Oct

2022

Q&A: How to navigate the turbulent months ahead

DIY Investor

24 October 2022

It’s been a tough year for investors in most asset classes. Schroders’ experts explain the current turmoil, and where they see opportunities developing in the coming months.

Why have financial markets been especially volatile recently?

Keith Wade, Chief Economist & Strategist: “What we’ve seen this year has been the end of a prolonged era of low inflation. A number of factors have led to inflation surging recently – not least Russia’s invasion of Ukraine and China’s Covid-19 lockdowns. There’s been a lot of focus on inflation recently in the UK, but it’s not just a UK problem.

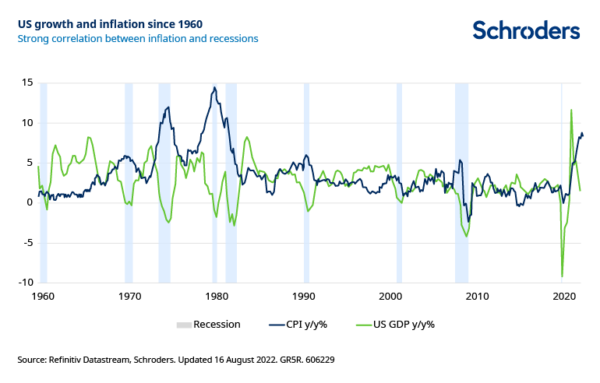

“The important point about high inflation is that it’s a good indicator that a recession is about to follow. It squeezes household incomes and is also usually followed by tighter monetary policy from central banks. This means borrowing is more expensive and hence has a cooling effect on economic growth.

“We haven’t seen inflation fall from these kinds of levels without a fall in GDP in the region of 2%-3%.

“There are signs that inflation in certain areas is moderating. For example, energy and food prices have come off their highs, while congestion at Chinese ports is easing, which should reduce logistics bottlenecks.

“But service sector inflation is still moving up and labour markets remain very strong, particularly in the US and UK. Partly this is due to lower participation in the workforce compared to pre-Covid times, with working age people retiring early and higher numbers of long-term sick.

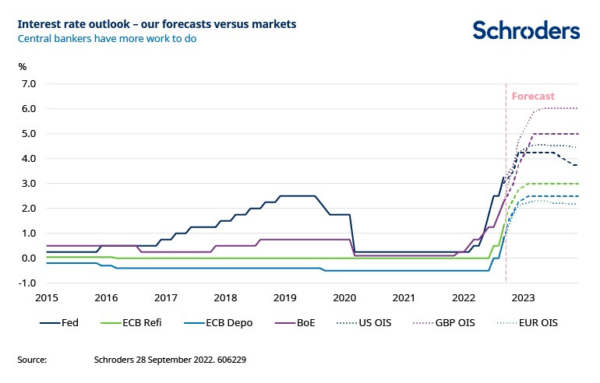

“We think the US Federal Reserve (Fed) is unlikely to pause its interest rate hiking cycle until there are signs of a slowdown in the labour market. This may happen quite soon and we forecast US rates to reach 4.25% by year-end, before a pause to see the impact.

“The good news is that markets do expect the Fed to succeed in controlling inflation. Long-term inflation expectations are steady at under 3%. This should mean that wage demands begin to moderate as people aren’t expecting a prolonged period of high inflation.

“Meanwhile in the UK, we’ve had a particularly volatile few weeks in the wake of the 23 September mini-budget. The fiscal measures announced would have been worth c.12% of UK GDP by 2026/27. That’s a significant amount and the news was accompanied by little detail on how it would be funded, which led to the sell-off in UK government bonds. Some of those measures have now been cancelled, and a new chancellor is in post.

“In markets, another reaction to the mini-budget was the fall in the pound, which in turn fuels inflation further because commodities like oil are priced in dollars.

“What all of this means is that interest rates look set to rise further in the US, Europe and UK. Our rate forecasts for the UK are perhaps not as high as market expectations (see chart). Some of the work in slowing the economy has already been done by the UK mortgage market, where rates have already moved up swiftly.”

How has this affected credit and equity markets?

