Apr

2022

Private Markets: A closer look at the expanding private debt opportunity

DIY Investor

7 April 2022

We look at the attractions of the private debt market, historically the hunting ground of the institutional investor….

We look at the attractions of the private debt market, historically the hunting ground of the institutional investor….

Disclaimer This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Increasing amounts of capital have flowed into the infrastructure and renewable infrastructure sectors for reasons we discussed in a recent strategy note. However, there is an alternative closer to home which could offer many of the same attractions. In the past few years, a handful of trusts have started to open up the private debt space from its historically institutional ownership to a broader investor base. Here we try to demystify this asset class and show how it could be made for the current economic environment.

What is private debt and why is it attractive?

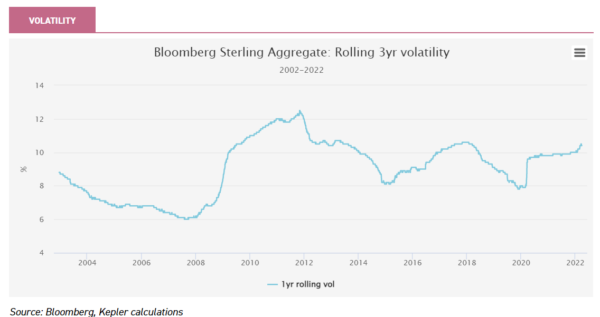

Bonds have traditionally been sought after for certain characteristics: lower volatility, diversification versus equities and steady annual returns through income. In recent years investors have sought to diversify as these attractions have become less reliable. Below we show the rolling three-year volatility of the Bloomberg Sterling Aggregate Index, a broad index of sterling-denominated debt. Going back as far as we can, we can see some evidence of higher volatility over time.

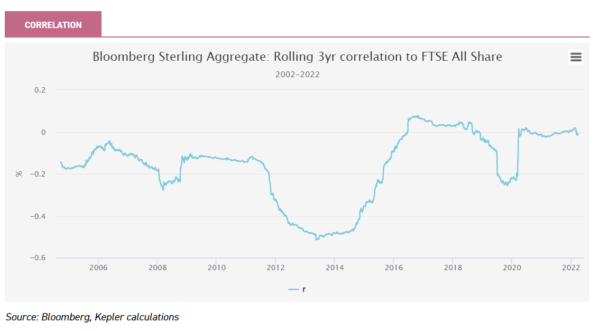

The correlation benefits of traditional bonds have been diminishing at the same time. Below we have charted the rolling three-year correlation of the same index versus UK equities. Notably the figure has been positive for much of the past six years. Not very positive to be fair, but enough to show that there has been limited diversification benefit from holding bonds compared to the past.

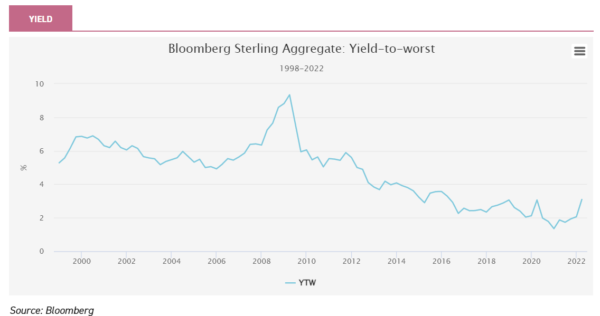

Meanwhile potential income returns have fallen, notwithstanding the back up in yields in recent weeks. Below we show the declining yield on the same index. One factor behind the rise in volatility is the growing duration of the index, thanks to higher prices which bring lower yields. Bonds at very high prices have tended to trade more in line with equities as both asset classes have been seen as supported by central bank policy to keep rates low and liquidity high.

Source: Bloomberg

Past performance is not a reliable indicator of future results

Ultimately investors have a problem: because yields are low in traditional fixed income, volatility is higher and diversification is lower. Investing in some segments of the fixed income markets has increasingly become speculating on duration, funded by a captive institutional investor base of insurers and pension funds.

