Oct

2019

Is Bitcoin money? Almost…

DIY Investor

23 October 2019

Stones, cows, seashells, cigarettes, peppercorns and rice are all examples of commodities which have been used over human history as forms of money. Buy what exactly is money and what are its features?

Economists traditionally consider money to have three core functions:

– a medium of exchange. Money allows its holders to trade goods and services without having to resort to bartering. Many thousands of years ago, those with surplus goods to trade needed to rely on there being a ‘double coincidence of wants’.

For example, if one person had a cow and wanted to trade it for 10 sacks of grain there needed to someone who had 10 sacks of grain and wanted a cow – a highly unlikely scenario.

By acting as a medium of exchange, money overcomes this problem.

– a store of value. By storing and holding value, money can be used as a medium of exchange over time. However, fiat currencies, such as the pound and dollar, are not the only stores of value and may not necessarily be the best ways of preserving value over time.

Fiat currencies are subject to the loss of value over time due to inflation, with other assets such as gold, art and property arguably holding their value better as time goes on. However, cash is more widely used as a medium of exchange due to its liquidity and is readily accepted in most places – you are unlikely to be able to go into Tesco and pay for your groceries with a gold bar.

– unit of account. Finally, money provides a common measure of the value of goods and services being traded. Being priced in certain units, such as pounds or dollars, buyers and sellers are able to know how much a cow is worth compared to a sack of grain and are able to make more informed decisions.

Along with the three core functions, forms of money must also have a number of other characteristics to be successful. These include being easy to carry around (not like gold bars) and be divisible into smaller denominations in order to facilitate transactions (so change can be given). Of course, money must be widely accepted by a population for it to be successful and difficult to counterfeit so confidence in its stability remains high.

Is Crypto Cash?

In the cryptocurrency world, Bitcoin was created in 2008 as the world’s first digital only currency, with its creator having the aim of developing ‘a new electronic cash system…’. But can Bitcoin be considered to be money? If we analyse the cryptocurrency against the three functions above then the answer sways towards yes, but how successful it is is up for debate.

Firstly, Bitcoin is definitely a medium of exchange. Holders are able to spend their coins in a variety of shops and with a range of traders in order to settle their bills. But while there have been several early adopters, its acceptance as a medium of exchange is not yet widespread. While you may be able to pay for your holiday on the Expedia website or purchase some spicy buffalo wings at PizzaForCoins.com, a report in July this year from Morgan Stanley found that Bitcoin is accepted at just three of the top 500 online merchants.

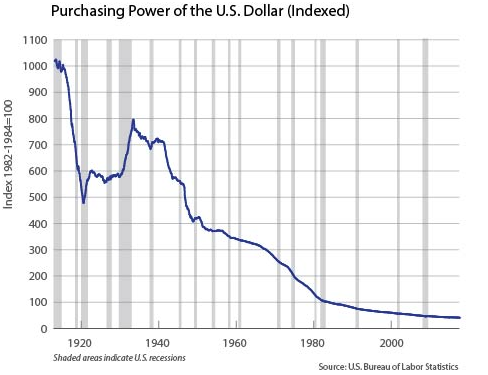

Perhaps the greatest success of Bitcoin has been its ability to store value. From trading as low as 5 cents seven years ago, as I write its value has just hit $16,708! This is in contrast to the US dollar, which according to US government stats has lost c.95% of its purchasing power since the creation of the Federal Reserve in 1913 (see chart below). However, with Bitcoin continuing to see highly volatile price movements on a daily, and even hourly, basis its future role as a stable form of value storage is uncertain.

Finally, Bitcoin is a unit of account as goods and services are able to be priced according to its value. On PizzaForCoins.com for example five cheese sticks from Pizza Hut currently cost 0.001BTC. But again due to its volatility, prices are often quoted alongside US dollars to give an idea of what its value is against more stable and widely accepted forms of money.

