Nov

2021

Beyond the Middle Kingdom

DIY Investor

30 November 2021

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

As momentum falters in the emerging markets powerhouse, we examine the options for investors outside China…

As momentum falters in the emerging markets powerhouse, we examine the options for investors outside China…

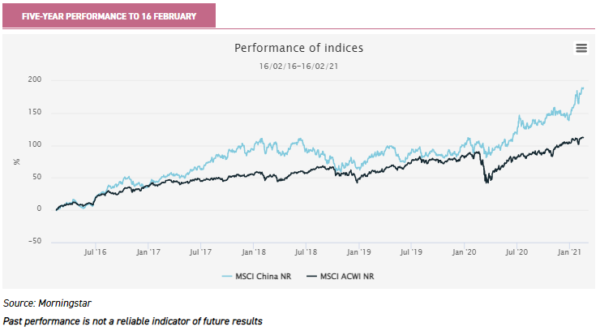

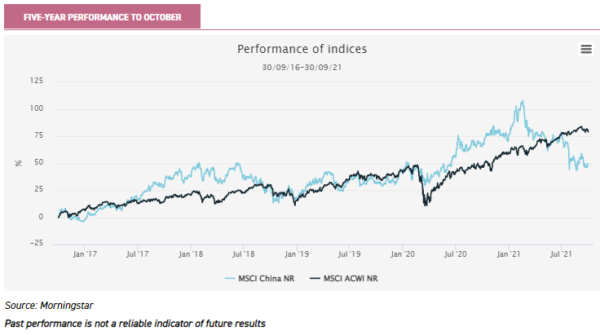

China was flying high at the start of the year, having performed strongly during the initial impact of the pandemic and then again during the reflationary rally. Looking back over five years investors had made 189% in the MSCI China Index on a total return basis compared to just 112% in the MSCI ACWI. China’s performance was the key factor behind the strong performance of the broader emerging Asia markets.

However, the picture looks very different now. To the end of September, the five-year total return from the Chinese Index is just 49% compared to 79% for the MSCI ACWI. The MSCI China is down 28% since 15 February, with the MSCI ACWI up 8%.

China: How bad is it?

We think it’s fair to say the secretive nature of the communist party and general distrust of the leadership’s motives leads to lots of rumours and debatable interpretations of actions in China. Even macro-economists and international relations experts disagree, but here is the basic state of play as far as we can understand it. There are three key factors behind Chinese equity market weakness: politics, energy and Evergrande.

The Chinese authorities have made heavy-handed interventions in a number of sectors with generally quite explicit political aims. The failed IPO of ANT Financial last year was in certain quarters interpreted as a personal rebuke to Jack Ma; in the light of recent events it seems better to interpret it at face value: as an attack on monopoly power. The CCP has since made a number of rulings designed to prevent monopolies developing in the online payments market in which ANT operates. The concern about the excessive power of the internet giants in the West is shared by Beijing, and China’s actions in the payments industry have been followed by an anti-trust probe in the ecommerce sector, affecting Meituan (takeaway delivery) and Pinduoduo (agricultural goods delivery) as well as Alibaba. More dramatically in terms of share price impact was the outlawing of selling education services for profit, which saw a collapse in the value of New Oriental Education, a favourite amongst active fund managers.

Scepticism about the reasons for these interventions and where the next one might fall have weighed on the Chinese market. One indicator is retail fund flows. According to the Investment Association, in the three months to the end of February retail investors poured £326m into the IA China/Greater China sector. In the latest three months for which we have data – May to July – they pulled out £37m.

The issues in the energy sector are more recent. September has seen power rationing across numerous provinces. The root cause is high fossil fuel prices. This has been caused by a sharp increase in demand as economies reopen post-pandemic, and also by various supply issues. Importantly for China, the coal price has skyrocketed over 250% YTD. The Chinese authorities set the prices at which power companies can sell electricity.

