Dec

2021

Seven outstanding funds over the past three years

DIY Investor

1 December 2021

Saltydog runs its latest quarterly report that looks for consistent performers.

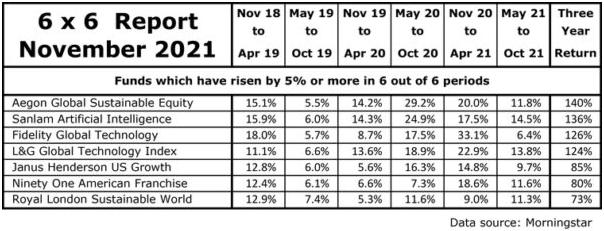

In May 2019, we ran our first ‘6 x 6’ report. We usually focus on the short term, from one week up to six months, but on this occasion we modified our algorithms to look at the performance of funds in a different way that is more long term.

For our 6 x 6 report, we went searching for funds that had regularly achieved a 5% gain in consecutive six-month periods over the last three years.

The first time we ran the report there were a small number of funds that had managed to achieve this for all six periods, and nearly 40 that had missed out only once. The list consisted of many familiar funds that featured regularly in our normal Saltydog analysis, and they were predominantly from the Technology, Global, and North American sectors.

Since then, we have been updating the report every three months.

In August this year, there were eight funds that had managed to beat our 5% target return in each six-month period over the last three years, and in our latest report there are seven.

At the top of the list is a fund that was not in August’s shortlist, the Aegon Global Sustainable Equity fund from the Global sector, which has gone up by 140% in three years.

Next is the Sanlam Artificial Intelligence fund, which used to be called the Smith & Williamson Artificial Intelligence fund. This is the only fund that has gone up by 5% or more in every six-month period over the last four years. It was in August’s shortlist, as was Fidelity Global Technology and L&G Global Technology Index.

At the bottom of the table is a fund that has not been in the list before. Royal London Sustainable World is from the Mixed Investment 40-85% hares sector and regularly features in our demonstration portfolios. It is currently our largest holding, so we hope this run of form continues.

This fund is back on track, so we are buying

Saltydog has upped exposure to an existing holding that’s returned to form in recent weeks

Last month, the best-performing equity-based sector was North America, which went up by 3.7%. A couple of weeks ago our demonstration portfolios invested in the UBS US Growth fund, and we added to it last week.

Because the US is such a major economy, when the North American sector does well there are funds in other sectors that also tend to benefit.

The obvious example is the Technology & Technology Innovations sector. The largest companies in the world are Apple and Microsoft Corp; not far behind are Alphabet, Amazon, Meta Platforms and Tesla.

They are held by funds investing in the North American sector and funds investing in the Technology & Technology Innovations sector; when they are on the up, funds from both sectors would get a boost.

The same is also true for some of the funds in the Global sector. The sector definition is ‘funds which invest at least 80% of their assets globally in equities. Funds must be diversified by geographic region’. This means that in theory they can invest anywhere in the world, but a significant number have America as their largest regional holding. As an example, the Baillie Gifford Global Discovery fund has more than 70% invested in the US.

When choosing funds for our demonstration portfolios (Ocean Liner and Tugboat) we take into account how volatile the sectors have been in the past. To limit the overall volatility of our portfolios, our largest holdings tend to be in funds from the less volatile sectors. In our analysis we have put these sectors into our ‘Slow Ahead’ group.

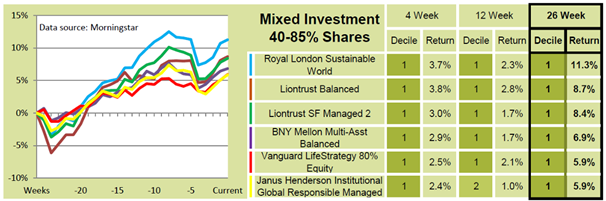

In October, the best-performing sector in the ‘Slow Ahead’ group was ‘Mixed Investment 40-85% Shares’. According to the Investment Association (IA), funds in this sector are required to have a range of different investments. However, there is scope for funds to have a high proportion in company shares (equities). The fund must have between 40% and 85% invested in company shares.

Some funds in this sector are also biased towards the US. This is true for two funds that we have been holding for a while. The Royal London Sustainable World fund has over 40% of its assets invested in the US, and the Janus Henderson Global Responsible Managed fund only has slightly less, 35%.

Both these funds struggled in September, but have recently recovered and appear to be back on track. Last week, they featured in our shortlist of best-performing funds.

We reduced our exposure to the Janus Henderson Global Responsible Managed fund last month, but have now topped it back up again.

The Royal London Sustainable World fund is currently our largest holding.

For more information about Saltydog, or to take the two-month free trial, go to:

Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.