We can use the cheese sticks example of how Bitcoin’s current volatility limits its usefulness as a form of money.

At a price of 0.001 BTC, the cheese sticks currently cost the equivalent of $16.71 (or £12.47) – a price no-one would be willing to pay unless they were very very hungry.

The issue is that Bitcoin prices are moving so fast that the PizzaForCoins website hasn’t been able to change its prices to adjust. If Bitcoin remains as volatile as it is, retailers would have to constantly re-price their products in order to achieve sales to consumers, thus increasing their operational costs and (the rising value aside) making Bitcoin a less attractive form of payment for them.

If Bitcoin remains as volatile as it is, retailers would have to constantly re-price their products in order to achieve sales to consumers, thus increasing their operational costs and (the rising value aside) making Bitcoin a less attractive form of payment for them.

Customers are not going to pay the equivalent of £12.47 for a few pieces of cheddar covered dough via Bitcoin simply because the Bitcoin price has gone up. Instead, unless the retailers constantly change their pricing to reflect what the consumer would be willing to pay in terms of a more established currency, the consumer would simply cash in their coins and go to Pizza Hut directly where the cheese sticks cost just $5.29 (£3.95).

While Bitcoin still has some way to go before it can be considered to be a widely accepted form of money, it does look like it, and other cryptocurrencies, are here to stay. Those interested in getting involved in cryptocurrencies but who are put off by the investment risks, which include the price volatility, potential loss of capital, no regulatory protection and issuing companies having a limited operating history, might want to look at the latest offering from Crowd for Angels.

Crowd for Angels is currently looking to raise up to £50 million by way of a 5 year ‘Liquid Crypto Bond’ paying 3% interest per annum. As part of the fundraise, for every £100 worth of Bonds purchased investors will receive up to 9900 ‘tokens’ (or cryptocoins) at no extra cost to themselves.

These tokens will subsequently be listed on external exchanges and their value supported by buy-backs by the company.

As the tokens are being given away as a reward to investors there will be no risk of loss of capital on them, so could be an ideal entry point for those wanting to dip their toes into cryptocurrency for the first time.

For more information on the Crowd for Angels token issue visit https://crowdforangels.com/company/plc/Crowd-for-Angels-UK-Limited-1031

RISK WARNING

Investing in small public listed or private companies involves risks, including illiquidity, lack of dividends, loss of investment and dilution, and it should be done only as part of a diversified portfolio. Investing in debt pitches through Crowd for Angels (UK) Limited involves lending to companies and therefore your capital is at risk and interest payments are not guaranteed if the borrower defaults. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results.

Crowd for Angels is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own Investment Decisions. You will only be able to invest via Crowd for Angels once you are authorised.

Please visit crowdforangels.com/risk-warning to read the full Risk Warning.

This email has been approved as a Financial Promotion by Crowd for Angels (UK) Limited (Company number: 03064807), which is authorised and regulated by the Financial Conduct Authority (Reference number: 176508). Investments made in companies listed on the Crowd for Angels platform are not covered by the Financial Services Compensation Scheme (FSCS).

The availability of any tax relief depends on the individual circumstances of each investor and of the

company concerned, and may be subject to change in the future. If you are in any doubt about the availability of any tax reliefs, or the tax treatment of your investment, you should obtain independent financial advice before proceeding with your investment.

The prices of virtual goods and products, like real goods and products, constantly fluctuate over time. Any currency, virtual or otherwise, could be subject to large swings in value and at any time might become worthless. As such, the value of your holding may increase or decrease over time or even go to zero.

Cryptocurrencies, tokens and other digital currencies are not regulated by the Financial Conduct Authority and therefore do not offer recourse to the Financial Ombudsman Service or the Financial

Services Compensation Scheme.

Alternative investments Commentary » Alternative investments Latest » Commentary » Fixed income Commentary » Fixed income Latest » Latest

Leave a Reply

You must be logged in to post a comment.