Nov

2021

The next value opportunity?

DIY Investor

21 November 2021

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Two of our analysts debate whether Europe’s improving vaccination programme will be the next opportunity for investors in their pursuit of returns…

Two of our analysts debate whether Europe’s improving vaccination programme will be the next opportunity for investors in their pursuit of returns…

The UK has performed strongly in the recent reflationary rally. One of the reasons may have been the pace of its vaccine programme. This meant that the UK was opening up its economy at the end of March and beginning of April when major European neighbours were imposing extra restrictions.

The discounts of UK-focussed investment trusts have narrowed significantly in recent months, while NAV performance has also been strong. However, in recent weeks the pace of vaccinations has picked up in Europe, and plans to reopen have already been announced in France.

This leads us to ask whether the EU is about to get the same bounce the UK has. In that case, the wider discounts on the European sectors could represent an interesting catch-up opportunity.

Below, two of our analysts debate whether European or UK markets have the better outlook: has the UK’s period in the sun ended, or is it set to outperform once more?

It’s the stimulus, stupid – David Johnson

The UK has clearly been on a roll, with the successful negotiation of the Brexit deal and the vaccine rollout. Yet I think the supportive tailwinds behind Europe place it in prime position to outperform its island neighbour.

In fact, I think we have passed ‘peak pessimism’, with today being one of the last chances we may have to buy the dip. This is thanks to the vaccine rollout and the largest fiscal stimulus package in the EU’s history providing significant tailwinds.

The 500-pound elephant in the room that must first be addressed is the third wave of COVID-19 gripping Europe, given that the pandemic has been the overwhelming driver of markets since last February.

While Europe’s vaccine rollout has paled in comparison to the UK’s, with 26% of its adult population having received their first vaccine compared to the UK’s 66%, what matters more now is its trajectory.

Despite the rising infection numbers the advent of an accelerating vaccine rollout ultimately ensures the region will, eventually, emerge from the grips of the pandemic. Europe has in fact already seen some of the benefits of a vaccine rally.

Look no further than Henderson EuroTrust (HNE) for an example, whose recent trading activity around the vaccine announcement (buying into economically sensitive sectors like energy and financials) led to a surge in its performance, contributing to a NAV total return of 41% over the last 12 months ahead of the MSCI Europe ex-UK’s 36%.

It was only this week that the EU ordered a further 100 million doses from Pfizer, bringing its total orders to 600 million, while also negotiating 25% acceleration in their scheduled delivery. Europe’s total vaccine orders top 2.6 billion, six times its current population.

While there is some internal debate over the blood clot risk from adenovirus vaccines, Europe is moving heaven and earth to catch up on the vaccine rollout.

The second near-term tailwind is the planned fiscal stimulus. Much of this is to come from the €750bn European recovery fund, the largest stimulus package in the EU’s history.

The German federal court recently rejected legal objections to the increased debt levels needed to finance the fund. A large chunk of this fund will be distributed through loans and grants, with Italy and Spain being the biggest winners here, marking a potential turnaround in the regions worst hit by COVID-19. Investors should be aware that this is not some goodwill policy yet to be fully hashed out, there are already tangible examples of its redistribution, with Italy having just announced its own €221bn recovery package, €191bn of which will be financed by the recovery fund.

The direction of fiscal policy in Europe is now clear; investors should now expect further support for the European economy in the near term and thus a rebound in its markets, both through direct expenditure by governments and the distribution of the recovery fund.

The recovery fund also marks the first jointly guaranteed pan European debt issue, where all of the member states will guarantee a single bond issue.

This is an important watershed moment and may help to alleviate the apprehension investors may have about the high debt-to-GDP levels of the periphery, as its wealthier northern nations are now able to repay bonds on their behalf in the future, at least to avoid a default.

The bullish sentiment around both the fiscal stimulus and associated political unity is something which is shared by the team of BlackRock Greater Europe (BRGE). While the team do not typically make macro calls, they viewed the announcement of a European recovery fund as a gamechanger and did not foresee a day when there would be bond issuances backed by all members of the EU.

They are even more excited by the secular trends the recovery fund will accelerate, as they expect it to support digitisation and renewable sectors above all else.

The current average discount in the Europe sector, 6.8%, and European small-cap sector, 9.3%, are not excessive, but given the tailwinds behind the region’s markets; incoming fiscal stimulus, a more unified Europe, and the clear path out of the pandemic, I believe the continent is well placed to outperform.

However, it is important to differentiate between European companies which are sensitive to the broader outlook of Europe, and those which rely on global demand, as is the case for JPMorgan European Smaller Companies (JESC). Despite being a small-cap strategy, a sector usually sensitive to its domestic economy, many of their holdings are global market leaders in their niche, like ASM, the European semiconductor manufacturer which has a global monopoly on its type-specific chip production.

Although it is arguably not so dependent on the health of the European economy, JESC trades at an 11% discount, which I think makes it an undeserving casualty of investor sentiment around Europe and therefore has the potential to do well once that sentiment turns.

It would be lovely to think Europe will see a barnstorming recovery once the pace of its vaccination drive really kicks in. Sadly, the valuations tell a different story. It is true that on an investment trust level the discounts are slightly more interesting in Europe.

According to JPM Cazenove the average discount of the AIC Europe sector is 6.8% and the AIC European Smaller Companies 9.3%, which compares to 3% and 5% for their UK equivalents. However, looking at the underlying market paints a different picture.

