Jun

2021

The income fund we have just bought

DIY Investor

17 June 2021

To control the volatility of our demonstration portfolios, we limit the amount that we invest in funds from sectors with the largest price fluctuations; we combine sectors to create our own Saltydog Investor groups:

Safe Haven – very low risk; very low returns.

Slow Ahead – low risk; often adequate returns.

Steady as She Goes – medium risk; potentially higher returns.

Full Steam Ahead – higher risk; potentially the best returns – split into developed and emerging markets.

Specialist sector contains funds that do not naturally sit within other sectors, so we look at them separately as if they have the same risk profile as the ‘Full Steam Ahead’ group.

Over the last six months, the best-performing sector has been UK Smaller Companies; both portfolios have held funds from this sector since last November and we have gradually increased the amount invested. It would be tempting to keep on adding to them until they make up 100% of the portfolio, but that would break our strict group allocation rules.

Our most cautious portfolio, the Tugboat, can hold a maximum of 30% in funds from ‘Steady as She Goes’ and ‘Full Steam Ahead’ groups; we currently have 27% invested in ‘Steady as She Goes’ – 16% in funds from the UK Smaller Companies sector and 11% in a UK All Companies fund.

Most of our holdings are ‘Slow Ahead’ funds, from the following sectors:

- Sterling Corporate Bonds

- Sterling High Yield Bonds

- Sterling Strategic Bonds

- Mixed Investment 0-35% Shares

- Mixed Investment 20-60% Shares

- Mixed Investment 40-85% Shares

- UK Equity and Bond Income

- Targeted Absolute Returns

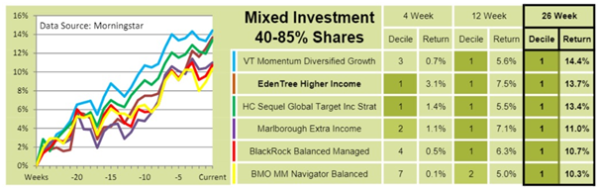

For a couple of years, three funds from the Mixed Investment 40-85% Shares sector have regularly topped our weekly data tables and performed particularly well – Janus Henderson Global Responsible Managed, Liontrust Sustainable Future Managed and Royal London Sustainable World funds.

We bought in February 2019 and held on until March 2020, when they were the last funds sold as markets started to slide; they were the first funds we bought in April 2020, when it looked as though we’d weathered the financial storm. By October, these three funds accounted for 50% of the total invested in the Tugboat portfolio.

We subsequently reduced our holdings as they became less dominant in the group, and other funds started to compete; we sold Royal London Sustainable World last month, and although we still hold them, the other two now make up only 20% of the portfolio.

Last week Tugboat invested in a different fund from the 40-85% Shares sector, EdenTree Higher Income fund; it was the best-performing fund in the ‘Slow Ahead’ group over four and 12 weeks, and near the top over 26 weeks.

For more information about Saltydog, or to take the two-month free trial, go to:

Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.