Aug

2019

Focus on Funds: More questions than answers at Woodford

DIY Investor

19 August 2019

More Questions Than Answers

By The Nimble Trader

There are more questions than answers are there not? No, I don’t mean about one of the more recent issues to engulf Alexander Boris de Pfeffel Johnson Member of Parliament of the United? Kingdom.

I wasn’t in the said flat in Camberwell, South London on the night of the ‘discussion’, so I’ve no idea what did or didn’t happen. Was it as little as a damn good domestic after red wine went all over the lady girlfriend’s sofa or is there more to it? Given that the great man has so far declined to talk about what happened, one does wonder.

Mind you, will the neighbours be asked round for dinner any time soon?

But no, what did or didn’t happen in Camberwell to the would-be leader of the Conservative Party is of no real interest to me, although I must say I would like to see the Conservative Government stop sodding around and start running the country, but that’s another story.

The story that currently has more questions than answers and does interest me however, is the disaster that’s befallen the investors in Neil Woodford’s Equity Income Fund and how they are currently trapped.

Given that many of them will have believed what they read and were told, I have a lot of sympathy for them; for those with big sums of money on the line it’s a nightmare.

‘Just because their name tag says ‘advisor’ doesn’t mean that they’re there to do anything other than sell us something’

Going off at a tangent for a moment I think their plight brings home to all of us that there are huge dangers to just following the advice of clever people in suits.

Just because their name tag says ‘advisor’ doesn’t mean that they’re there to do anything other than sell us something; the something might be to our advantage, might not, but it will be to their advantage no question of that.

The best course of action for all of us is to learn what we’re doing……..and then do it for ourselves without recourse to advice from anybody.

Will we always get it right? Of course not, but with sensible risk control, over time the results are likely to be satisfactory.

Right back to the plot. As I’m sure you know, Woodford was a ‘star’ fund manager at Invesco Perpetual before starting his own fund management company in 2014.

His reputation and status meant that money flowed into his new fund in huge quantities as investors somewhat blindly placed their faith and their savings with him. At its peak his equity income fund was worth £10 billion.

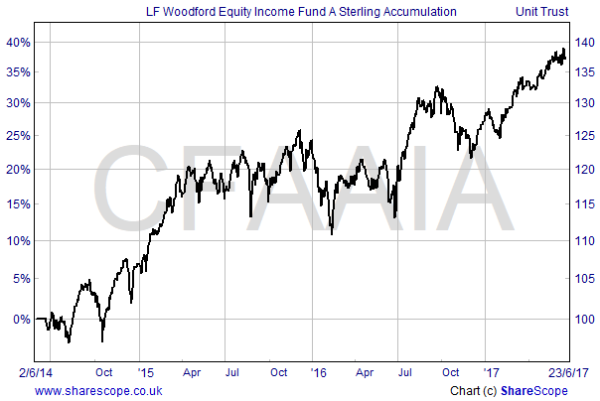

To begin with it all went quite well.

A 37% capital gain in three years is not bad for a passive investor, in fact its just fine. But I suspect that most of the investors had no idea what they’d put their money into.

The funds Woodford managed were promoted hard by Hargreaves Lansdown, other on-line platforms and a host of IFAs and advisors, my guess is that most of their clients were ‘arm chair’ investors, who basically put their money where they were recommended to do so.

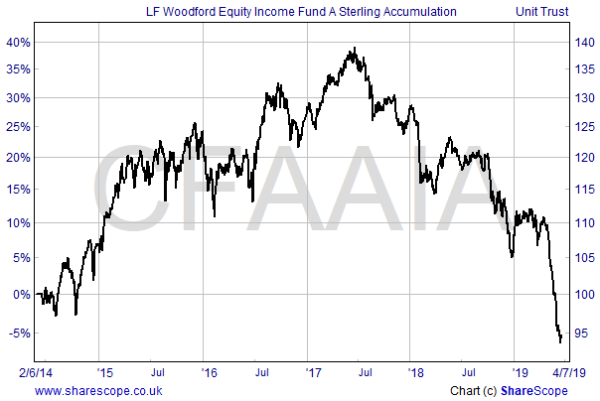

The fund began falling in value almost exactly three years after its inception.

