Jan

2021

The great debate: Active & passive funds

DIY Investor

19 January 2021

Life is full of debate: milk before tea or tea before milk, cats versus dogs, the best James Bond? The investment industry is no different and is currently divided on the active versus passive debate, with strong feelings on either side – writes Tom Poulter, Head of Quantitative Research, Square Mile .

before milk, cats versus dogs, the best James Bond? The investment industry is no different and is currently divided on the active versus passive debate, with strong feelings on either side – writes Tom Poulter, Head of Quantitative Research, Square Mile .

At Square Mile we believe the debate needs to be re-framed a little. A portfolio should consist of a combination of the best funds to meet the clients’ objectives. That may be active, passive or a blend of both, at a cost that represents value for money.

With that in mind, when is each type of approach appropriate? The decision will depend on several factors including the asset class and region, the cost sensitivity of the investor and their time horizon.

Like with like

Firstly, before we critique active or passive funds, we need to make sure we are comparing both types of funds fairly. Currently, most investors compare a fund’s performance against its benchmark, which is usually an index or a sector. However, it is impossible for an investor to obtain the exact exposure and performance profile of a sector or an index, due to factors such as trading and management fees.

Square Mile believes that it is more appropriate to compare an active fund to an equivalent passive fund, for example a UK Equity fund benchmarked against the FTSE All Share Index should be compared against an equivalent passive fund that tracks the FTSE All Share Index. This gives a comparison that is closer to the investor’s real experience.

Active funds

Active funds have a number of appealing characteristics. Key for many investors is their ability to offer the potential to provide superior returns over the index. Although this is not guaranteed, and plenty don’t succeed, passive funds don’t have this ability at all. Active funds can also offer other characteristics, such as generating an income, preserving capital and protecting against inflation.

The manager of an active fund has the ability to avoid significant drawdowns during periods of market stress. They can anticipate and respond to market turmoil, rather than simply following the index. This allows active funds to provide investors with a “smoother” journey.

Managers also have greater flexibility in where they can invest, so they do not blindly invest in specific regions/industries and stocks. They can look forward, striving to find tomorrow’s winning companies, rather than relying on yesterday’s winners.

At the same time, investors have greater choice, allowing them to invest in a fund that best suits their needs.

Passive funds

At the same time, there are a number of reasons why an investor would choose a passive fund. Notably, they are generally cheaper than their equivalent active fund. However, there are exceptions. In the UK All Companies sector the OCFs range from 0.06% to 1.51% for passive funds, while the range for active funds in the same sector is 0.22% to 2.91%*. (*Source: FE Analytics)

Passive funds often have greater transparency, allowing investors to have greater insight into their portfolio’s risk characteristics, although this may change as active managers are being pushed (quite rightly) to improve disclosure.

Passive funds are also exposed to less active risk (the risk associated with not performing in line with the index), however, they do remain exposed to the same overall risks as the market.

In general, passive funds are more readily understood by investors who know what they are going to get and can judge the progress of their investment more easily. This means lighter touch monitoring and maintenance is required.

Performance

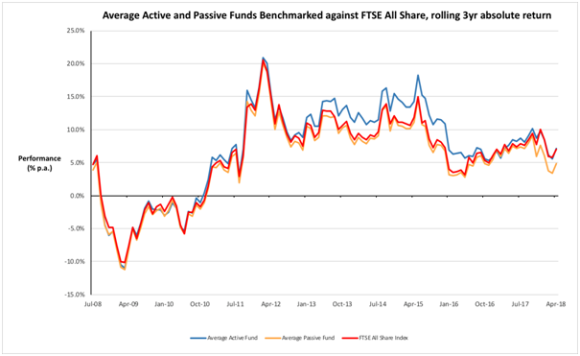

Square Mile has recently conducted some analysis on whether active funds in general have outperformed or underperformed their passive counterparts for several different sectors. As you can see from the chart below on average over rolling three year periods the average active UK equity fund has outperformed the average passive fund which tracks the FTSE All Share, while the average active UK equity fund was even able to outperform its benchmark.

We have also discovered that in the Sterling Corporate Bond, North American and Sterling UK Gilt Sectors on average passive funds have outperformed active funds while in the Global and UK All Companies sector active funds have outperformed passive funds.

This reaffirms our belief that the decision to go active or passive is not binary. For most investors, the choice is usually not one or the other, but a bit of both.

Source: FE Analytics

View the full active & passive report by visiting www.squaremileresearch.com/Insights/entryid/383/

Important Information

This article is for the use of professional advisers and other regulated firms only. It is published by, and remains the copyright of, Square Mile Investment Consulting and Research Ltd (“SM”). SM makes no warranties or representations regarding the accuracy or completeness of the information contained herein. This information represents the views and forecasts of SM at the date of issue but may be subject to change without reference or notification to you. SM does not offer investment advice or make recommendations regarding investments and nothing in this presentation shall be deemed to constitute

financial or investment advice in any way and shall not constitute a regulated activity for the purposes of the Financial Services and Markets Act 2000. This presentation shall not constitute or be deemed to constitute an invitation or inducement to any person to engage in investment activity. Should you undertake any investment activity based on information contained herein, you do so entirely at your own risk and SM shall have no liability whatsoever for any loss, damage, costs or expenses incurred or suffered by you as a result. SM does not accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance is not a guide to future returns.

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Investment trusts Commentary » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.