With it now being unprofitable to generate power, many have shut down. This has led to numerous factory closures across various industries – anyone wanting to buy an iPad as a Christmas present might want to get a move on. The Chinese authorities’ policy of ordering reduced usage during times of peak demand is clearly only a short-term solution. According to Bloomberg, China’s Vice Premier directly ordered state owned energy companies to secure supplies for the winter at all costs, stating that blackouts will not be tolerated. Economic growth has been downgraded while equity markets could well be impacted.

The third major bearish factor is the collapse of Evergrande, China’s second-largest real estate developer. This is an ongoing situation, which will have progressed substantially between the date of writing and publication! However, there are two fears that have weighed on markets: contagion through the banking system and the impact of a disorderly failure.

The Bank of England, the ECB and the Hong Kong authorities have all reported that the exposure of their commercial banks to Evergrande is not material, so that fear should have been allayed. The Chinese authorities seem to be set on an orderly solution, which should end the second issue too. However, for investors in China, there are still likely to be second order effects. Defaults on wealth management products and loans to developers will have knock-on effects through the economy.

Most importantly, Evergrande’s issues are only one symptom of widespread issues in the real estate market. Widespread defaults would be deflationary and have the effect of reducing economic activity and consumption. However, the authorities have seen this coming for a long time, and in 2019 were already telling banks to cease lending to the most indebted real estate companies.

Investment implications within Chinese equities

The issues in the real estate sector and the energy markets are contributing to a general slowing of economic activity. The authorities’ interference in the market is likely a sign they are concerned about popular reaction to this slowdown. Rebecca Jiang, Greater China specialist on the JPMorgan Emerging Markets and Asia Pacific Equities Team, says that the authorities are attempting to address a rising cost of living and perceived unfairness in the Chinese economy.

The banning of for-profit education services is attempting to address the fact that it is becoming ubiquitous and poorer families are having to spend a higher share of their income on education to keep up with the wealthier, she says, and she notes that the authorities’ crackdown on Meituan has partly focussed on workers’ rights.

This is likely to contribute to a change in market leadership. Rebecca argues that the ecommerce and internet companies were once at the forefront of innovation, but have already become much more established and stable elements of the economy, where their importance is as much from the employment they provide rather than innovation and productivity gains.

While there may still be high returns, by international standards, to come, she thinks healthcare and renewable energy are likely to be sources of greater innovation in the coming years. JPMorgan China Growth & Income (JCGI) has been looking to add to companies in this space, and healthcare is the second-largest overweight after information technology. We have updated our note on the trust this week.

Another source of higher returns in future could be the hardware sector. China is prioritising hardware, over software and ecommerce, for strategic reasons. The confrontation with the US has led to a plan to produce high-end semiconductors and other vital technologies domestically. To that end the CCP is using its power to push investment and labour into this industry, which could lead to greater opportunities in this space.

Notably the secular shift to more powerful technology should be relatively insensitive to the economic cycle, so a slowdown in China would likely affect hardware companies less than ecommerce companies.

In order to encourage innovation, the Chinese authorities have launched a new exchange in Beijing which is designed to be amenable to innovative small and mid-sized businesses (a Chinese AIM if you will), which could be a source of funding for this sector. It could well be that the small and mid-cap space becomes a greater source of alpha, with the long period of large cap outperformance coming to an end. This would be in alignment with the authorities’ political aims to reduce inequality and limit the obvious success of the billionaire class.

If small and mid-caps become a better hunting ground, this might make allocating to a China specialist trust more attractive, or at least to an emerging markets or Asia portfolio with extensive boots on the ground. The JPMorgan team are in a good position in this regard, with their sizable team being boosted by the joint venture with CIFM, which gives them a domestic footprint and an expanded analyst team.

Fidelity China Special Situations has had a more persistent and larger overweight to the small and mid-cap space. It also has a team of analysts on the ground in China. Baillie Gifford China Growth has only been focussed on China since September 2020 following a change of mandate and manager. It has more of a bias to large caps, according to Morningstar data, and maintains Baillie Gifford’s approach of managing from a distance, with Roderick Snell and Sophie Earnshaw being based in Edinburgh.

