Aug

2023

The compound effect of environmental solutions

DIY Investor

5 August 2023

Jon Wallace, Noelle Guo and Grisha Milushev reflect on progress on ecological challenges during the almost 36 years since the Brundtland Report.

Jon Wallace, Noelle Guo and Grisha Milushev reflect on progress on ecological challenges during the almost 36 years since the Brundtland Report.

As always, in managing the Jupiter Green Investment Trust we are aiming at long-term capital growth, and we think it essential to seek resilient performance during a currently challenging time for the global economy, in which interest rates have risen and companies are feeling the effects of higher financing costs.

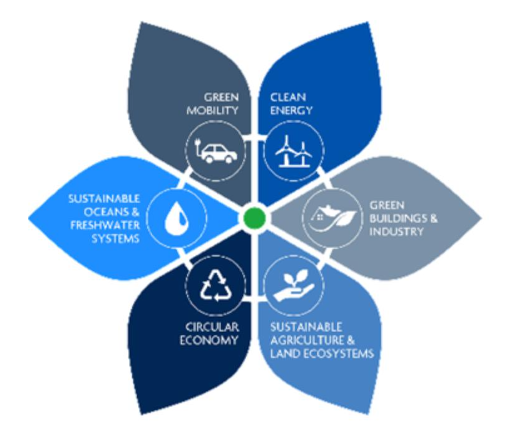

Our philosophy is to select the leading companies across six themes: clean energy, green mobility, circular economy, green buildings and industry, sustainable agriculture and land ecosystems, and sustainable oceans and freshwater systems.

Within those themes, the Jupiter Green Investment Trust is focused on companies – many of them on the smaller end of the market capitalisation spectrum – that are at the forefront of innovating technological solutions to sustainability challenges (‘innovators’), as well as companies that are already rapidly delivering proven sustainable solutions in their markets (‘accelerators’). We believe this approach should deliver attractive capital growth to shareholders over the long-term.

We are encouraged that many environmental solutions companies are now showing resilient real-world growth. Looking back over the last few decades, that has not always been the case.

A pivotal moment: The Brundtland Report

‘Our Common Future’, also known as the ‘Brundtland Report’ was published in October 1987. This landmark report became a foundational document in the history of sustainable development. Initiated by the United Nations, and drawing on submissions by governments, scientists, and research institutes across the world, the Brundtland Report set out a global agenda for change.

It argued that environmental and social issues are vital to economic prosperity and progress. As the report states, ‘Ecology and economy are becoming ever more interwoven locally, regionally, nationally, and globally into a seamless net of causes and effects.’ 1

‘environmental and social issues are vital to economic prosperity and progress’

Moreover, the Brundtland Report accelerated a growing understanding that our economy operates within our ecological systems, not the reverse. As the report puts it, ‘We have in the past been concerned about the impacts of economic growth upon the environment. We are now forced to concern ourselves with the impacts of ecological stress – degradation of soils, water regimes, atmosphere, and forests upon our economic prospects.’ 2

In calling for action, it laid the groundwork for the earth Summit in 1992, the Rio Declaration, the UN Commission on Sustainable Development, and serves as an important benchmark by which to measure progress.

Today, global environmental challenges are more clearly defined, the impacts from failure to address them acknowledged, and concrete solutions exist in most areas. Clean technologies are becoming more economically competitive and regulatory action is beginning to catch up with scientific knowledge. In our view, environmental solutions investors are better placed to capture unfolding secular (long-term) trends in the global sustainable transition than ever before.

Reflecting on the Brundtland Report shows how far we have travelled and how much further we have yet to go. We believe that the global economy is beginning to experience the compound effects of deepening environmental knowledge, widening communication on sustainability and social issues, and advancing green technologies. The fact that challenges such as climate change and biodiversity loss are now recognised as inter-connected, shows that the seeds planted by the Brundtland Report are now bearing fruit.

Embracing complexity

Since 1987, the environmental solutions landscape has become more complex. The structural growth opportunity is accelerating but so is its complexity. We believe this places specialist active managers at an advantage. Environmental solutions are today a fertile area for dedicated, specialist stock-pickers.

Perhaps the biggest development we have observed since the Brundtland Report is the sheer volume of academic and non-academic literature accumulated about environmental challenges. The first Assessment Report issued by the Intergovernmental Panel on Climate Change (IPCC), which reviewed everything known about climate change at the time, was 414 pages. The sixth Assessment report, issued in 2023, was 2,409 pages. Published academic papers on ecology-related topics have grown apace.

