May

2022

It’s the end of the world as we know it

DIY Investor

8 May 2022

We examine five potential themes for investors seeking long term returns in a troubled and uncertain world….

We examine five potential themes for investors seeking long term returns in a troubled and uncertain world….

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Global equity markets have been extremely turbulent in 2022, thanks to increasing inflationary pressures, the war in Ukraine and spiralling resource prices. In the below article we highlight some numbers behind current market trends, which might hint at how investors should position for the future. Believe it or not, there are some reasons for optimism…

Could this be the start of a stock-picker’s market?

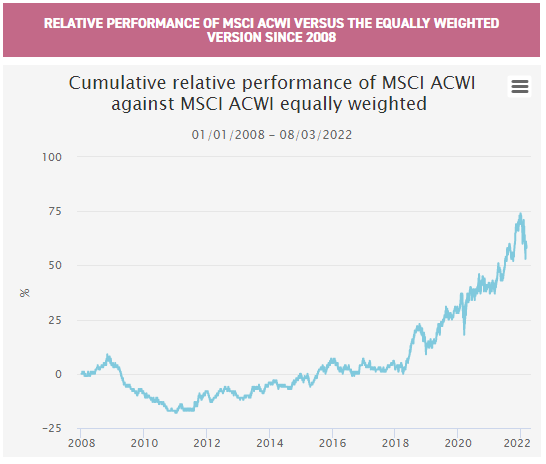

One critical factor explaining returns over the last few years has been the increasing concentration of returns, with an ever-dwindling number of stocks having driven markets. As can be seen in the below graph, since 2018 the equally weighted version of the MSCI ACWI has substantially lagged behind the performance of the market capitalisation weighted index.

In our opinion this is due to a particularly beneficial environment for the relative performance of US large caps since 2018, in particular the mega-cap growth names. Over the last three years accommodative monetary policy, a strengthening US consumer and the ever-increasing earnings of US technology companies have seen US large-cap indices barrelling ahead of the rest of the world.

They were then given a second wind by the 2020 pandemic and subsequent lockdowns. US growth stocks offered investors one of the few sources of growth during what would become the worst market crash since the Great Depression, with Apple, Amazon and Microsoft accounting for c. 50% of the S&P 500’s returns over 2020.

However, as the graph above shows, in the sell-off this year the leaders have led the market down. Rises in interest rates (or expectations of rises) may be behind the painful readjustments in their share prices.

We think the decline in the leadership of US mega caps could be a long-term boon for diversified global strategies like Alliance Trust (ATST). ATST offers investors a highly diversified approach to active investing, employing ten professional stock-pickers across multiple styles of global equity investing to create a c. 200-stock portfolio, with any active risks relative to the MSCI ACWI being diversified away by its manager, Willis Towers Watson.

ATST has underperformed the MSCI ACWI since the change in mandate in April 2017, returning 51.2% in NAV total return terms compared to the 55.6% of the index (as at 10/03/2022). However, this was the direct result of the market’s narrow leadership. Given ATST’s use of highly active managers, it is composed of a wide range of ‘best ideas’ distributed across a wider and far more idiosyncratic group of stocks, with a high active share and a large number of holdings.

ATST’s delegated stock-pickers are unlikely to simply overweight the largest weightings in the benchmark, given their desire to add alpha through active management rather than benchmark-hugging, and a diminishing of the leadership of US mega caps could be what ATST needs to generate attractive outperformance.

Another consequence of the market’s narrow leadership has been the declining presence of small-cap companies within global equity markets. Like ATST, if the drivers of global equity markets were to become far more diversified , we would expect that to be a boon for the relative performance of diversified global small-cap strategies. In this regard we highlight BMO Global Smaller Companies (BGSC), which not only offers investors a highly diversified portfolio of global small caps incorporating c. 200 companies from across world equity markets, but also has a clear bias towards high-quality companies. This attribute may become increasingly important, as high-quality companies are better positioned to absorb the pricing pressures that come from higher inflation.

American strength

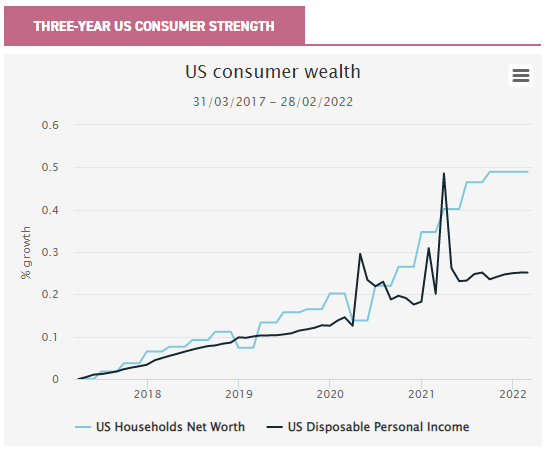

The US consumer remains as strong as ever, which could provide a cushion against some of the negative trends in markets. US household wealth has in fact never been stronger, which should act as a tailwind for domestically focussed companies. As can be seen in the graph below, US household wealth took a sharp upturn post-COVID-19, due to a combination of the impact of US stimulus, a post-pandemic economic upturn and an increase in US wages.

