Nov

2021

Japan: the next generation of growth

DIY Investor

21 November 2021

Nicholas Price

Portfolio Manager, Fidelity Japan Trust PLC

Around 90% of Japanese small and mid-sized companies get little or no analyst coverage.* As under-researched companies are more likely to be undervalued, that’s an opportunity.

The trust looks to benefit from the more dynamic sectors of Japan’s economy, focusing on fast growing but attractively valued stocks. With an acute understanding of this unique region and economy, combined with our hands-on local research, portfolio manager Nicholas Price and our team of analysts aim to hone in on stocks often not picked out by others.

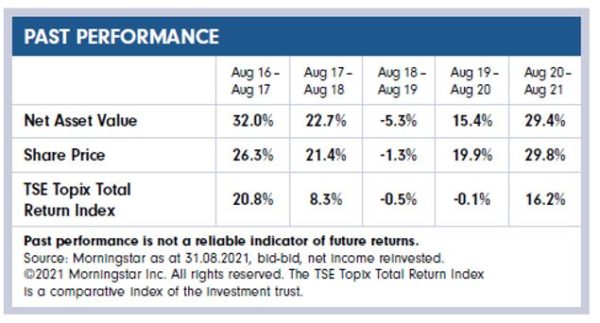

In this broadcast Nicholas spoke to Citywire’s Gavin Lumsden about how his near three decades’ experience of Japanese companies has put the £407m closed-end fund at the top of its sector over 1, 3, and 5 years, and why he sees the investment opportunities continuing in the world’s third largest economy.**

* Source: Analyst coverage – Fidelity International as at April 2021

** Source: Total Net Assets (£303m) – AIC as at 31.08.2021

Top of sector – Morningstar: Period: 5 years: 08.09.2016 to 08.09.2021

Economy size – BBC website as at 16.09.2021

Watch Nicholas’ recent broadcast with Citywire

The ‘Big Broadcast’ with Nicholas Price is produced, recorded and distributed by Citywire.

Important information

The value of investments and the income from them can go down as well as up, so you may get back less than you invest. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Investors should note that the views expressed may no longer be current and may have already been acted upon. Fidelity Japan Trust PLC invests more heavily than others in smaller companies, which can carry a higher risk because their share prices may be more volatile than those of larger companies and the securities are often less liquid. Changes in currency exchange rates may affect the value of investments in overseas markets. The shares in the investment trust are listed on the London Stock Exchange and their price is affected by supply and demand. This investment trust can gain additional exposure to the market, known as gearing, potentially increasing volatility.

The latest annual reports and factsheets can be obtained from our website at www.fidelity.co.uk/its or by calling 0800 41 41 10. The full prospectus may also be obtained from Fidelity. The Alternative Investment Fund Manager (AIFM) of Fidelity Investment Trusts is FIL Investment Services (UK) Limited. Issued by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited.

Brokers Video » Commentary » Equities Video » Investment trusts Commentary » Investment trusts Latest » Investment trusts Video » Latest » Mutual funds Video » Take control of your finances video » Uncategorized » Video » Video Funds » Video Latest

Leave a Reply

You must be logged in to post a comment.