Oct

2022

QD view – has logistics been oversold?

DIY Investor

23 October 2022

They say a week is a long time in politics, try a day. Wednesday was a breathtakingly embarrassing day for the government, with the calamitous Liz Truss finally falling on her sword of uncosted tax cuts on Thursday. This will mean that the UK will have its third prime minister in less than two months next week – by Richard Williams

The impact of the Trussonomics experiment has been catastrophic, sending the bond market into turmoil and interest rate expectations soaring. One of the sectors to come off worse from this has been property. High interest rates are bad news for the sector, with borrowing costs greater than the initial yields on many real estate investment trust (REIT) portfolios, implying an upward re-basing of property yields and a decline in portfolio values.

This is most apparent in the industrial and logistics sector, where over many years investment yields have compressed due to the sheer weight of money chasing the e-commerce-fuelled rental growth narrative. The sell-off of logistics-focused REITs over the past few months has been staggering.

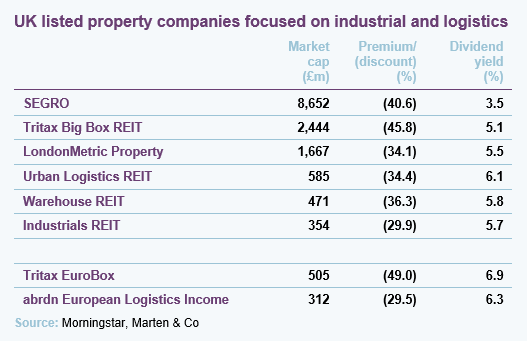

The market leader, SEGRO, is now trading on a discount to net asset value (NAV) of 40%, with the average discount among the eight London-listed, industrial and logistics-focused companies being 37.5%.

This is at odds with the predictions of Goldman Sachs, which last week said that it expects values across the whole commercial property sector to fall by between 15% and 20%. The discounts are more in line with Oxford Economics and Bayes Business School forecasts for valuation declines in the retail sub-sector of up to 35%.

Fire sales are expected across retail as landlords come under pressure from banking covenants (loan to value and interest cover restrictions put on the borrower) on existing loans. This is less of an issue in the industrial and logistics sector where values have risen sharply over the last five years (the typical loan term).

What the industrial and logistics discounts do not account for is the strong occupier market and the off-setting of yield movement from rental growth. The key metric for rental growth is the vacancy rate, which is around 3% in the UK and in Europe. This is way below the threshold where substantial rental growth is typically witnessed of around 8%. Despite the hysteria that surrounded Amazon’s announcement earlier this year that its US expansion was over, the lettings market is still strong and rents increased an average of 16% in the UK in the six months from February 2022.

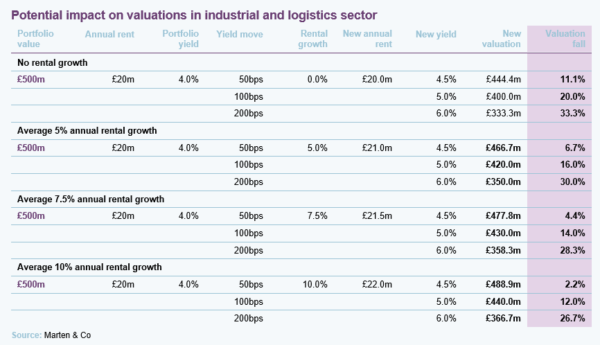

As industrial and logistics yields move out, rental growth in the sector will play an important role in curtailing the impact on values. If we take Goldman’s expectation for a 20% valuation fall (equivalent to a 100 basis points yield shift) then rental growth of 7.5% will cushion the valuation fall to 14%. Even in a worst-case scenario of a 200 basis points shift in yields (the equivalent of a valuation fall of around 35%, as predicted for the retail sector by Oxford Economics), a 7.5% uplift in rents would result in a 28% valuation decline.

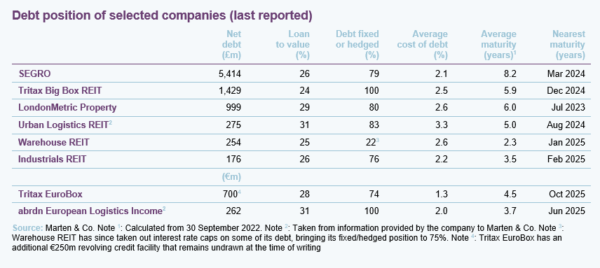

The strong debt positions of the industrial and logistics companies are also at odds with their current discount ratings. The majority of the companies are in a strong position with debt fixed or hedged, protecting it from further increases in interest rates. SEGRO, for example, has stated that a further 100 basis points rise in benchmark rates from current levels would increase its cost of debt by 24 basis points. The same rise in benchmark rates would increase LondonMetric’s cost of debt by 20 basis point and reduce earnings per share by 0.2p on an annualised basis. Rental growth would more than mitigate against this potential rising interest costs.

Predicting where interest rates and real estate prices will go from here is impossible. But if one looks through the current interest rate cycle and trusts that inflation will be brought under control at some point within an investable timescale, then the hope is that as the cost of capital reduces real estate values will rise again. Whether we can trust this government (or the next) to bring inflation under control is another matter.

Alternative investments Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest

Leave a Reply

You must be logged in to post a comment.