Aug

2019

Saltydog Investor: ‘What has been is what will be…..

DIY Investor

21 August 2019

‘What has been is what will be, and what is done is what will be done, and there is nothing new under the sun.’ (Ecclesiastes)

By Douglas Chadwick, Founder of Saltydog Investor

The above saying is unfortunately how I view the operation of the world of personal finance.

The money invested by the general public, the ‘common man’, is there simply to enrich the lives of those people operating the system.

The pension funds, the banks, insurance companies, investment houses would all appear to operate for the benefit of their Company Directors and Managers, all at the expense of the unwitting public.

At regular intervals financial disasters occur and the government, politicians, the F.C.A. and the media all wring their hands, whilst calling for changes which actually change nothing.

The latest calamity is the unravelling of the Woodford funds along with their promoter, the fund platform Hargreaves Lansdown.

‘Yet again the losers are the public, they will see their savings and pensions taking the strain’

Yet again the losers are the public, they will see their savings and pensions taking the strain, whilst the directors will carry on unscathed with no apparent reduction in their lifestyle; hurray for the system, roll on the next calamity.

The above does not have to be the case, as private investors you can take back control. After all, this is your money and savings, it is your baby, and you are ultimately the person responsible for its’ future.

I learned the hard way that the financial industry generally promotes passive investing for your money.

‘hundreds of billions of pounds of private investors’ money lie unloved in cash ISAs and ‘dog’ funds, earning you nothing’

It goes into a stock or fund, and then you are expected to stick with their decision through thick and thin, regardless of stock market conditions and the performance of your investment.

That is why today it is reported that hundreds of billions of pounds of private investors’ money lie unloved in cash ISAs and ‘dog’ funds, earning you nothing, whilst they, the fund managers and institutions, sit back and count their commission!

Here at Saltydog Investor we believe that to make your current savings work harder you need to take a few simple steps:

- Take advantage of the low-cost fund supermarket platforms and discount brokers; you need access to a wide selection of funds and be able to switch between them without it costing you an arm and a leg.

- Use tax-efficient wrappers like ISAs and SIPPs; the government has set up various schemes to encourage us to save more, and it is important to take full advantage of these.

- Manage risk; by understanding how different funds are classified it is possible to tailor your portfolio to match your appetite for excitement.

- Regularly monitor your progress and be prepared to change tack as conditions vary.

At Saltydog we are confirmed believers in Momentum Investing (sometimes called Trend Investing) using Unit Trusts, OEICs, Investment Trusts, and Exchange Trading Funds. This is a proven way of making money on the stock market and goes back over one hundred years.

It is fascinating how momentum investors in very different times and places, have come up with remarkably similar rules for making good profits.

- Here are some that have stood the test of time:

- The vital importance of market sector recognition and a constant supply of up-to-date performance data.

- Don’t always be invested in the market.

- In times of uncertainty, cash is a good home for your money.

- Test the validity of a new trend with a small investment first before piling in.

- Once a trend is established for a fund or a sector, it is more likely to continue in that direction than to move against the trend.

- After a steady rise the fund, or sector, will level off and turn down, with only occasional rallies, and it is obvious that the line of least resistance has changed from upwards to downwards.

- There is no need for explanations, now is the time to sell.

- Do not try to catch the top or bottom of the trend, be happy if you are on the ladder going up and off the snake before it goes down.

Of course, the big question is where do you get your information on the performance of the many tens of thousands of funds available to the U.K. investor in a format that is meaningful?

We singularly failed to find this source and were forced to create our own system. We wrote our own algorithm which does the following:

It breaks down the many tens of thousands of available funds by removing the currency duplications and concentrating on those funds available in sterling from the UK.

‘where do you get your information on the performance of the many tens of thousands of funds available to the U.K. investor in a format that is meaningful?’

It then allocates these remaining funds into the relevant Investment Association sectors.

It then compares the performance of the funds within each sector and removes the non-performers. We are only interested in those funds at the front of the race not those bringing up the rear.

Thirty plus sectors are rather a lot to concentrate the mind, so we combine the I.A. sectors into our own proprietary Saltydog groups…Safe Haven, Slow Ahead, Steady as She Goes, Full Steam Ahead Developed Markets, and finally Full Steam Ahead Emerging Markets. These groups help to indicate the potential risk associated with each fund within them.

The numbers are based and presented on a four and twenty-six week performance basis, which are released to our subscribers every week.

The above sounds complicated but in fact it is not. When making your investment decision the choice of sector should come before the choice of fund.

The best fund manager in the world is going to struggle to make a profit if the sector his fund is invested in, is failing. You should change your investments as the investment climate changes, and select your funds on the basis of performance, and not on the history or the reputation of the fund manager. Below are some extracts from our data that should help you see what we mean.

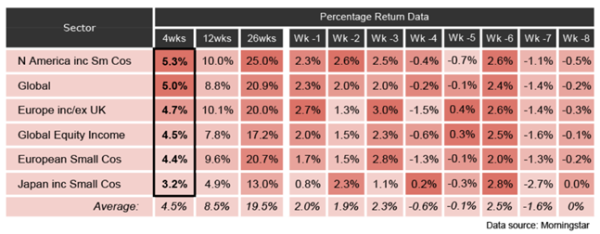

Here’s an example of our sector analysis from the Full Steam Ahead Developed Markets group

It shows the cumulative four, twelve and twenty-six week returns for the top 50% of funds in each sector, along with the last eight individual weekly returns. We also show this information graphically.

Having decided which sectors look interesting you can then look at the specific sector data. We have two tables for each sector. One highlighting the leading funds based on their performance over the last four weeks, and the other looking over twenty-six weeks. It’s a good sign when a fund appears in both.

Here’s an example of one of our twenty-six week tables.

On this occasion the Baillie Gifford American fund was also at the top of our four-week table.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

Click here to see the latest edition of Focus on Funds

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.