One feature of the Chinese equity space which might play into Bailie Gifford’s hands is the growing importance of the unlisted space. According to data firm CB Insights, of the 810 ‘unicorns’ (privately owned companies worth more than $1bn) in the world, 159 are based in China.

This is the second highest number of any country, with the United States having the most at 405. Baillie Gifford China Growth’s first unquoted investment in China was in ByteDance, the owner of TikTok, which was the only unlisted investment as of the date of the annual report in March.

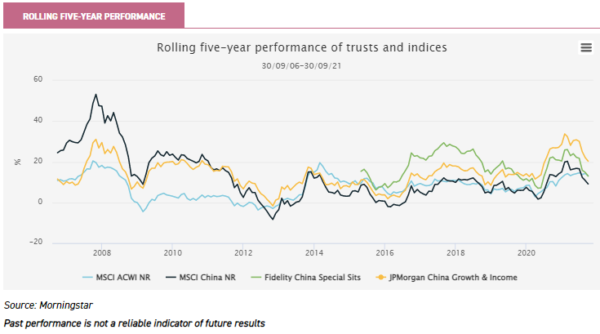

We think it is important to focus on the opportunities active stock-pickers provide. Since September 2012, the MSCI China has outperformed the MSCI ACWI only 32% of the time on a rolling five-year basis (calculated monthly), after a long run of outperformance came to an end. If we restrict our analysis to the period after FCSS was launched in April 2015, the figure is 37%.

However, FCSS and JCGI have been ahead of the MSCI World 94% and 100% of the time respectively since April 2015. We think even if market leadership changes, the Chinese market is still likely to offer opportunities to add alpha against the global market given its dynamism and inefficiency.

Where are the opportunities in EM ex China?

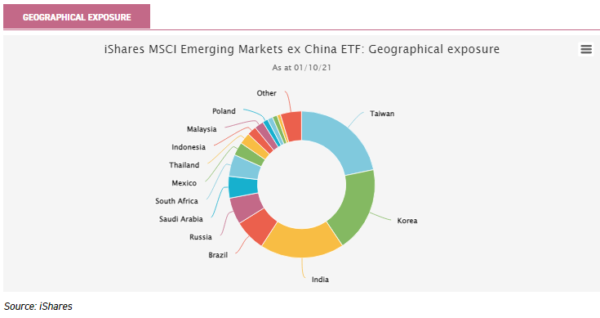

For those looking to diversify their exposure to China in the light of its current issues, we think there are a number of good opportunities in the GEM ex China space. The first thing to point out is that the passive index (MSCI EM ex China) gives a strange mix, with 42% in Taiwan and South Korea – both of which have a similar GDP per capita as Spain – and of that 16% in TSMC and Samsung; global leaders in high tech industries. For the real diversifying growth stories, you need to dig into the active funds.

We think three themes look interesting at this point in time: 1) India, 2) demand for raw materials used in green technology, and 3) the potential for internet and ecommerce catch-up.

India

In our view this is an exciting time to be investing in India. Modi has made a number of business-friendly reforms which have seen India jump from ranking number 142 out of 190 countries in the World Bank’s Ease of Doing Business Ranking in 2014, to its new ranking of 63. Reforms to the bankruptcy laws, employment law and the taxation system have all been positive.

Modi has also opened up more of the Indian market to foreign investment, and this policy has been given greater impetus by the pandemic which has seen renewed determination from companies and countries to reduce their reliance on Chinese supply chains and has seen India take steps towards creating a technology ecosystem.

This includes Samsung and Apple locating manufacturing centres in the country and also a growing domestic internet and ecommerce sector. This was given impetus by the listing of food delivery company Zomato in July. Since January $27bn has been raised in the digital start up space (Source: Ocean Dial) and there are 38 unicorns (Source: CB Insights). Managers tell us there are numerous IPOs lined up in the digital and internet sectors this year which are of interest.

