Jun

2020

Outlook June 2020: Square Mile Research

DIY Investor

28 June 2020

The recent moves in the markets have been astonishing, both the collapse and the subsequent recovery. The accelerated pace of this cycle has caused this to be a very challenging period to be managing money.

The recent moves in the markets have been astonishing, both the collapse and the subsequent recovery. The accelerated pace of this cycle has caused this to be a very challenging period to be managing money.

The economy has taken an enormous hit, yet we are pleasantly surprised to find the S&P 500 nudging back into positive territory for the year.

Markets have recouped their losses due to aggressive monetary and fiscal responses and the gradual emergence of the main global economies from their shutdowns. However, a myriad of uncertainties and risks remain.

The economic numbers have been derailed so badly that it is impossible to make sense of them

The economic numbers have been derailed so badly that it is impossible to make sense of them. For instance, the improvement in the US jobs report on Friday was much better than economists had been expecting.

The BLS, which generates the report, acknowledges difficulties in collecting data during the crisis. Nevertheless, the markets leapt on the announcement which underlines what we already knew; the US is reopening its economy.

The avalanche of monetary and fiscal responses by authorities around the world will reinforce the pent-up demand, ensuring a surge in activity as economies reopen.

This is a certainty. Yet, the virus has not been tamed and large sections of the economy face huge challenges, such as the travel & leisure industries which now face a protracted period of difficulty.

It will take a good deal longer before activity in these sectors returns to anything like normal. In short, the recovery will happen, but the lasting damage will linger. It will take many quarters before lost GDP can be fully recovered.

The surge higher in the S&P 500 has been led by a narrow band of stocks. This is rarely a healthy sign for a market.

the recovery will happen, but the lasting damage will linger

Consensus estimates suggest that earnings will fall 24% this year and the dispersion in performance between growth and value stocks has never been wider.

The challenges faced by the latter are obvious, but we are not so sure about the unbridled optimism about the former. A business like Facebook owns the billboards of the internet and advertising is inescapably a cyclical industry.

In the midst of the deepest post war recession on record, 33x earnings is demanding to say the least. Beyond that, Facebook may face growing pressure to be broken up.

Bulls say that Amazon could be worth twice its current valuation if its web services division gains a monopoly position, but it will not. Apple is a remarkable brand but it is operating in the fiercely competitive tech hardware sector. Do not overlook that I.T. spending relies heavily upon capex. Are these areas really such safe havens?

The US market is now back to within 5% of its February peak. It wasn’t cheap then and it certainly isn’t now.

The list of risks has only lengthened. For a start, buybacks are not about to return to the levels seen in recent years. Corporation taxes are sure to be lifted, particularly if Biden is elected.

Covid-19 remains an unknown and the threat of a second wave cannot be ignored. Corporations around the world have been hit by two existential events over the last 12 years.

Boards will move away from geographically-distant but ‘just in time’ supply lines to shorter and more diverse ones that should prove more robust. Costs will increase as a consequence.

Balance sheets will also be structurally strengthened, just like they are in Asia, where companies have greater experience with dealing with the unexpected.

The trend towards de-globalisation will be reinforced

The trend towards de-globalisation will be reinforced. This will be not helpful for developing economies.

Emerging market-based businesses will be handicapped in their financing, which will be costly if it is available at all. In contrast, debt funding for most developed nations’ large companies is close to being free.

The UK, also a trading nation, is not well placed either. Brexit still overhangs and little progress has been made on the trade negotiations.

The Government’s handling of the Covid crisis has been a mess and policy delays have left it a long way behind the other European nations. This is a costly mistake, both in lives and money lost. The relative attractions of our home market have dipped as a consequence.

We have considered our positions in fixed income, particularly for our lower risk clients.

The relative attractions of our home market have dipped as a consequence

Government bonds provide very little deflationary protection when yields are so low. We run the risk that the Bank of England opens the door to negative rates but it is nigh on impossible to justify buying a gilt on a yield of just 0.2%.

US Treasuries are richly valued but they do at least offer a small quantum of insurance against a further downturn. This protection might be enhanced if we owned them unhedged in dollars.