Ozone layer recovery

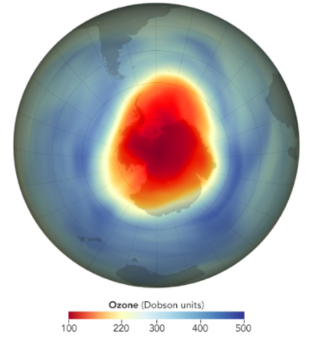

One example of positive change since 1987 is the ozone layer, which, after suffering years of depletion from damaging manufactured chemicals such as halocarbon refrigerants and foam-blowing aerosols, is now showing signs of healing. The way the world came together to address the ozone layer problem shows how important it was to effectively communicate the seriousness of the threat. The prospect of ultraviolet rays damaging people’s skin, causing cancer and other dangers, was too immediate to ignore.

‘Although the threats are severe, the world has never been in a stronger position to address them’

We are now nearing a similar phase of climate and biodiversity awareness. Extreme weather events are occurring more often, seasons are shifting, food yields are suffering due to disasters, insurers are accumulating extreme losses, coral reefs are bleaching and ice sheets are melting. These are all examples of climate change impacts which are easy to comprehend  by the public and which inevitably will lead to increased calls for action.

by the public and which inevitably will lead to increased calls for action.

Fortunately, scientists are doing their part in communicating these threats. Although the threats are severe, the world has never been in a stronger position to address them. Renewable energy costs have fallen for solar, wind, and batteries. Funding for climate tech has grown.

Engineers are supported by increasingly sophisticated technology, software and computational power. Governments and regulators are pushing for climate action, biodiversity protection and sustainable development. Targets are now in place to limit global warming and protect natural capital following the COP 21 conference on climate change held in Paris in 2015, and the COP15 conference on biodiversity held in Montreal in 2022. The world now knows what needs to be done and there is an action plan for carrying out the transition.

Successes and failures

On many fronts humanity has achieved incredible successes. The ozone hole above the Antarctic will probably be fully healed by the 2050s – a remarkable feat considering the rate of decay just 20-30 years ago.

Most countries are now signed up to international multilateral environmental agreements aimed at protecting our planetary boundaries, including the Vienna Convention, the Paris Agreement, and the Kyoto Protocol.

Most countries are now signed up to international multilateral environmental agreements aimed at protecting our planetary boundaries, including the Vienna Convention, the Paris Agreement, and the Kyoto Protocol.

Most importantly, global GDP growth has decoupled from global CO2 emissions growth, so nations no longer rely purely on fossil fuels to grow their economies.

The world has likely reached peak fossil fuel demand for electricity. The Brundtland Report stated that an energy efficient alternative for lighting was a 100W light bulb: nowadays LED bulbs use just 3-4W. Even whaling peaked shortly before the 1980s. Air pollution kills less people now than ever before.

Unfortunately, there have also been failures. The Living Planet Index, which measures global wildlife populations, has decreased about 70% since 1988. Global plastics production has grown to 400m tonnes per annum and giant garbage islands are forming in the Pacific Ocean.

Global greenhouse gas emissions have kept on growing, causing further global warming. Energy efficiency has only improved at about 1.4% per annum, far below what is required. Public climate financing has remained below targets. Financing for both climate change mitigation and adaptation is far below what is required. ‘Forever chemicals’ and microplastics are now understood to have high carcinogenic risk.

Compound effects

Just as the growth in knowledge about environmental challenges spurred innovation and led to calls for action, we believe that the current accumulation of regulatory, societal and economic pressure for sustainable development will accelerate the deployment of green technologies, environmentally positive activities and sustainable initiatives.

There is already exponential growth across numerous green sectors and this will soon cause compound effects in others. For example, the deployment of renewable energy not only decarbonises the electricity grid, but will also allow non-inflationary energy generation, decarbonisation of transport, reduced air pollution, and improved competitiveness for countries with fewer fossil resources.

‘regulatory, societal and economic pressure will accelerate the deployment of green technologies, environmentally positive activities and sustainable initiatives’

Competitive clean energy is critical in the potential production of green hydrogen. In turn, green hydrogen at commercial scale could be critical for the decarbonisation of many industries such as steel, cement or fertiliser production. Green hydrogen may also unlock alternative fuel options for the maritime and aviation industries. In the longer term, green energy may even be used to capture carbon and reduce the amount of it in the atmosphere. Decarbonising one part of the supply chain can have compound effects across the whole green economy.

While currently less clear, it is probable that biodiversity will eventually benefit from efforts to protect natural capital. Progress on biodiversity has been slower to start in earnest compared to climate mitigation. We are only at the start of the sustainable development journey. Its fastest pace of acceleration will be in the future.

