Dec

2023

Outlook 2024: Equities in the age of the 3D Reset

DIY Investor

31 December 2023

The mega-themes reshaping the world economy provide a wealth of opportunities and risks for investors in equities. Taking a global view, Alex Tedder and Tom Wilson look across developed and emerging markets for the sectors, countries and themes best placed for the period to come.

Global and thematic equities

Alex Tedder:

Beneath the surface of some respectable returns for global equities in 2023, with the MSCI World so far up 9.1% in USD terms, the picture is anything but benign.

A confluence of factors, associated with what we’ve called the 3D Reset, is driving a regime shift of major proportions. Structural challenges that were already apparent before the pandemic are becoming acute.

In 2024 uncertainties will persist and equity markets are likely to remain volatile. As always, however, the old adage that “there is always a bull market somewhere” may prove accurate. In fact, we think there are a number of areas that may prove highly profitable for global equity investors next year.

The 3D Reset and the end of the free money era

Perhaps the most striking feature of financial markets in the last decade was the steady decline in the cost of risk. With post-Global Financial Crisis (GFC) central bank policy driving down interest rates to zero, the effect on asset prices was dramatic; they went up, a lot.

Then came the pandemic, closely followed by the war in Ukraine, events which served to crystallise pressures that had been building for some time.

There are many different factors at play, but we think they can be usefully grouped into three categories, namely 1) Demographic constraints; 2) Decarbonisation imperatives; and 3) Deglobalisation initiatives. Together, they form what we’ve called the 3D Reset.

Combined with high sovereign debt levels, these factors have created supply bottlenecks, driven up wage costs, boosted general price inflation, and underpinned populist politics. Central banks have been forced to act decisively. Interest rates have been raised dramatically and look set to stay that way for some time. No wonder financial markets are jittery.

Time to do the opposite of what you did in the last decade

Hindsight is always 20/20. Looking back over the 10 years to 2021, there were only a few things that investors needed to have done: buy equities; invest in growth (especially technology); invest mainly in the US; not worry about valuations; lever up (finance with debt).

Anyone following this approach would have done superbly well, and many investors did.

But the 3D Reset is now ongoing and the implications for investors are substantial across most asset classes. Most obviously, cash is no longer trash: money in the bank can get you respectable returns.

For equity investors a change in mindset is needed. This involves:

– more diversification across regions (less US, more of the rest of the world)

– more focus on the implications of structural change

– renewed attention to valuation, quality, and risk.

We examine each of these below.

Look beyond the US; particularly to unloved markets like Japan and the UK

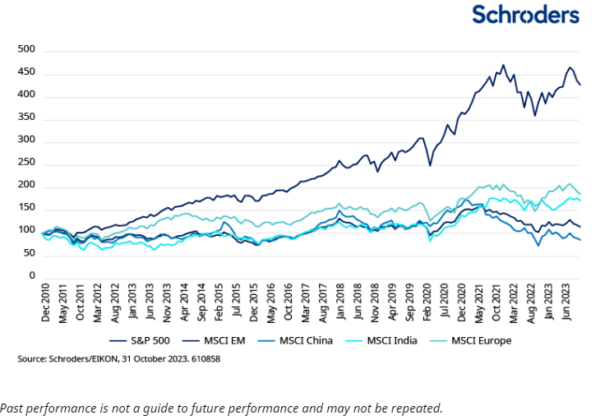

As Warren Buffett regularly reminds us, it’s tough to bet against the S&P500. Since the end of 2010 the S&P has delivered, in US dollar terms, a cumulative return of 340% compared to 95% for European equities and just 20% from emerging markets. China has delivered a negative return over that period.

Chart: time to think about non-US markets again?

The US corporate sector remains, in aggregate, better managed and more innovative than pretty much any other. It has a unique constellation. High growth areas such as technology, communications, or healthcare account for a far higher proportion of the index than in other regions. The IT sector, for example, now accounts for 28% of the S&P500 compared to just 6% in Europe.

