Dec

2023

Outlook 2024: Multi-asset strategy

DIY Investor

31 December 2023

“The excess liquidity that has helped keep many assets buoyant since the global financial crisis is now retreating as central banks unwind stimulus. The good news is that may pave the way for a more active approach to asset management where opportunities for alpha may emerge.“

Gregor MA Hirt

Global CIO Multi Asset

Look beyond the norm

We think 2024 could be the year when multi asset strategies show their mettle as potential openings emerge across asset classes

Investors will go into 2024 with questions surrounding growth and monetary policy. All eyes are on whether central banks can successfully tame inflation without tipping economies into recession. Geopolitical tensions provide a difficult backdrop as wars rage in the Middle East and Ukraine. As a result, markets may be volatile. Hence diversification will be essential. Investors may also need to be sufficiently agile to look for opportunities beyond the key pillars of fixed income and equities.

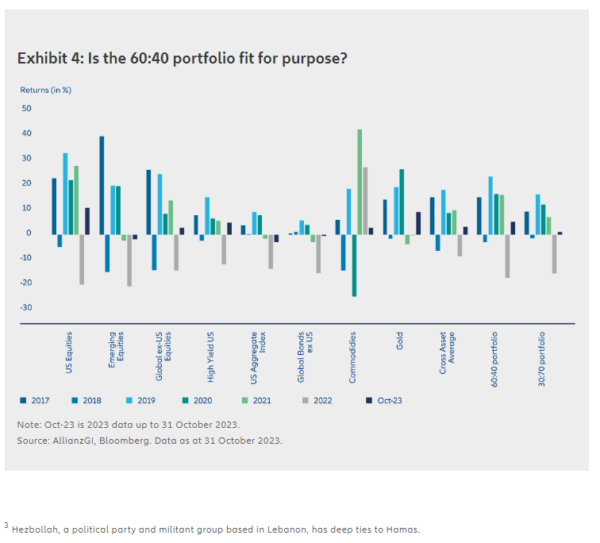

As a result, investors may scrutinise the make-up of their portfolios. In 2023, the 60:40 portfolio – investing 60% in equities and 40% in bonds – staged a modest comeback after one of the worst years in history in 2022 when both assets underperformed (see Exhibit 4), challenging the notion that the split provides decorrelation benefits. But with risk assets (particularly equities) facing a potentially testing outlook, investors may consider other asset allocations and less traditional asset classes, including commodities and certain private markets. During periods of elevated uncertainty, a dynamic approach will be important. That may mean scanning for equity market opportunities as valuations adjust or building in protection by adding option strategies, allowing for short positions and liquid alternatives in case of sudden market movements.

Time to go beyond the “dash for cash”

Many investors have been adding cash positions since the start of 2022 as a surge in short-term interest rates, coupled with still volatile bond markets, have boosted the allure of cash – an asset once considered one of the least interesting and lowest-yielding parts of financial markets. The uncertain outlook and higher rates on offer mean we understand the “dash for cash”. But we think that in 2024, fixed income and, in the longer-term, equities and other assets are likely to offer far better potential for total returns.

So, where do we see opportunities?

- Consider safe haven staples – Within fixed income, we see the potential for carry and some capital appreciation by holding US Treasuries due to current high yields. Government bond yields have touched multi-year highs on expectations that the Fed may keep interest rates higher for an extended period to fight inflation. With the Fed close to the end of its cycle of rate rises, and a recession risk still looming, we believe that the backdrop is supportive for Treasuries. We also think gold could make gains in an environment of still-elevated inflation and geopolitical risks. A steadying in real interest rates – which we expect – will offer further support to gold. Gold buying by central banks has reached record levels and we anticipate this trend to continue, particularly as emerging markets shift their reserves away from the US dollar. A spiralling of the Israel-Hamas conflict into a wider regional war would further fuel gold’s perceived safe haven status.

- Monitor the competing forces in oil markets – We see oil markets in a push and pull between concerns about an escalation in the Middle East conflict and the outlook for global growth. Slower growth or even a recession in the major global economies could undermine oil demand. But inventories remain at low levels and major oil producer Saudi Arabia has a strong incentive to keep prices high – at around USD 80 to 120 a barrel. Any wider intensification of the war between Israel and Hamas could push prices higher still. Such an escalation, which is not our base case, would have an impact far beyond oil – sending prices of other commodities soaring. Markets will be focused on any signs of Iran, a backer of Hezbollah3 and a big oil producer, becoming more directly involved in the conflict. But we will also be monitoring global macroeconomic data as signs of faltering growth could provide potential buying opportunities.

- Look to Japan’s rising sun – While we are moderately constructive on equities overall, we tactically favour Japanese equities. Japanese companies are among the few in developed economies still receiving support from lower interest rates, a legacy of years battling deflation. With company earnings staying resilient, thanks to positive macro data and corporate reforms, we think valuations are attractive at current levels, although our view could change during 2024. We’ll be watching for further signs of BoJ unwinding its yield curve control policy – one of the most underestimated market risks heading into 2024, in our view. Japan is the largest foreign holder of US Treasuries and the possibility of higher yields in Japanese bonds and a stronger yen could spell market volatility if Japanese investors move money home.

What other potential ideas show the importance of diversification across markets? We think Mexico could benefit as producers shift supply chains from China to be closer to the US market. Emerging markets overall are being held back by questions about the health of China’s economy. Property market challenges have weighed on China and may limit the immediate growth prospects. But we expect a turnaround in sentiment in 2024 and remain convinced about long-term investment opportunities in China as it pivots to an innovation-driven economy.

Opportunities for alpha?

Across the investment spectrum, we think a nuanced approach to asset selection will be important in 2024. In an era where money has a cost again, not all assets will perform. The excess liquidity that has helped keep many assets buoyant since the global financial crisis is now retreating as central banks unwind stimulus. The good news is that may pave the way for a more active approach to asset management where opportunities for alpha may emerge.

Download our 2024 outlook here >

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable, but it has not been independently verified; its accuracy or completeness is not guaranteed and no liability is assumed for any direct or consequential losses arising from its use, unless caused by gross negligence or wilful misconduct. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. This is a marketing communication issued by Allianz Global Investors UK Limited, an investment company, incorporated in the United Kingdom, with its registered office at 199 Bishopsgate, London, EC2M 3TY, www.allianzglobalinvestors.co.uk. Allianz Global Investors UK Limited, company number 11516839, is authorised and regulated by the Financial Conduct Authority. Details about the extent of our regulation are available from us on request and on the Financial Conduct Authority’s website (www.fca.org.uk). The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors UK Limited.

Leave a Reply

You must be logged in to post a comment.