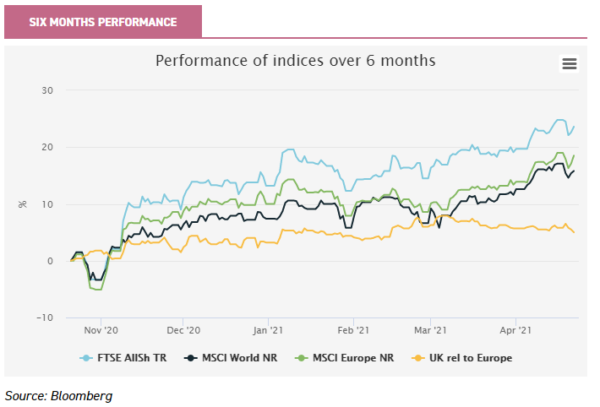

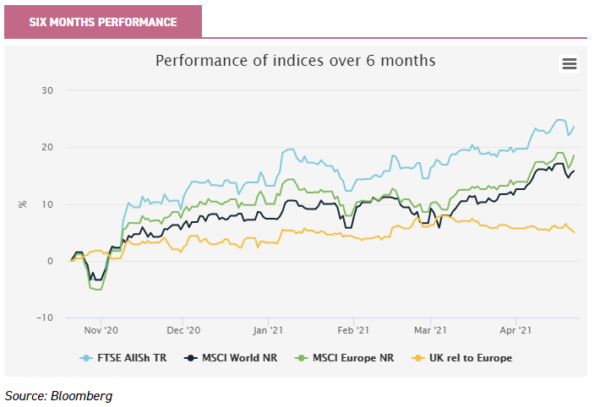

The graph below shows the relative performance of the UK and MSCI World versus the MSCI Europe over the past six months, in which time the FTSE All Share has added 5% to the returns of the European index.

However, the UK is still cheaper than it was before the Brexit referendum, while Europe very much isn’t. While the UK has made back some of the valuations discount, it is still trading below where it stood at the end of May 2016 on a forward P/E basis – 13.2x compared to 14.4x. However, the MSCI Europe is more expensive, trading on 15.3x forward earnings, up from 14x. The MSCI World is even more expensive, at 17.7x compared to the pre-Brexit 14.4x.

The chart below shows the forward P/E on consensus earnings estimates over the past five years for UK, Europe and the developed world. Five years takes us back to just before the Brexit referendum, when we can see the indices all had very similar valuations.

Since then the UK has been notably out of favour. Even in recent months the valuations of Europe and the World have risen more than they have in the UK. And the UK still has a marginally negative Z-score, trading 0.1 standard deviations below the average of the past five years. Meanwhile the European index is 1.3 standard deviations above this mean, and the MSCI World almost two – 1.8 to be precise.

I think the main reason for this remaining premium is that Brexit is still weighing on the UK market. Although I believe that the striking of an eleventh-hour deal is possibly as important as the vaccination programme in the UK’s recent outperformance, market participants’ worries are unlikely to have simply evaporated.

The trade deal still has to be ratified by the European Parliament, the Northern Ireland issue rumbles on, while trade figures are very volatile at the moment due to the pandemic, meaning that the initial impact of Brexit on the economy is hard to unpick.

Looking at the consensus forward earnings field underlying Bloomberg’s P/E figure above, the UK and EU have both seen the same percentage uplift to earnings expectations since the end of November 2020 (20%). In my mind this is dubious.

The outlook for UK earnings should have more sensitivity to both Brexit and the general global reflationary rally that has anticipated the roll-out of vaccines. The consensus was that a no-deal Brexit would have had greater impact on the earnings of UK-facing businesses, while the high weighting to cyclical miners, energy and banks in the FTSE 100 should increase the sensitivity of the UK market to the global recovery. I think it is likely analysts are too bearish.

As a result, I think the UK looks the better short-term bet, despite the narrower discounts available on the investment trusts.

One trust to have done very well in the UK rally so far is Henderson Opportunities Trust (HOT), which is trading just below par at the time of writing (-0.7% as of COB on 22/04/2021). Over the past six months the NAV is up 51% and the share price 84% (on a total return basis). Yet the trust has one of the highest levels of gearing for UK focussed trusts at 13%, as well as mid-cap and cyclical biases which means it could continue to do well.

Unfortunately, it will have to be removed from our Discounted Opps Portfolio. Trusts like JPMorgan MidCap (JMF), Mercantile (MRC) and Schroder UK Mid Cap (SCP) have a focus on the FTSE 250 and trade on discounts of 4.5%, 4.4% and 5% respectively. In the large-cap space, City of London (CTY) has good exposure to traditional value names, but trades on a 3.1% premium.

Edinburgh Investment Trust (EDIN) looks cheaper on a 5.3% discount, and has a more explicitly value-focussed approach under the new manager Majedie Asset Management. EDIN has performed more strongly on a NAV basis over the past year, perhaps thanks to this greater value exposure.

JPMorgan Claverhouse (JCH) has outperformed both, and sits on a discount of 2.1%. All three sit in the equity income sector, which tends to have much higher exposure to the FTSE 100 than the UK All Companies sector.

Click to visit:

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Leave a Reply

You must be logged in to post a comment.