, both the House and Senate have introduced bills that aim to lower drug costs, and the Trump administration has announced regulation that demands greater price transparency at hospitals starting in 2021.

In our opinion, these initiatives face an uncertain path forward. Neither the House nor Senate proposals have bipartisan support, with cooperation especially difficult amid impeachment proceedings. In addition, US hospital groups recently filed a lawsuit to block the Trump transparency rule.

A focus on innovation

Consequently, we believe healthcare stocks could experience more volatility in 2020, but a significant overhaul of the US healthcare system looks unlikely.

Even if reform is passed, it could deliver some positive benefits, including limiting out-of-pocket costs for consumers, which would ease access to prescription drugs and, in turn, potentially improve public sentiment toward the biopharmaceutical (biopharma) industry.

This focus on cost-savings and efficiencies is having other positive effects, too. As we discussed in an article earlier this year, the threat of a single-payer healthcare system has encouraged managed care companies to use technology to better control expenses and improve patient outcomes.

‘the biopharma industry is investing heavily in innovation, delivering breakthrough therapies that could potentially improve lives and lower costs over the long term’

At the same time, the biopharma industry is investing heavily in innovation, delivering breakthrough therapies that could potentially improve lives and lower costs over the long term.

For example, in October, the Food and Drug Administration (FDA) approved the drug Trikafta for the treatment of cystic fibrosis (CF), a life-threatening illness in which patients experience progressive lung deterioration.

Trikafta is revolutionary in that it could change the course of the disease for up to 90% of the CF patient population, including many who previously had no available treatments.

Also this year, the FDA approved Oxbryta, the first therapy to directly address the underlying cause of sickle cell anaemia, another devastating genetic disorder.

Sickle cell anaemia affects the red blood cells of approximately 100,000 individuals in the US2, and can lead to premature stroke, organ damage and death.

In 2020, we expect to see data for the first gene therapy to treat muscular dystrophy, a devastating muscle-wasting disease that leaves many teenagers in wheelchairs.

We also expect to see more data from combinations of new immunotherapy drugs, which have the potential to prolong survival for millions of cancer patients.

With 17 million people globally diagnosed with cancer in a single year,3 the market opportunity for these revolutionary treatments could be significant.

For example, lead immunotherapy drug Keytruda has already reached a US$12 billion run rate, with sales still growing at over 60% annually.

Valuations and M&A

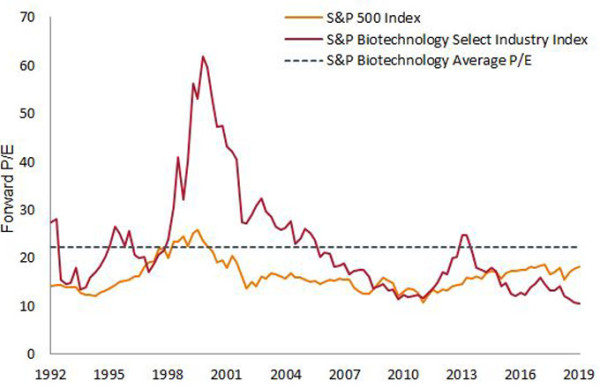

Meanwhile, the recent underperformance in healthcare has compressed multiples, including in biotechnology.

This, in turn, has helped spur heightened merger and acquisition (M&A) activity, and we saw a number of multibillion-dollar deals announced in 2019.

Given attractive valuations and companies’ willingness to invest in innovative products, we could see more of the same in 2020.

Biotechnology price-to-earnings (P/E) ratios

Source: Bloomberg. Quarterly data from 30 September 1992 to 30 September 2019. The S&P Biotechnology Select Industry Index comprises stocks classified in the GICS biotechnology sub-industry. Price-to-earnings (P/E) ratio measures share price compared to earnings per share for a stock or stocks in a portfolio. P/Es are based on forward estimated 12-month earnings. Past performance is not a guide to future performance.

Global growth

Some of that willingness may be encouraged by growth opportunities overseas, particularly in China, where healthcare access has become a government priority.

In late 2018, the country adopted what is known as the “4+7 plan”, a policy that aims to reduce generic drug prices and consolidate China’s fragmented procurement system.

‘Beijing is applying the savings to accelerate the pace of drug approvals and expand access to new medicines’

In turn, Beijing is applying the savings to accelerate the pace of drug approvals and expand access to new medicines.

For example, multinational firms are no longer required to run separate Chinese clinical trials to access the market, and hundreds of products are getting added to China’s national drug reimbursement list.

We believe China’s initiatives are emblematic of a larger trend, in which governments seek to prioritise innovative medicines through savings from older, highly commoditised therapies.

Healthcare can experience significant volatility and a wide dispersion of returns, and 2019 was no exception.

In biotechnology, the top-performing stocks saw gains of over 300%, while the worst performers declined by more than 90%.4 We believe this disparity is driven by the binary nature of drug development, where the clinical and commercial success of new medicines can be difficult for the market to predict.

Given such binary outcomes, we believe it is important for investors to take an active approach to the sector, and 2020 will likely be no exception.

Footnotes

1 Bloomberg, from 1 January to 5 December 2019. Past performance is not a guide to future performance.

2 American society of Hematology at 2019.

3 Cancer Research, worldwide cancer statistics at 2018.

4 Bloomberg, as at 5 December 2019.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Commentary » Henderson Partner Page » Investment trusts Commentary » Investment trusts Latest » Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.