Active management

Due to our increased understanding of global environmental challenges, we believe that our team is now in a better position than ever to capture the tailwinds behind the clean economic transition. We have expertise across sectors and along value chains and we seek to identify the thematic winners and losers likely most to affect the portfolio. This is how we can add value as active managers.

Identifying catalysts is a powerful tool to enhance returns and find the pockets where progress is most likely to accelerate. Time and time again a catalyst has been the convergence of environmental and health-related risk (the ozone layer and skin cancer being an example). Catalysts often come from technology. As in nature, change leads to change, unlocking cascading effects.

Looking ahead, where else might we see catalysts converge? We see agriculture as a key domain, largely untouched by environmental solutions, and yet hugely affected by the risks it contributes to so significantly.

We believe in the importance of seeking companies that can execute above their peers and protect their competitive advantage and so benefit from ongoing megatrends. This is why we hold company leadership to a high standard. It is also why we focus on identifying the technology winners. Finally, we understand the supporting legislation and regulation.

We are more convinced than ever that environmental solutions will be among the leading mega-themes of the foreseeable future, and a source of long-term, above-market capital growth.

1 Report of the World Commission on Environment and Development: Our Common Future. The United Nations, 1987. Published by Oxford University Press. Available at https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf. Para 15.

2 Ibid. Para 15.

More information about Jupiter Green Investment Trust PLC >

The Key Investor Information Document, Supplementary Information Document and Scheme Particulars are available from Jupiter on request.

- Market and exchange rate movements can cause the value of an investment to fall as well as rise, and you may get back less than originally invested.

- Risks applicable to investment companies

Market and exchange rate movements can cause the value of an investment to fall as well as rise, and you may get back less than originally invested. We recommend you discuss any investment decisions with a financial adviser before investing. Investment companies are traded on the London stock exchange, therefore the ability to buy or sell shares will be dependent on their market price, which may be at a premium or discount to their net asset value.

Risks applicable to geared investment companies

Investment companies can borrow money and use the proceeds to invest, known as being ‘geared’. This may increase returns but can also result in sudden and large falls in the value of the shares. In the event it is necessary for the company to repay sums it has borrowed during market declines, this repayment could have a negative effect on future capital growth.

Important Information:

Market and exchange rate movements can cause the value of an investment to fall as well as rise, and you may get back less than originally invested.

We recommend you discuss any investment decisions with a financial adviser, particularly if you are unsure whether an investment is suitable. Jupiter is unable to provide investment advice.

Investment trust companies are traded on the London stock exchange, therefore the ability to buy or sell shares will be dependent on their market price, which may be at a premium or discount to their net asset value.

Jupiter Green Investment Trust PLC

The Jupiter Green Investment Trust can borrow money and use it to invest, known as being ‘geared’. This may increase returns but can also result in sudden and large falls in the value of the shares. In the event it is necessary for the company to repay sums it has borrowed during market declines, this repayment could have a negative effect on future capital growth.

Before making an investment decision, please read the PRIIPS Key Information Document which is available from Jupiter on request and at www.jupiteram.com.

Past performance is no guide to the future.

Company examples are for illustrative purposes only and are not a recommendation to buy or sell.

The Company currently conducts its affairs so that its shares can be recommended by Financial Advisers to ordinary retail investors in accordance with the Financial Conduct Authority’s (FCA) rules in relation to non-mainstream pooled investment products and intends to continue to do so for the

foreseeable future. The Company’s shares are excluded from the FCA’s restrictions which apply to non-mainstream pooled investment products because they are shares in an investment trust.

This website provides links to third party websites over which Jupiter has no control. These links are provided for your convenience and Jupiter accepts no responsibility for the content of such websites.

Important Information:

The information contained in this market commentary is intended solely for members of the media and should not be relied upon by private investors or any other persons to make financial decisions.

This communication, including any data and views in it, is not a financial promotion as defined in MiFID II. It does not constitute an invitation to invest or investment advice in any way. Every effort is made to ensure the accuracy of any information provided but no assurances or warranties are given.

Market and exchange rate movements can cause the value of an investment to fall as well as rise, and you may get back less than originally invested.

The views expressed are those of the Fund Manager at the time of writing, are not necessarily those of Jupiter as a whole and may be subject to change. This is particularly true during periods of rapidly changing market circumstances.

Issued in the UK by Jupiter Asset Management Limited, registered address: The Zig Zag Building, 70 Victoria Street, London, SW1E 6SQ is authorised and regulated by the Financial Conduct Authority. Issued in the EU by Jupiter Asset Management International S.A. registered address: 5, Rue Heienhaff, Senningerberg L-1736, Luxembourg which is authorised and regulated by the Commission de Surveillance du Secteur Financier.

Brokers Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.