We think this situation is a key reason for the growing interest in the alternative space in the investment trust universe. However, we would highlight that a small selection of trusts has started to offer exposure to private debt markets which may offer a more obvious alternative.

In a broad sense, private debt refers to debt which is not traded on exchanges, but the terms of which are negotiated privately. This includes loans made by banks or non-bank financial institutions directly to businesses, loans backed by real assets, lending against real estate, certain asset-backed securities, trade financing and structured credit deals. Often these are bilateral arrangements, with borrowers and lenders coming to a deal between them. However, a broader definition of private debt could include syndicated loans, whereby a collection of lenders underwrite a deal. There is no hard and fast distinction between public and private markets (although technical definitions could be based on registration status). Ultimately many publicly listed bonds trade over-the-counter rather than on computerized exchanges. Given that private debt can be traded between investors if they wish (although is intended to be held-to-maturity), the distinction arguably boils down to one of liquidity.

This is a space where institutional investors supply funds to those who need it, largely taking on the cost and risk of doing the due diligence on the lender themselves, with fewer regulatory demands and no intermediaries. Borrowers do not have to be private companies: public companies may prefer to issue private placement notes for various reasons: confidentiality, diversification of sources, accessing longer maturities, reducing all-in costs by removing regulatory and underwriting fees and creating a long-term relationship with a lender. Similarly, private companies can issue publicly traded bonds if they wish.

For the lender, the intention is to hold to maturity, which means private debt portfolios tend to use fair value accounting rather than marking to market, delivering stable NAVs with much less volatility than publicly listed bonds. To some extent this is an artificial reduction in volume, as it is simply the lack of pricing.

It is important to recognise that one thing falls in fixed income prices tell us is that better yields are available in new investments, and this is true even if there is no recognition of this in the NAV. However, were private debt to be marked to market equivalent, there are a number of factors that would reduce the volatility anyway. Much of the private debt space is floating rate which means the duration is low. Furthermore, private debt typically pays higher coupons for reasons discussed below, so the stable element in total returns is a higher proportion.

As for correlation, the lack of mark to market accounting and high proportion of income to total return will reduce the correlation of portfolio returns to equity markets. On the other hand, credit is an important risk factor and source of returns in private debt, which brings with it some correlation to equity markets. The low duration means there isn’t even a theoretical negative correlation to equities from this source, and so holding private credit is arguably no improvement for investors on this metric.

One out of two of the key problems so far are improved by allocating to private credit then, which leaves income. This is the key attraction in our view: private credit offers much higher yields for the same credit risk by supplementing this with other sources of returns, chiefly illiquidity and complexity as we discuss in section on returns below.

What are the options in the investment trust space?

The investment trust structure is ideal for offering the mass market access to this institutional space due to the ability for trusts to hold illiquid assets yet provide daily liquidity through the shares of the trust.

In November 2018 M&G launched M&G Credit Income (MGCI), which has a target allocation of 70% private debt. The 30% in public bonds provides liquidity and also potentially offers higher risk-adjusted returns at different points in the cycle. MGCI aims to generate the yield of a high yield product from a portfolio with an average investment grade credit rating. The ratings are internally provided by M&G’s analysts, and around 75% are classed as investment grade as of the latest quarterly report. On a historic basis the yield is 4.1%.

One factor that will likely push up dividends this year is rising interest rates. Around 85% of the portfolio is floating rate, which means there will be a direct pass-through of rising interest rates via the interbank rate the loans are priced off (generally SONIA now that LIBOR has been retired). Another factor is widening spreads. Private markets price off public markets, and one benefit of maintaining a significant allocation to public debt is it can be swiftly sold to purchase higher-yielding private debt.

The manager, Adam English, tells us he is currently quite defensively positioned and expecting to be able to earn higher spreads in the coming months. MGCI has a debt facility but has not used it, a further source of defensiveness.