Sterling has persistently weakened in crises and a hard Brexit cannot be discounted entirely. On top of this, sterling could weaken in the event that the Bank of England pushes rates into negative territory.

Note that all the other countries that are experimenting with negative rates have significant current account surpluses; the UK has been running an unhealthy deficit for some time.

We have also re-considered the risk characteristics of our corporate debt positions and in particular in absolute return credit funds.

We have modest return expectations from these funds, yet their performance displays an unpleasant tendency to falter at the same time as equity markets.

These positions do nothing to spread risk. We are also investigating more closely the merits of our emerging market debt position versus high yield debt.

One of the consequences of the crisis is an acceleration towards a softer side of capitalism. Governments will play an increasing role in economies.

an acceleration towards a softer side of capitalism

This has implications for corporate earnings which have grown ahead of GDP as the private sector has been the main driver of the expansion. This may now reverse. The new budgets being prepared in Europe and the UK will be green and infrastructure centred.

A far greater focus will be made on the environment that we live in. If Biden wins the election, the US will probably take a similar path. The shutdown has provided all of us with an opportunity to reset and adjust our lifestyles as never before.

Prior to Covid-19 the sands were gradually already shifting and the trend seems now likely to accelerate. We are therefore taking the opportunity to begin to shift our portfolios towards companies that are already operating in a more sustainable manner. Companies already committed to this path may benefit from an early mover advantage.

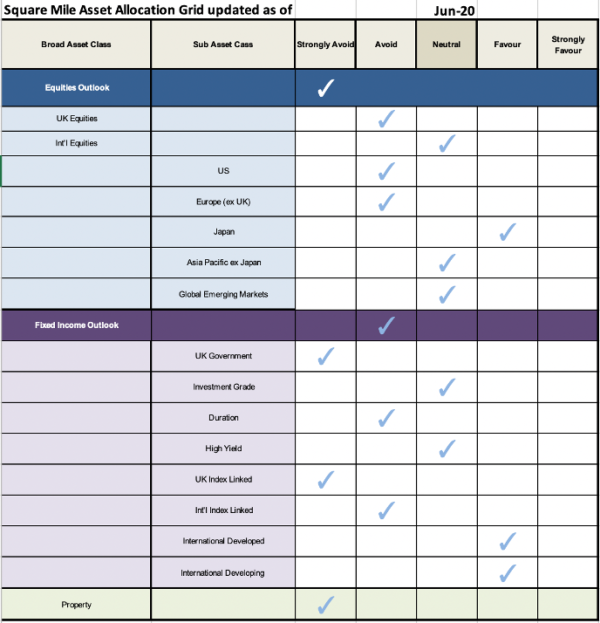

On our grid we are shifting equities to strongly avoid and reducing the overweight to emerging market equity. The increased caution on the pound is not reflected.

Our thoughts expressed in this blog relate only to the portfolios we manage, or advise on, on behalf of our clients and as such may not be relevant to portfolios managed by other parties. This is not a recommendation to buy or sell any individual stocks that are mentioned.

As at 9 June 2020

Click to visit:

Important Information

This article is for the use of professional advisers and other regulated firms only. It is published by, and remains the copyright of, Square Mile Investment Consulting and Research Ltd (“SM”). SM makes no warranties or representations regarding the accuracy or completeness of the information contained herein. This information represents the views and forecasts of SM at the date of issue but may be subject to change without reference or notification to you. SM does not offer investment advice or make recommendations regarding investments and nothing in this presentation shall be deemed to constitute

financial or investment advice in any way and shall not constitute a regulated activity for the purposes of the Financial Services and Markets Act 2000. This presentation shall not constitute or be deemed to constitute an invitation or inducement to any person to engage in investment activity. Should you undertake any investment activity based on information contained herein, you do so entirely at your own risk and SM shall have no liability whatsoever for any loss, damage, costs or expenses incurred or suffered by you as a result. SM does not accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Past performance is not a guide to future returns.

Commentary » Equities » Equities Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Uncategorized

Leave a Reply

You must be logged in to post a comment.