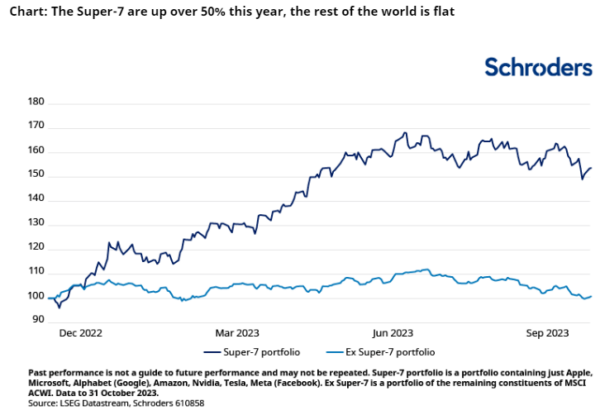

On the basis of the above it is likely that the S&P will continue to trade at a premium to other markets. However, it is notable that the valuation gap between the US and the rest of the world is now at extreme levels. To put this into context, the market capitalisation of the “Super-7” group (responsible for most of the return from global equities this year) is now greater than that of the UK, France, China, and Japan combined. Historically, while such polarisation has often persisted for long periods, inevitably at some point the gap closes.

Chart: The Super-7 are up over 50% this year, the rest of the world is flat

To be clear: we aren’t negative on the US market. Stripping out the Super-7 and other high growth names, the S&P500 is trading only slightly above its long-term average. Indeed, small- and mid-cap US stocks look compellingly valued in many cases.

And in the case of the Super-7 (Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla), although they may not have as far to run as before, they remain unique franchises with powerful and highly profitable business models. They aren’t going away anytime soon.

Incrementally though, after years of disappointing returns, now is probably a good time to look at unloved markets such as Japan and the UK.

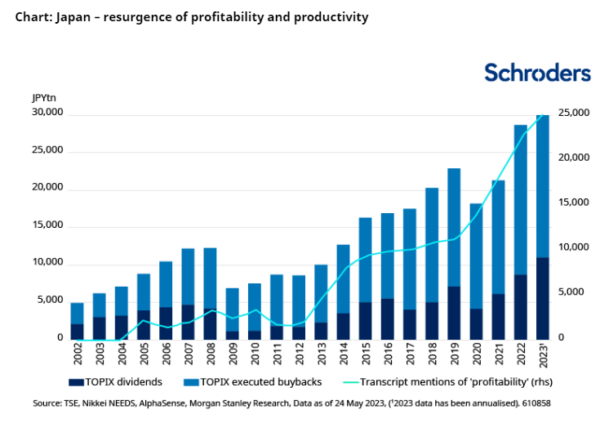

Japan’s market has been a laggard since its asset price bubble burst in 1992, with catastrophic consequences for the economy. After two decades without inflation and a currency that has depreciated 50% against the US dollar, the Japanese economy is now highly competitive. What’s more, authorities there have woken up to the fact that more than half of companies on the stock market trade on less than the value of their assets (that is, have a book value of less than 1), as at end May 2023.

In late 2022, a directive was issued to “encourage” Japanese companies to return cash to shareholders, either via buybacks or higher dividend pay-outs. There has already been a startingly strong response from the corporate sector, and we expect this to continue.

Chart: Japan – resurgence of profitability and productivity

Long perceived as a “legacy” stockmarket due to the relatively high concentration of traditional industries such as energy, mining, consumer staples, and banking, the UK has steadily under-performed the world index over the last 20 years. Regulation, government apathy and Brexit haven’t helped. Yet scratch the surface and the UK has much to offer.

Governance and accounting transparency is generally best-in-class. Companies in the FTSE are mostly global businesses with broad exposure to growth markets. And there around 1,800 other listed companies, many of which are over-looked and under-researched.

Most significantly, the UK market trades at a material discount, both to the rest of the world and to its own history. With the FTSE All-Share valued at just ten times next year’s earnings and with a dividend yield over 4%, the market looks compelling (source Bloomberg, October 2023).

Think about long-term, structural themes

It is striking that so far in 2023 the MSCI Global Alternative Energy Index is down 40% (source Bloomberg, end October 2023). Investor sentiment has been hit by a combination of poor results (not helped by extended valuations in some cases), and a political backlash against environmental initiatives.

And yet, even the most hardened eco-sceptic would struggle to deny that extreme climate effects are becoming ever more apparent. The case for decarbonisation is over-whelming. Given that many of the post-pandemic cost pressures and over-capacity in parts of the renewable energy space have now been worked through, now would seem to be an excellent time for investors to consider the energy transition theme.

It seems clear that technology is key to addressing many of the structural challenges we currently face. Solar and carbon capture are central to the energy transition theme, for example. In a similar vein, the challenge of demographics is one that will largely be met by medical discovery, automation, and Artificial Intelligence (AI).

AI has captured the imagination of investors and of course there is a substantial risk of it getting over-hyped. Nevertheless, the logic behind the market’s excitement is irrefutable. Automation is a long-standing trend that has rapidly expanded from narrow industrial processes to whole swathes of the service sector. Generative AI, based on language models, raises the stakes materially.