Kristy Fong, manager of Aberdeen New India (ANII) is looking for opportunities in these listings to add to her 2020 purchases of digital marketer Affle India and ecommerce company Info Edge. While the team at Ashoka India Equity (AIE) are also looking for opportunities in the IPO space, they can also hold pre-IPO unlisted investments. Current top ten holding CarTrade Tech is a private company facilitating online car sales. You can hear about this direct from the horse’s mouth at our event on November 4th where we will be joined by Ashoka’s Ramesh Mantri. Click here to register.

Looking out long-term, India’s demographics are favourable, with a young and growing population, in contrast to China where the working age population is shrinking as a proportion of the total population. Carlos Hardenberg, manager of Mobius Capital partners – which is not constrained to invest in India – says he believes the country is about to embark on a period of massive increase in household wealth, with its cadre of entrepreneur-run businesses providing great opportunities for investors. India also has a highly educated workforce which is cheaper than the equivalent in China and should give it an advantage in developing technology industries. We think there is an attractive mix of traditional emerging market themes – urbanisation, the growth in basic consumer industries and financial products – and internet led digital themes in India, at this point in time.

The green revolution

Another potential source of great returns in the emerging markets ex China region is materials. The shift to electric vehicles being planned by many countries will require huge amounts of metals to deliver, and key sources of these metals are in developing countries. For example, according to the US Geological Survey, 71% of the palladium produced in 2020 was mined in South Africa, while 95% of estimated reserves were in the country (arguably the more important figure given a huge expansion of production is required).

Chile contains 44% of the world’s identified lithium reserves while a further 4% are in Argentina. As much as 51% of world cobalt reserves are in the Congo while 22% of nickel reserves are in Indonesia and 17% in Brazil. All these metals are used in car batteries, while copper is essential for wiring. Chile contains 23% of identified copper reserves and Peru a further 11%. Key risks to bear in mind are substitution – it is possible that technological developments will lead to other metals being substituted – and the volatile nature of commodity prices which is likely to remain even if the secular trend to higher demand continues.

One trust with exposure to this exciting trend is Barings Emerging EMEA Opportunities (BEMO). BEMO’s expanded remit (it was known as Baring Emerging Europe until November 2020) sees it invest across the developing countries of Africa and the Middle East as well as Eastern Europe. This means the previous heavy exposure to fossil fuels has been accompanied with a number of positions in companies mining the metals essential to the transition away from these industries. Russian-listed Norilsk Nickel has been inherited from the previous portfolio, and has been joined by Anglo American and Amplat, both of which mine the rich resources of South Africa.

Materials make up 12% of the BEMO portfolio, but 24% of the portfolio of BlackRock Latin American (BRLA). BRLA’s largest holding is Brazilian miner Vale, which is the world’s largest Nickel producer. BRLA also owns SQM of Chile, which owns the largest and cheapest lithium mine in the world, as well as Ternium, the Argentinian steel producer, and Cemex, the Mexican cement manufacturer. Vale is held as a slight underweight to the index position, which may indicate the manager Ed Kuczma’s view of the short-term outlook but, when we met with him ahead of our recent note, he reaffirmed his belief demand for commodities would remain strong thanks to fiscal stimulus plans, particularly that of the US.

The internet of places

Another theme that is present in both portfolios is ecommerce. While China has taken a turn against what are now relatively mature industries in that country, the runway is clearer in other jurisdictions and the stage of development is much earlier. Mercadolibre, the Argentinian ecommerce company which operates across Latin America, has seen strong share price appreciation during the pandemic period.

However, it has an estimated market share of ecommerce of 25% in its Latin American markets, just over half the 47% of Alibaba in China. The prospects for market share growth are clearly higher. Furthermore, in Brazil only 3.2% of retail sales are online (Source: JPMorgan) compared to c. 25% in the UK. One company which stands to benefit from the growth of ecommerce in Brazil is Via Varejo, a top ten holding for BRLA.

Over half of Via Varejo’s sales now come online, with 20% of total sales made via WhatsApp in the fourth quarter of 2020. Via Varejo trades on a forward P/E of 19.4x according to Bloomberg, compared to 15x for Alibaba and 59.5x for Amazon.