Julien Houdain, Head of Credit – Europe: “The surge in inflation has obviously had a significant impact on rate expectations. At the start of the year markets anticipated US rates moving 1% or 1.5% higher; now we’re looking at rates reaching more like 4.5% or 5%.

“US inflation is certainly the most important data point driving markets right now, as that guides where rates are likely to go. The US has recently released its latest CPI inflation data, which at 8.2%, remains elevated and will drive price action for the next month.”

“We saw credit markets react to the prospect of hawkish central banks very quickly with credit premiums rising sharply (i.e. bond prices falling) from April to June this year. What’s happening now is the rest of the market is catching up.”

Alex Tedder, Head of Global & Thematic Equities: “What’s happened so far in equities is that we’re in a bear market, and probably about three-quarters of the way through it. Markets have de-rated but corporate earnings expectations have yet to fall.

“The de-rating has happened because, with higher rates, companies’ future cash flows are worth less. But the prospect of recession isn’t yet fully factored into the market’s expectations for corporate earnings.

“We’re just at the start of the Q3 corporate reporting season, so we will see downgrades come through. But certainly forecasts for 2023 profits are way too high. Earnings estimate have to come down quite a bit further before we reach the bottom of the market.”

Where does this leave a multi-asset investor?

Remi Olu-Pitan, Head of Multi-Asset Growth and Income: “Neither credit nor equities have been attractive options this year. For a multi-asset investor, cash has been the place to be and patience the key attribute to have. Even commodities have not provided an option lately; inflation helps commodities but they don’t fare well in recessions as demand falls.”

“Again, it’s all about US inflation. We need to know when we’ll get stability on the rates front. And that will help us determine whether shares look cheap enough.”

How can investors position in this environment?

Julien: “The good news is that credit provides attractive compensation. Credit has rarely been so cheap, and the opportunity has been there since June, as credit priced in this slowdown before other asset classes.

“Fixed income investing is all about getting your money back, and collecting a coupon along the way. Yields currently provide good protection for investors. It’s possible to build a diversified portfolio with an average investment grade credit rating yielding close to 8%, and that’s a fund with daily liquidity.

“However, it’s still important to be selective and understand the difference between cyclical and structural impacts. Certain companies, such as in the telecom sector, have built a high level of leverage which was not perceived as a problem in a low rate environment. Telecoms are often seen as a defensive sector but for some companies in this sector that won’t be the case when they have to refinance that debt at a 5% interest rate, compared to the much lower levels that prevailed in the past decade. That’s a structural impact.”

Alex: “In equities, quality is crucial in the current environment. Companies with good cashflows, solid business models and the ability to raise prices to offset inflation will fare best.”

Remi: “From a multi-asset perspective, I think we’ve had phase one of this market re-set, which was all about moving into cash. That was a ‘macro’ phase.

“We’re now going to move into phase two, which will be more ‘micro’. It’ll be about identifying those companies who can deliver earnings and avoid default. It’ll also potentially offer a good entry point into commodities for those without exposure already.

“For investors, phase one has been a difficult environment but phase two could be quite good.”

What about opportunities for 2023?

Alex: “There are still long-term structural investment opportunities in markets that haven’t changed as a result of the current turmoil. In fact, they’ve become more pressing as we can see in terms of the need for security – whether that’s energy security, food, cyber, etc. Investment themes such as energy transition are only increasing in importance.

“But for next year specifically, I’d highlight Japan. The weak yen and low inflation have made the economy very competitive.

“And in terms of sectors, banks look attractive. The rising interest rate dynamic is positive for them as they can reprice loans. There are some individual problems in European investment banking, but ordinary European retail banks are much more conservatively run now than pre-2008 and look attractive to us.”

Julien: “I’d agree about European banks from a credit perspective too. As a sector, they’ve gone through major crises before and those that are left are more resilient as a result. What’s more, the European Central Bank has put in place measures to contain potential issues – such as its plan to support peripheral markets – and ensure financial stability.”

Remi: “I still think patience is the watchword but it’s certainly true that valuations have improved. Investors can slowly add back to their portfolios and taking advantage of these valuations, starting first with credit with equities to follow.”

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Brokers Commentary » Brokers Latest » Commentary » Investment trusts Commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.