Globally, there are more than one billion knowledge workers – that is, workers applying theoretical or analytical knowledge to specific tasks. Augmenting, enhancing, and perhaps replacing a portion of this work will result in immense changes and create significant opportunities for investors not just in the technology sector but in almost every part of the economy. PWC put the potential economic value of AI at $17 trillion annually by 2030. Compared to current global GDP of around $110 trillion that is an extraordinary sum and the opportunities in the automation space are likely to prove immense.

Price is what you pay, value is what you get

In a higher interest rate environment, valuations matter much more than when interest rates are close to zero. Equities have been wonderful long-term investments, with the S&P500 delivering a real return (after inflation) of more than 7% per annum over the last 150 years, compared to just 2% from US Treasuries. And yet, as we all know, equities are also highly volatile; there have been drawdowns of more than 10% in 29 of the past 50 years. Equity markets are fickle and can be quite unforgiving.

All the more reason, in our view, to focus on valuations. Or more precisely, on value for money. Whereas the last decade was all about growth (especially revenue growth), the next decade is likely to be much more about finding companies that offer genuine value.

By this we do not simply mean companies that are cheap. Cheap stocks are usually cheap for a reason. Companies in traditional sectors such as energy, financials, or industrials are not only highly cyclical, but also face major disruption from the transition to new technologies. In contrast, a company trading expensively on current metrics may turn out to be anything but if it delivers sustained growth and cashflows in the future.

We think it will pay investors to focus on the longer-term, identify the areas with structural, under-appreciated growth, and commit strongly to those companies with sustained competitive advantage. Like anything, the price you pay for a security is the price you pay. Value is what you get. There is plenty of value in global equity markets, especially for the patient investor.

Global emerging market equities:

Tom Wilson:

Emerging markets (EM) enjoyed a turbo-charged period of growth during the 2000s, led by China. It was a decade of globalisation, urbanisation, the commodity “super cycle” and a rising middle class. Manufacturing, commodities and consumption all benefitted strongly.

However, the following decade has been a disappointment. Persistent US dollar appreciation has dragged on EM financial conditions and nominal growth. Globalisation levelled off as the loss of manufacturing jobs in developed markets added to populist pressure. Chinese property, infrastructure and debt became increasingly developed and more recently geopolitical tension has intensified, with economic and market implications.

So where now for EM? How are the 3Ds of decarbonisation, deglobalisation and demographics causing risks and opportunities?

Let’s begin with the structural, starting with China which currently accounts for 30% of the MSCI Emerging Market benchmark.

Don’t write off China

China faces slower growth in the coming decade. Its economy needs to transition away from an investment-led growth model. Investment share of GDP is unsustainably high: infrastructure is considerably built out, while a years-long real estate boom has led to oversupply in many parts of the country. Debt levels are high and demographic trends are an increasing drag, with China facing a shrinking working age population, a marked fall in its birth rate and a rapid increase in its dependency ratio as the population ages.

What’s more, China is facing the “middle-income trap.” As wage costs have risen China has become less competitive in low-end manufacturing and needs to continue to move up the value chain.

Geopolitical tension with the US is adding to the economic headwinds. It contributes to supply chain diversification, impedes access to advanced technology and knowledge transfer, has triggered aggressive US industrial policy and impedes foreign direct investment (FDI).

However, China is an $18 trillion economy with a very large domestic market and the scale to support its own industrial policy. If any country can move through the middle-income trap, China can.

China is highly integrated into the global economy and remains highly competitive, so supply chain diversification will take years to play out. The country is innovative and is a major potential beneficiary of decarbonisation: it manufactures 80% of the world’s solar panels, sold two-thirds of the world’s electric vehicles in 2022, controls 75% of the world’s battery cell production capacity and dominates large parts of the renewables supply chain. It has a high savings rate, and a controlled capital account so is not reliant on external capital for growth. Together with its control of the financial system, this gives China significant policy flexibility. Finally, in such a broad and deep market, there will always be opportunities at the company level.

It should also be said that China is not emerging markets. Emerging markets are a diverse universe of countries with a variety of drivers.

Demographics among drivers of India’s inexorable rise

India is the counterpoint to China. Having been outstripped by China over the past 40 years, maybe it is now India’s turn in the sun.