BEMO includes a number of companies in this space such as Allegro of Poland and Ozon of Russia. It also has a large position in MTN Group of South Africa. The group’s MoMo payments platform facilitates ecommerce and gives it exposure to the growth of online commerce in a country with a population of c. 59m.

The threats

These three trends are all essentially secular, but there are cyclical factors to consider too which could influence the success of an investment in the short term. The macro picture for the smaller emerging markets is arguably darkening at the same time as it is for China. One of the key issues is inflation. In poorer countries food and energy make up a larger proportion of the typical consumption basket.

With energy and food commodities seeing rapid increases in prices over the past year, inflation rates are high and above target in Russia, Brazil and India amongst others. Central banks have already hiked rates in Russia and Brazil despite the lingering weakness in the economy from the effects of the pandemic in the face of this high inflation. The Indian central bank has refrained so far, being more concerned to boost the recovery.

We also think the recent rise in the dollar is something to watch out for. A hawkish fed has seen the dollar index rise as earlier rate hikes are priced in. The DXY is at its high for the year, and back to levels briefly seen last September but last seen on a more sustained basis prior to the initial impact of the pandemic.

Strength in the US economy and the expectation of rate hikes could see further dollar strength. This would lead to higher funding costs for emerging countries and rate hikes to cope with it would dampen economic activity too. This wouldn’t necessarily prevent ecommerce companies from taking market share, EV vehicle production surging or the Indian business sector developing fast, but it could lead to volatility and lower valuations in the short to medium term.

Conclusion

We don’t think the exciting growth story in China is over, but think the engines of growth are likely changing. Maybe distrust of the communist system is leading investors to fear the worst? There may also be some wishful thinking in some of the criticisms of China – the hope that an authoritarian model cannot succeed. From an investor’s point of view, we think it is critical to see that China’s focus is on making itself and its people richer. It has invested a huge amount of capital (of all types) in bringing its economy within the world system, and is unlikely to reverse this course with large scale expropriations. That said, the risk of government intervention is much higher in China – and always was.

Given the discussion above, we suspect the burst of large cap tech super-returns is probably over, and it may be that China’s regulatory interference is a foreshadowing of similar moves in the West against the monopoly-like powers of Facebook, Google and Amazon. It also seems likely that China’s weakening macro environment means that consumer spending and business activity will grow at a slower pace, and the mythical ‘GDP’ will rise by less than in the past.

On the positive side, none of this will prevent innovation and economic development in the critical spheres of emphasis for the Chinese authorities. These are chiefly hardware, green technologies and healthcare. Moreover, managers tell us they still see huge potential in high-end consumer goods and services. For all its recent growth, GDP per capita is still estimated at $10k in China by the World Bank, compared to c. $25k in Taiwan. Consumer goods and services will be rolled out to many millions over the next decade, even if there are cyclical slowdowns on the way.

We do, however, think the size of China in the emerging markets and the weakening short-term picture make allocations to ex-China trusts attractive at this point in time for both returns and diversification. Investors have been slow to pick up on the opportunities outside China in our view, in particular in the secular trends we have discussed above. BEMO is the second-best performer in the AIC Emerging Markets sector this year (to 011/10) with returns of 21.5%. Yet it trades on a 12.8% discount, the second-widest in the sector.

BRLA is more exposed to reflationary sentiment thanks to the exposure to materials and energy (and perhaps to the strength of the dollar on the negative side too). It is down 5.8% year-to-date, and trades on an 10.6% discount. In 2021 the Indian trusts have done exceptionally well. ANII is up 20.7% and AIE 43.6% (the index is up 27.8%). Yet ANII trades on a 12.7% discount. AIE trades on premium of 4%.

We wouldn’t want to forecast short-term market movements, and the economic environment globally does seem to be darkening. However, for the long-term investor all these discounts look like interesting entry points – although with the exception of AIE the trusts have tended to trade on wide discounts for some time. Even the Chinese trusts are starting to look like decent value, with JCGI trading on a 7.2% discount, Fidelity China Special Situations 7.8% and Baillie Gifford China Growth 2%. The China trusts are all down between 10% and 13% this year.

Commentary » Equities » Equities Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.