Oct

2022

‘Low-risk portfolios’ post average losses of 12.7%

DIY Investor

31 October 2022

Increasingly popular as a ‘ready-made’ investment solution for time-poor or less confident investors, model portfolios are now very much part of the investing landscape.

Whether being selected by an investor directly, or powering an automated investment platform, people have become accustomed to being asked their attitude to risk and being steered to a ready-made portfolio that gives them the best chance of achieving their financial objectives, without keeping them awake at night.

Many also include the ability to invest in line with your environmental and social conscience.

The risk-and-reward-curve is pretty much inked on to page 1 of ‘Investing 101’ and like most investing basics, makes perfect sense.

However, in a release with the headline ‘Low-risk portfolios defy the description and post average losses of 12.7% this year’ data published by Boring Money shows that DIY investors who selected ‘low’ or ‘medium’ risk portfolios are more likely to have suffered heavier losses in 2022 than those who selected a higher risk option.

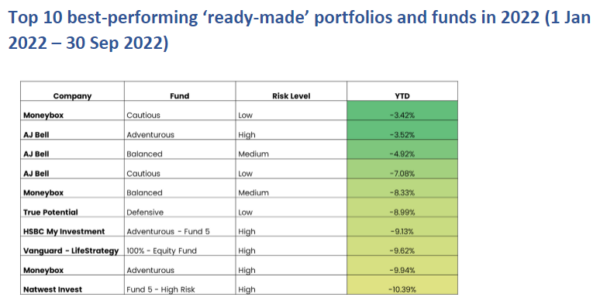

Boring Money published the performance of 33 leading ‘ready-made’ investment portfolios, from 1 Jan 2022 – 30 Sept 2022.

Its research included ten of the industry’s key providers of ready-made portfolios or funds for DIY investors, across a range of business models.

These providers included platforms such as AJ Bell and Hargreaves Lansdown, robo advisers such as Moneybox, Nutmeg and Wealthify, and leading global multi-asset fund provider Vanguard.

There is no doubt that this has been a challenging year for investors, but these results are not the first to point to point to results that deviate from what might be expected.

Key findings of the research show:

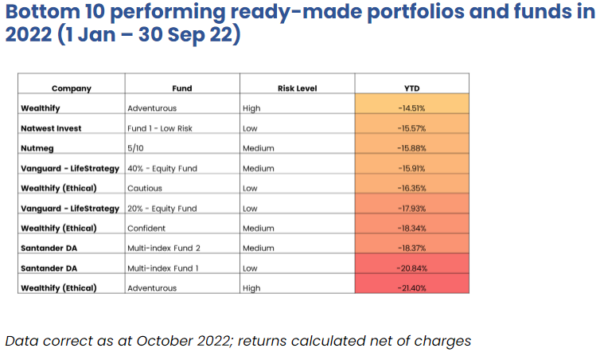

- All ‘ready-made’ investment portfolios have recorded negative returns since the beginning of 2022

- 8 portfolios or funds in the lowest 10 by performance in 2022 have been ‘low risk’ or ‘medium risk’ portfolios – 4 of these are ‘low risk’ options

- 50% of the top 10 performing ready-made portfolios YTD have been ‘high risk’

- The average ‘low risk’ portfolio has returned -12.7% YTD compared to an average return of -11.7% for the ‘high risk’ options

In 2022, AJ Bell and Moneybox have posted the best performance, across various risk profiles

Boring Money CEO Holly Mackay comments:

“There are many factors behind these performance numbers, from the expected underperformance of ethical options which exclude fossil fuels, the upheaval in bond markets and especially UK bonds, and also the approach taken to hedging in light of a strong US dollar.

“Although 9 months is not long enough to support any conclusions about a provider’s performance credentials, it is long enough to call into question again the description and positioning of ‘ready-made’ portfolios to novice investors.

“It’s hugely difficult to get the right balance between simplicity – but also arming people with the right expectations around the journey they can expect.”

Visit Boring Money >

Brokers Commentary » Brokers Latest » Commentary » Equities Commentary » Latest » Mutual funds Commentary » Take control of your finances commentary

One response to “‘Low-risk portfolios’ post average losses of 12.7%”

Leave a Reply

You must be logged in to post a comment.

[…] a time when a Boring Money survey reports ‘low risk’ portfolios losing an average of 12.7% in a year this is a time to make sure that investors understand, and fully embrace the importance of […]