India is coming off a low base. Urbanisation is low and represents a significant medium-term productivity opportunity. Returns from infrastructure investment are high. Demographics are supportive, and labour is abundant and cheap. Government policies to improve fiscal efficiency, increase infrastructure investment, reduce friction for trade between Indian states, and drive import substitution have improved the prospects for growth. Meanwhile, digitisation and smartphone penetration creates the opportunity to improve economic formalisation and improve financial intermediation, education and price discovery.

However, caveats are required: issues of infrastructure, bureaucracy, protectionism, labour skills and labour code persist and despite its scale India is not necessarily the first choice for export manufacturing FDI. But India’s prospects for the next decade look promising.

Decarbonisation and deglobalisation beneficiaries

Korea and Taiwan are markets exposed to trade and in particular technology. We have a positive structural view on technology as the world becomes increasingly digitised. 70% of the benchmark in Taiwan is technology, while in Korea it accounts for 50%, as at October 2023. Meanwhile, Korea also has strong battery companies with excellent long-term growth prospects from decarbonisation.

Other countries in EM are beneficiaries of supply chain diversification. While India might not yet be a first-choice destination for export manufacturing FDI, a mix of infrastructure, skilled labour and geographic proximity supports the prospects for Mexico, Central Europe, and ASEAN. Manufacturing in developed markets can be very expensive both to build and operate, for example reshoring chip and battery production to the US requires enormous fiscal support. Hence deglobalisation is likely to be more about near-shoring and friend-shoring than it is about reshoring. It is also more about de-risking supply chains.

The impact of commodities in EM has diminished markedly. But the investment requirements of the energy transition will strongly support certain commodities to the benefit of some markets, primarily in Latin America.

Finally, even though the Middle East will face challenges from the energy transition due its economic dependence on oil production, interesting opportunities derive from a strong government focus on economic diversification, with significant fiscal support and reform in Saudi Arabia and the UAE.

Hence structural opportunities abound in EM. But investing in this universe is as much about the cyclical as the structural, which is one of the reasons we believe that style agnostic active management is so important. India represents a compelling medium-term structural growth opportunity, but valuations in that market are currently very high and we see stronger opportunities elsewhere.

This includes China. Sentiment in China is currently very negative. The structural and geopolitical headwinds are much discussed, while weak economic momentum adds to shorter term concerns. However, this is now reflected in cheap valuations and positioning has adjusted markedly. The government has the policy flexibility to support growth, while there is a visible push to stabilise US-China relations. Although the market is not without risk, we feel that there may be excessive pessimism at this time.

We also see opportunities in the trade cycle, particularly in technology where we have a material overweight. The inventory cycle is inflecting as inventories run down and production and capacity expansion are constrained. While soft developed market demand in 2024 may mute the upcycle, we have positions in companies and markets that trade at attractive valuations and which will benefit from the upcycle while also having good medium-term prospects.

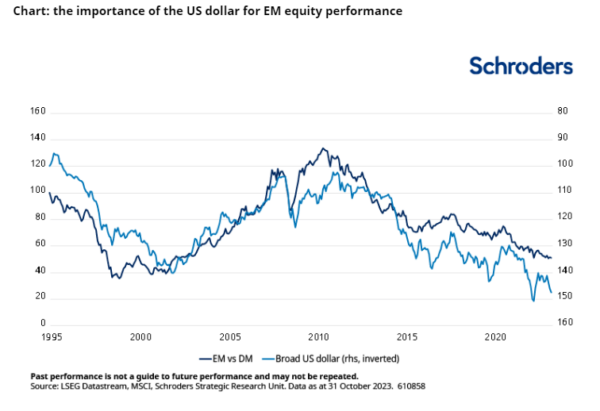

Finally, we cannot speak of global emerging markets without referring to the fourth D, which is the US dollar. A decade of dollar appreciation has been a headwind for EM, and this remains the case in the near term.

Chart: the importance of the US dollar for EM equity performance

However, the dollar now looks richly valued, while the US carries significant fiscal and current account deficits. A slowing economy which triggered monetary easing and an easing in the yield curve would potentially soften the dollar, which would improve financial conditions in emerging countries. In combination with valuations that are broadly attractive, this would be very supportive of EM equity returns.

Any reference to regions/ countries/ sectors/ stocks/ securities is for illustrative purposes only and not a recommendation to buy or sell any financial instruments or adopt a specific investment strategy.

The views and opinions contained herein are those of the individuals to whom they are attributed and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Brokers Commentary » Commentary » Equities » Equities Commentary » Equities Latest » Investment trusts Commentary » Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.