May

2022

Performance hits, misses, and newcomers among most-consistent funds

DIY Investor

8 May 2022

Saltydog’s latest quarterly report looking for consistent performers finds that most have posted losses over the past six months

At Saltydog Investor, we normally focus on the short term, anything from one week up to about six months.

Every week, we produce new graphs and tables showing our members how a wide range of funds have performed over the past few weeks and months. We believe that the overall performance of the Investment Association (IA) sectors reflects what is happening in the wider economy, and that different sectors will emerge at the top of our tables as the geopolitical landscape changes. It is then relatively straightforward to find the leading funds in these sectors. This information is designed to make it easy for private investors to make sure that their portfolios are always invested in the best-performing funds from the best-performing sectors.

Although this system works well for investors who enjoy reviewing their portfolios on a weekly basis, we appreciate that there are a considerable number of people who do not believe they have the time to take this approach.

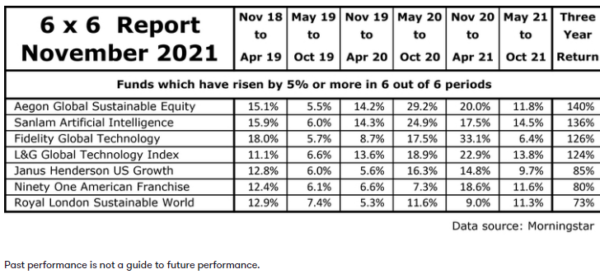

Three years ago, we started providing our Saltydog members with a new piece of analysis highlighting funds that have performed consistently well over a longer timescale than we usually consider. This is our ‘6 x 6 report’, where we identify funds that have performed at a consistently high level in each of the six-month periods over the last three years. Ideally, they will have achieved a return of at least 5% in all six periods, however not many do.

We run this report every three months, so the last one was in February. At that point, no funds had managed to beat the 5% target in each of the six-month periods, but 12 funds had achieved it in five out of six.

The last time any funds achieved the elusive six out of six was in our November 2021 report. There were seven funds, four of which had gone up by more than 100% in three years.

Our latest report covers the three years starting at the beginning of May 2019 and ending at the end of April 2022. We have not found any funds that have gone up by 5% in each of the six six-month periods, but there are 11 that have managed to do it five times.

6 x 6 Report May 2022

| May 19 to Oct 19 | Nov 19 to Apr 20 | May 20 to Oct 20 | Nov 20 to Apr 21 | May 21 to Oct 21 | Nov 21 to Apr 22 | Three-year return | |

| Funds that have risen by 5% or more in five out of six periods | |||||||

| FTF ClearBridge Global Infrastructure | 7.4% | -3.0% | 6.9% | 8.4% | 8.2% | 17.4% | 53% |

| L&G Global 100 Index | 5.6% | 1.6% | 6.5% | 20.9% | 9.6% | 5.7% | 60% |

| L&G Global Health & Pharma Index | 8.9% | 10.1% | -2.2% | 10.3% | 9.5% | 5.6% | 49% |

| Schroder Global Healthcare | 6.4% | 17.1% | 6.2% | 12.1% | 5.8% | 0.0% | 57% |

| Fidelity Global Technology | 5.7% | 8.7% | 17.5% | 33.1% | 6.4% | -5.0% | 82% |

| L&G Global Technology Index | 6.6% | 13.6% | 18.9% | 22.9% | 13.8% | -7.4% | 86% |

| Ninety One American Franchise | 6.1% | 6.6% | 7.3% | 18.6% | 11.6% | -7.8% | 48% |

| Janus Henderson US Growth | 6.0% | 5.6% | 16.3% | 14.8% | 9.7% | -9.0% | 49% |

| Royal London Sustainable World | 7.4% | 5.3% | 11.6% | 9.0% | 11.3% | -9.5% | 39% |

| Sanlam Artificial Intelligence | 6.0% | 14.3% | 24.9% | 17.5% | 14.5% | -19.8% | 63% |

| Aegon Global Sustainable Equity | 5.5% | 14.2% | 29.2% | 20.0% | 11.8% | -26.3% | 54% |

Data source: Morningstar. Past performance is not a guide to future performance.

I have arranged these in order of their returns over the last six months.

At the bottom of the table, there are the seven funds that featured at the top of our November 2021 report. They all went up during the first five periods, but have made losses over the last six months.

There are two new funds in the table that have not made losses in any of the periods but did not manage to achieve the 5% target in one of them. They are the Schroder Global Healthcare and L&G Global 100 Index funds.

Sandwiched in between is the L&G Global Health & Pharma Index fund, which went down in the six months starting in May 2020, but has gone up in the other five six-month periods.

The remaining fund, which is at the top of the list, is FTF ClearBridge Global Infrastructure. It made a loss in the six months starting in November 2019, but has done well since then. In the last six months it has gone up by 17%. Last week, we added it to one of the Saltydog demonstration portfolios.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Brokers Commentary » Brokers Latest » Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.