Neuberger Berman Monthly High Income (NBMI) offers investors a way to dip a toe in the space with a majority public debt exposure. NBMI is a bit more of a typical strategic bond fund with a broader opportunity set, including private debt. Its allocation to the space should be expected to be much lower, with a typical higher credit rating than MGCI – and therefore probably a higher yield over the cycle. It might be more appropriate as a straight replacement for a strategic bond fund or a holding for an investor wanting to moderate potential exposure to private investments.

NBMI aims for 50-70% in traditional credit, and 30-50% in what they call alternative credit. As well as private debt this includes special situations, a borderline category between public and private debt. This involves buying debt at deeply discounted levels, with the potential to receive repayment of the original loan or something similar.

A key attraction of this as a source of returns is the idiosyncratic nature: it should depend on company specifics and the execution of management rather than on market conditions. NBMI offers a much higher yield of 5.7%, but with a greater proportion of the returns coming from credit risk rather than illiquidity or complexity and with greater NAV volatility. As of the end of February, less than 1% of the portfolio was in debt rated investment grade. NBMI is also not geared.

One area MGCI invests in is real estate backed loans. The AIC Property – Debt sector contains a number of trusts which operate exclusively in this field. One is Starwood European Real Estate Finance (SWEF), the publicly-listed fund of Starwood Capital, one of the world’s largest real estate investors. SWEF lends against commercial real estate, sometimes participating in deals with other private debt funds run by Starwood. The portfolio has typically had high allocations to the leisure and retail sectors. The pandemic was difficult for tenants of these properties, but SWEF sailed through without recognising any impairments to its NAV.

We think this demonstrates the resilience of investing in the debt rather than equity of commercial property. SWEF is naturally more protected from the economic performance of borrowers than equity investors are, thanks to being higher up the capital structure. The average LTV on the portfolio of 60.3% provides a significant equity cushion.

SWEF generates a historic yield of 5.8%, without any gearing at the portfolio level.

SWEF is the purest play option in the sector. Real Estate Credit Investments straddles the public and private debt markets, and also uses gearing in order to boost returns.

RECI offers a higher yield, but the NAV journey has been more volatile, with the NAV taking a significant hit when the pandemic struck. SWEF on the other hand took no impairments to its loans and so its NAV saw no impact, illustrating the defensive properties of investing in secured private debt at conservative LTVs.

Alpha Real invests in equity as well as debt, and has built up large amounts of cash in the aftermath of the pandemic (43% of the portfolio as of November 2021). It trades on a wide discount of 28%. ICG-Longbow Senior Secured UK Property Debt Invest is in realisation.

One diversified fund to take advantage of private debt is JPMorgan Core Real Assets (JARA). JARA has around 5% in debt secured against commercial real estate. This offers the trust diversification and more security which was particularly desirable during the tumultuous period of the pandemic. JARA offers access to a broad array of private assets listed around the globe via investment in private open-ended funds run by JPMorgan for institutional investors.

The underlying funds are mostly perpetual life open-ended funds investing in private assets (c. 80% of the portfolio) with the remainder invested in more liquid, listed securities via bespoke segregated accounts. The portfolio is allocated across REITs, equity and debt, as well as listed infrastructure and transportation. The liquid part of the portfolio gives the managers the flexibility to adjust exposures at the margin and diversification.

The direct lending sector is another source of private debt exposure. This sector once housed a number of platform lending strategies which turned sour. This is a reminder that the complexity of private credit is a risk factor: it is hard for the average investor to track what is going on in the market when that market is private, and hard to understand unfamiliar asset classes.

There are also a number of trusts in this sector which are in realisation or in the process of leaving the sector after a strategic overhaul. However, the sector also includes some large and mature portfolios such as Biopharma Credit, which focusses on the pharmaceutical industry and GCP Asset Backed Income which is a more diverse portfolio focussed most on social infrastructure and property. These offer higher yields than the other trusts mentioned so far, but bring greater sector risk and single stock risk through greater position sizing.

What returns might investors expect from private debt trusts?

As a largely floating rate sector, there is minimal capital return potential in key segments of the space. Generally speaking, loans are made for a fixed term with the intention being to hold them to maturity and receive a return of the capital lent. Returns come overwhelmingly from the coupon paid.

