Jul

2023

Smaller-than-expected decline in UK GDP boosts case for more interest rate hikes

DIY Investor

13 July 2023

Upside growth surprise suggest that the Bank of England can, and perhaps should, keep raising interest rates in coming months – by Azad Zangana

The UK economy is estimated to have contracted by 0.1% in May compared to April, surprising consensus expectations to the upside. The economy was expected to contract by 0.3% as there was an additional bank holiday across the country to mark the coronation of King Charles III.

Past additional bank holidays have typically resulted in larger falls in activity, followed by a rebound in the following month. For example, the Platinum Jubilee bank holiday in June 2022 and the bank holiday to mark the day of national mourning following the passing of Queen Elizabeth II in September 2022 both contributed to GDP falling by 0.7% in those months.

And so the smaller contraction on this occasion either suggests that the underlying momentum in the economy was stronger than thought, or that the bank holiday (and celebrations) disrupted activity by less than past examples. The size of the rebound in the next reading will give us a better understanding of the impact from the bank holiday.

Within the details of the release, services activity was flat largely thanks to a 1.1% rise in activity in human health and social work activities, which also made the largest positive contribution in the month. Arts, entertainment and recreation, along with education and information and communications sectors also made positive, albeit smaller contributions in May.

However, these were offset with a 0.5% decline in wholesale, retail and repairs activity, along with administrative support sectors, accommodation and food services sectors and the financial and insurance sectors.

Outside of services, both manufacturing output and wider industrial production contracted in May, while construction activity also fell.

Overall, while the headline numbers suggest a poor reading for the economy, the small contraction compared to past declines when additional bank holidays have taken place means that the economy has outperformed expectations.

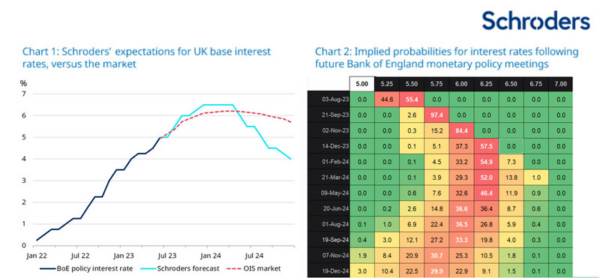

The figures also suggest that the Bank of England can, and perhaps should, keep raising interest rates in coming months. We recently raised our forecast for interest rates to reach 6.5% for the end of this year, which remains an above consensus call (see UK should brace for 6.5% interest rates: here’s why we’ve raised our forecast).

However, financial markets are slowly starting to agree, with options markets now pricing in a peak of 6.25% (see charts, below), helping to lift sterling significantly in recent days.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Brokers Commentary » Brokers Latest » Commentary » Equities Commentary » Investment trusts Commentary » Latest

Leave a Reply

You must be logged in to post a comment.