Jan

2020

Bruntwood Retail Bond; Building on Success

DIY Investor

29 January 2020

Bruntwood Investments plc, the family owned property group issued its first retail bond on 24th July 2013, offering investors a 6% return, secured against the Manchester company’s £891m property portfolio.

Due in 2020, Bruntwood was looking to raise £70m to help diversify its funding base, and in return those investing from £2,000 received semi-annual coupons and full redemption at the end of the term of the loan.

Retail bonds proved extremely popular with retail investors starved of income, but many have been frustrated by a dearth of issuance, with some lured by the siren call of mini-bond issuers all too ready to muddy the waters and cash in; even a cursory glance at Retail Bond Expert will point to the error of their ways.

The Bruntwood Group was founded in 1976 and is one of the United Kingdom’s largest privately owned commercial property groups. Their main activity is the customer service led provision of conventional office space with ancillary retail premises, storage and car parking facilities to a range of customers including the public and private sectors.

Commenting on the launch at the time, Chris Oglesby, Chief Executive of Bruntwood, said: “We are very pleased to announce the launch of our first retail bond. This will enable us to diversify our funding base without increasing our leverage. Bruntwood has operated in the regional property sector for 37 years and looks forward to joining the growing number of companies in the retail bond market trading on the LSE ORB platform”.

Bruntwood describes itself as ‘a business led by one purpose: creating thriving cities’; it says its deep connection with the cities it has worked in for more than 40 years sets it apart.

Bruntwood’s commitment to creating thriving cities has helped it to grow into a company with more than £1bn in assets under ownership across more than 100 landmark properties, a development pipeline of £1.4bn, and a team of more than 800 people working across the group.

‘a company with more than £1bn in assets under ownership across more than 100 landmark properties, a development pipeline of £1.4bn, and a team of more than 800 people’

It owns, lets and manages outstanding buildings, workspace, innovation and science facilities through Bruntwood SciTech and Bruntwood Works.

Bruntwood SciTech creates environments and ecosystems that enable companies in the science and technology sector to form, collaborate, scale and grow. It provides high-quality office space, high specification labs, a range of scientific services and a bespoke programme of business support that helps customers gain access to finance, talent, markets and mentorship at every stage of their business lifecycle.

Bruntwood Works creates workspace environments that help businesses thrive; it owns, lets and manages over 100 buildings across Manchester, Cheshire, Leeds, Liverpool and Birmingham, with outstanding workspaces ranging from co-working spaces and meeting rooms through to fully serviced offices and corporate headquarters.

Today (29th Jan 2020) ’Bruntwood Bond 2’ PLC as the issuer has announced an invitation to holders of the £50,000,000 outstanding 6% bonds due 2020 (ISIN: XS0947705215; the ‘2020 Bonds’) issued by Bruntwood Investments PLC to exchange them for new sterling denominated 6% bonds due February 2025.

The ‘New Bonds’ are guaranteed by Bruntwood Limited and Bruntwood Management Services Limited.

Each holder whose existing 2020 Bonds are accepted for exchange by the Issuer will receive on the settlement of the Exchange Offer: (i) £100 in nominal amount of New Bonds for each £100 in nominal amount of 2020 Bonds validly offered and accepted for exchange by the Issuer; (ii) a cash amount representing the accrued and unpaid interest on their 2020 Bonds, from and including the interest payment date in respect of the 2020 Bonds immediately preceding the Settlement Date (as defined below) to but excluding the Settlement Date; and (iii) an exchange fee in cash in the amount of £1.25 per £100 in nominal amount of 2020 Bonds validly offered and accepted for exchange by the Issuer.

The New Bonds will bear interest at a fixed rate of 6% per annum, payable semi-annually in arrear in two equal instalments on 25th August and 25th February each year, with the first payment being made on 25 August 2020, and will be redeemed in accordance with their terms and conditions at their nominal value on 25 February 2025.

The New Bonds are expected to be listed on the Financial Conduct Authority’s Official List and admitted to trading on the electronic order book for retail bonds of the London Stock Exchange’s Main Market.

Holders of the New Bonds should, in most normal circumstances, be able to sell their holdings during normal trading hours (subject to market conditions) on the open market through their stockbroker.

Holders of the 2020 Bonds may decide to participate in the Exchange Offer in respect of all or part of their holding by offering at least £1,000 in nominal amount of 2020 Bonds (provided such amount is in multiples of £100).

The Exchange Offer is being made on the terms and subject to the conditions and requirements specified in the exchange offer memorandum and prospectus dated 28 January 2020 (the “Exchange Offer Memorandum and Prospectus”) and is subject to offer and distribution restrictions described in such Exchange Offer Memorandum and Prospectus.

Copies of the Exchange Offer Memorandum and Prospectus, including instructions on how to accept the offer, are (subject to distribution restrictions) available from the Exchange Agent as set out below.

The New Bonds will form a single series from the Settlement Date.

City & Continental Ltd and Peel Hunt LLP are Joint Lead Managers in respect of the New Bonds.

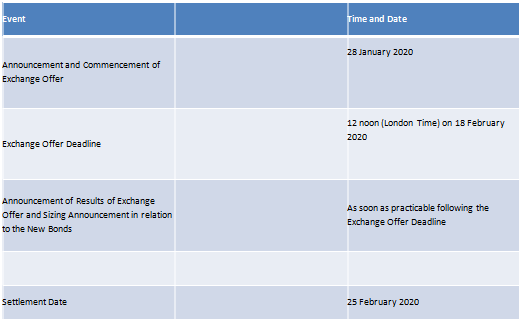

Indicative Timetable for key events relating to the Exchange Offer

The above times and dates are subject to the right of the Issuer to extend, re-open, amend and/or terminate the Exchange Offer (subject to applicable law and as provided in the Exchange Offer Memorandum and Prospectus).

Lucid Issuer Services Limited is acting as Exchange Agent for the Exchange Offer. Details can be found about the Exchange Offer at https://portal.lucid-is.com

Leave a Reply

You must be logged in to post a comment.