To begin with I doubt anybody was that bothered, nothing goes up in a straight line after all. But after the fund had under performed for a while the redemptions started in earnest, as they did, Woodford was forced to sell his more liquid holdings to meet them and as a result the composition of the fund changed.

He held a mixture of both public and private investments, but to meet the increasing level of redemptions was forced to sell down the public ones as they were more liquid, as a result the percentage level of his unquoted assets rose thus changing the character of the fund.

‘trying to get out of small unquoted ones as anything other than a distressed seller is just about impossible’

As the crisis deepened the negative press comments started up, this increased the selling pressure and made a bad situation even worse. Selling down large positions in big public companies in a hurry is no easy trick, but trying to get out of small unquoted ones as anything other than a distressed seller is just about impossible.

The pressure became too much and on the 4th of June Woodford was forced to lock the gate to redemptions to give himself breathing space to restructure the fund. While that’s happening there is some £3.7 billion of investors money locked away where they can’t access it.

What a mess. For example, the Sunday Times reports that almost 300,000 clients of Hargreaves Lansdown have £1.6 billion stuck in Neil Woodfords frozen fund. At the moment the fund price is 94.75p one wonders what will happen to this price if most of those people plus the many others on other platforms who are also stuck, decide to take their money out once dealing starts again, whenever that is.

You wouldn’t bet against it being carnage, would you?

A lot of very angry people are going to be asking a lot of questions of their financial advisors and my guess is that many professional reputations are going to take a hit they may never recover from.

Right now, there are a lot more questions than answers.

The crisis that has engulfed Woodford was caused by a lack of liquidity, this is a problem common to many funds. Open ended funds, where investors can withdraw their money as they please are very vulnerable if a flood of redemptions come in and the assets they hold can’t be sold quickly and cleanly at a good price.

‘a new type of fund, a ‘long term asset fund’ is being proposed to counter the problem’

As a quick side issue, here’s an obvious example: Because of the state of the high street I personally would not want to be anywhere near a fund that was heavily exposed to retail property right now, for just that reason. Rents are falling, retailers are failing and as a result property prices are on the slide. Against that background, how would a fund manager cope with a flood of redemptions?

The fund industry and the UK Treasury are also clearly worried about liquidity problems and a new type of fund, a ‘long term asset fund’ is being proposed to counter the problem. The idea is that this new class of fund will be for long term investors and will limit their right to make withdrawals as and when they like.

I clearly understand the industry needs such a product, but it will be of no interest to me as a Nimble Trader. I see no advantage to me in possibly having my money locked up in an underperforming situation just because it suits the industry.

I’m only interested in what suits me. Is that cos I is selfish? Or is it cos I is sensible?

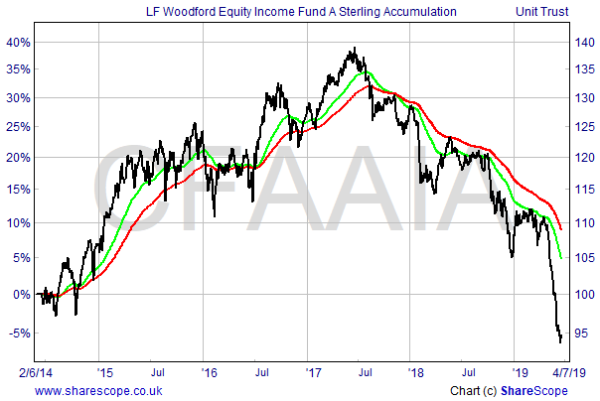

Finally, have a quick look at this chart of Neil Woodford’s Equity Income Fund.

The green and the red lines are one of the indicators Simon my trading partner and I use to evaluate long term investments.

- Buy when the green line crosses above the red.

- Hold for as long as the green line stays above the red.

- Sell out when the green line crosses down through the red.

- Avoid like the plague when the red line is above the green.

Neither of us have ever invested in this fund, but had we done so we would have entered in September 2014 at around 104p and exited in November 2017 at around 126p. We would not have held since then.

Regards,

The Nimble Trader

If you would like to find out more about The Nimble Trader click on the logo for receive a free 30 day trial:

Leave a Reply

You must be logged in to post a comment.