US consumers have not been reckless with their newfound wealth, however, as the increase in wealth has been met with an increase in savings. The consumer debt-to-GDP ratio has fallen back to its pre-pandemic level of 77%, well below the level of c. 98% of GDP prior to the global financial crisis. We note that a sharp rise in US wages is an important element, as it may indicate that US inflation is not merely due to higher input prices but also strong demand, a key factor in combating the possibility of ‘stagflation’ (the devastating combination of inflation and zero growth).

We believe the biggest beneficiary of a strong US consumer will be US small caps, given the sector’s sensitivity to its domestic economy. However, despite this supportive factor, JPMorgan US Smaller Companies (JUSC) and Brown Advisory US Smaller Companies (BASC), the two US small-cap trusts, trade at discounts far wider than their one-year averages, with both having a Z-score of -1.4 (indicating they are 1.4 standard deviations wider than their one-year averages).

Both BASC (on a discount of 12.6%) and JUSC (on a discount of 5.9%, as of 11/03/2022) focus on high-quality US small-cap stocks, with BASC preferring more growth-focussed companies and JUSC instead offering investors a core style of allocation.

We note that despite the sell-off in risk assets in 2022, the two trusts have not significantly underperformed the S&P 500 as might have been expected of small caps in a falling market. We think this may reflect the strength of the US domestic economy. Both trusts have also outperformed the Russell 1000 Growth Index, which is down 13.6% over the same period.

Opportunities in commodities

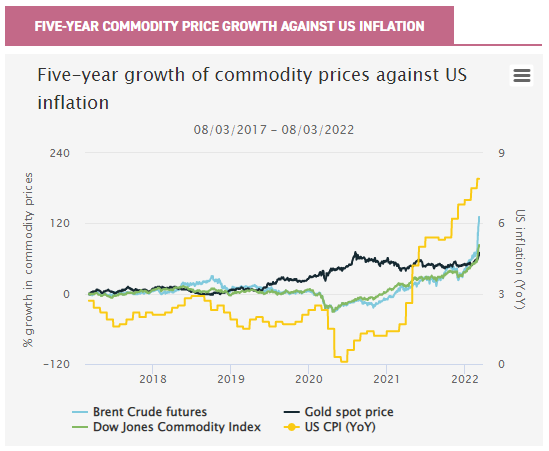

It seems odd that nearly two years ago oil was trading at a negative price. However, thanks to the Ukrainian war and resulting sanctions on Russia, oil has now hit levels not seen since 2015, selling for well over $100 a barrel. Natural gas, another mainstay of Russia’s exports, has also been on a tear, and while not quite as expensive as it was during the height of the post-COVID recovery, it is still well above its long-term average. The war in Ukraine has also had a major impact on agricultural prices thanks to the sudden supply disruptions, as Ukraine is a major supplier of agricultural goods and fertilisers.

Yet the upward spiral of commodity prices is not solely reserved to energy and agriculture, as most other commodities, from aluminium to uranium, have also seen price increases over 2021 and 2022. Russia is a key producer of many of these, and the fundamentals were strong even before the threat of sanctions and trade embargoes.

The surge in economic activity post-lockdowns has led to outsized demand for commodities of all sorts – be those industrial inputs like nickel or lithium, or energy – due to producers having struggled to keep operating through lockdowns.

Gold has also seen a resurgence in its value, with its current price hovering around $2,000 an ounce, nearing the all-time high of $2,075 it hit in August 2020. We note that the increased demand for gold was to be expected, given its role as a flight-to-safety asset and partial hedge against inflation.

Arguably the most painful consequence of rising commodity prices (even to non-investors) is their immediate impact on the cost of living, an issue we discuss in greater detail in our recent editorial, with energy prices being a major driver of global inflation.

High inflation could be difficult for growth stocks, but better for value stocks if it leads to hikes in interest rates (and thus discount rates). This has already been reflected in the closed-ended peer groups, as value-biased strategies like BlackRock Sustainable American Income (BRSA) and Murray International (MYI) have done well relative to their peers.

BRSA has returned an NAV total return of 0% year to date compared to the -5.6% simple average of its peers, while MYI has returned 2.5% compared to the -6.6% simple average of its peers (as at 10/03/2022).