There are two key sources of return above credit risk, which allow private debt to offer higher yield pound for pound. The first is the illiquidity premium. Liquidity is a characteristic which investors are willing to pay for: this contributes to the willingness of investors to hold extremely low-yielding bonds, as well as foregoing return potential to hold cash.

Less liquid investments generally offer high returns as compensation for the risk of not being able to sell or sell at a good price when desired. This liquidity premium in the private debt space is one reason that loans from investment grade quality borrowers can offer yields equivalent to public high yield bonds. Ultimately the institutions lending in the private markets are not intending to sell until maturity, so on a day-to-day basis the illiquidity is not an issue.

Furthermore, those who buy a diversified portfolio of private loans through an investment trust or other structure are protected by the diversification of the portfolio and in many cases by the specialisation of the manager. The major players in the private debt markets will have teams devoted to restructuring and helping borrowers who get into distress. This is the preferred route; to tackle borrowers who get into trouble, rather than trying to sell.

An extra source of return in the private debt markets is the complexity premium. This refers to the extra returns available for being able to originate, structure and analyse the risks of a complex private deal and monitor the borrowers and loan performance on an ongoing basis. One important feature of complex investments is that the acquisition costs of information are high.

This means the pool of buyers is naturally limited to those with the scale to justify those costs. With fewer potential investors competing for investments, returns (all being equal) will be higher. One could argue this is another facet of illiquidity: this is a market with few operators and so investors need to be able to hold to maturity and handle restructuring in extremis. We can leave the question of whether there is a hard and fast distinction between the two premia to the academics: it is certainly analytically useful to think of these as two separate sources of returns.

The extra spread earned for lending in the private markets will vary over time, as will credit spreads themselves. However, investors should expect to receive a higher yield than public credit for the same credit risk. MGCI focusses on debt it considers equivalent to investment grade in credit quality, and yet seems likely to offer a yield closer to public investment grade markets.

The more specialist direct lending trusts offer much higher yields, but bring with them more credit risk and therefore a greater possibility of write downs and NAV volatility. As such, investors new to the space may prefer to take exposure through MGCI or NBMI, which dilutes exposure to the private markets with majority conventional bond exposure.

SWEF’s income return is higher than that available on UK commercial property trusts. These tend to languish on wide discounts at the moment, which could lead to high share price returns if they narrow. The commercial property sector has also been experiencing a strong few quarters in the recovery from the pandemic which could lead to positive capital returns, which SWEF cannot provide. On the other hand, SWEF has proven its resilience during the pandemic.

Furthermore, in recent years the dividend has been put under pressure by the decline in interest rates off which the trust’s deals are priced. With the outlook for interest rates being positive, this should provide support behind the dividend in future.

Fundamentally the return received from private debt will be the income return. This could make returns more predictable and reliable, but it does mean that in any future bond rally investors won’t receive the capital uplift from having high duration.

Outlook

We think private debt looks attractive given the current economic environment. The key attraction is the floating rate nature of much of the sector. With interest rates expected to be steadily raised in the US and the UK and in the EU more slowly, this should see the interest earned by private debt rise, allowing trusts investing in it to pay higher dividends. This is in sharp contrast to the effect on traditional fixed income which will see no change in the coupons received but falls in capital values. As private debt portfolios use far value accounting, they will not see any write downs due to the minimal duration they have.

The key factor is what happens to credit spreads while rates rise, which is likely to depend on what happens to equity markets. Equities have staged a recovery in recent weeks after tumbling on the outbreak of war in Ukraine. However, it remains to be seen how the economy and markets navigates the current spike in inflation. If equity markets and credit spreads sell off, then private debt investors will be able to lock in higher yields.

Assuming this sell off doesn’t bring with it significant defaults, any sell off would actually be positive for private credit portfolios, with the only drawback being the opportunity cost of being invested in lower-yielding loans than could be arranged in a higher-yielding market. We think private credit could be a useful choice for those looking to diversify their bond exposure, either alongside or instead of infrastructure and other real assets.

Brokers Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.