The question investors must now ask themselves is whether current commodity-driven inflation is a short- or long-term issue, or a new source of prolonged inflationary pressures that could continue to jeopardise the once dominant growth stock trade in favour of value

.

Value opportunities are out there

So far, damaged investor confidence has led to widening discounts across many sectors over early 2022. The majority of trusts have generated a negative NAV performance year to date, and only c. 30% of investment trusts have a positive one-year Z-score, indicating that the vast majority trade at a discount wider than their one-year averages (Source: JPMorgan Cazenove, as at 10/03/2022).

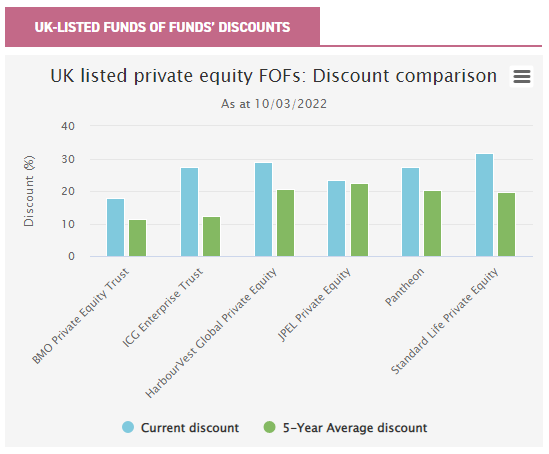

One sector which stands out to us is private equity. In particular, every trust in the UK-listed funds-of-funds (FOFs) peer group is now trading at a wider discount than its five-year average.

While there is a lag in valuations to be considered, we think this could provide an interesting long-term entry point, with discounts having generally been very wide even before the recent sell-off. ICG Enterprise (ICGT), for example, trades at a discount of c. 29.8% at the time of writing. Both that and its five-year average discount of 21.1% seem unwarranted to us. ICGT seeks to provide shareholders with access to the best risk-adjusted returns in the private equity industry, and we published a full note on the trust earlier this month.

Pockets of strong performance

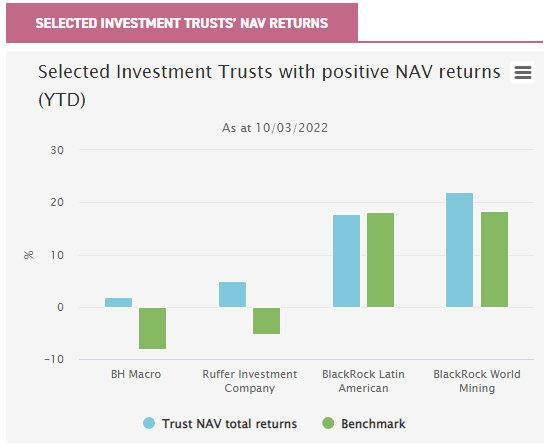

It has been a poor year so far for investors, but a handful of trusts have provided strong performance year to date. Most of the best performers have been in the commodity sectors, or in countries with exposure to them. Chief among these has been BlackRock World Mining (BRWM).

BRWM has a portfolio of companies involved in extracting industrial metals, as well as an allocation to gold (pure-play gold was 15% of the portfolio as at the end of January). It had little exposure to Russia going into the current crisis, and with the capacity for Russia to come out of global markets it could be well placed.

BRWM has returned 132.5% in NAV terms over the last five years, and 21.9% year to date (as of 10/03/2022). On the other hand, BlackRock Latin American (BRLA) has benefitted from strong returns in Latin America, whose strength is due in large part to it being a major commodity-producing region. In the case of Brazil, as a large food exporter its economy will benefit from the rising agricultural commodity prices that are one of the many sad effects of the current war, while the region is a major metal exporter too. In addition, with a dividend payout of 1.25% per quarter on an NAV basis, investors in BRLA are poised for increased payouts if strong performance continues. BRLA has also generated enviable returns year to date, returning 17.7% in NAV terms.

Outside the commodity space we would also highlight Ruffer Investment Company (RICA). RICA has been positioned for rising inflation for some time through its holdings in index-linkers and through energy equities, as well as thanks to its position in gold. As at 10/03/2022 it was up 5.2% year to date, compared to a loss of 8.0% for the MSCI ACWI.

Another protective strategy to perform well has been BH Macro (BHMG), which was up 1.8% to 10/03/2022. BHMG uses options-based trading strategies to try to profit from market volatility. Both RICA and BHMG should offer positive return potential in troubled markets if they continue to perform well.

Brokers Commentary » Brokers Latest » Commentary » Investment trusts Commentary » Investment trusts Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.