Jan

2023

Investment trusts: a rare opportunity in UK small and mid-sized companies

DIY Investor

9 January 2023

Opportunity knocks for UK small and mid-sized companies – find out why

UK equities have been more resilient than many other world markets in 2022. This has occurred as inflation has hit multi-decade highs in major economies such as the UK, US and Germany and interest rates have risen sharply. Within the UK stock market, there has been a significant dispersion of returns. Investors have displayed a clear preference for the larger, more international FTSE 100 companies. The extent of the underperformance of small and mid-caps (“smids” for short) is rare and, in the past, such periods have usually been followed by longer spells of outperformance. Here, we explore the current outlook for this part of the market and explain how two Schroders investment trusts are positioning to benefit.

The UK smids market encompasses more than 1,000 companies. They may be less well-known than the household names that form the FTSE 100, but that doesn’t mean they’re not world-leading companies capable of generating superior returns. There are plenty of well-run, innovative and disruptive small and mid-sized businesses in the UK, with market-leading positions in new and emerging industries.

While this is normally an enticing blend of characteristics, in general terms, 2022 has not been a good year for UK smids. This part of the market is more domestically-exposed than the FTSE 100, which is dominated by large, internationally diversified businesses1. These larger companies conduct much of their trade in US dollars and have benefited the extraordinary strength of that currency, which has provided a translational boost to profits that are reported in pound sterling. In turn, this has provided support to the share prices of larger, global-facing businesses, whilst the more domestically-focused smids have succumbed to the broader weakness in equity markets globally.

UK smids, as measured by the Numis Small Cap plus AIM ex IT (investment trusts) index, have fallen by 21% year-to-date2. In comparison, the FTSE 100 is up more than 6% on the same basis, with the largest of its constituents benefiting from the strength of their dollar earnings, and their perceived safety in a world of uncertainty.

Recovery prospects

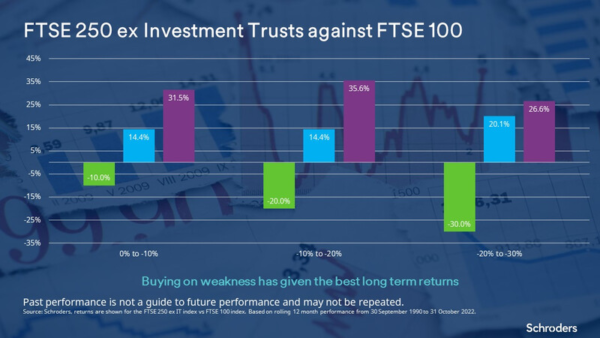

The acute underperformance of UK smids is piquing the interest of a variety of investors as they look to 2023. Over the past three decades, it has been statistically rare for UK smids to underperform to the extent that they have this year. When it has occurred, a period of strong outperformance versus the FTSE 100 has usually followed. Historically, buying UK smids on weakness has delivered positive long-term results, as illustrated by the chart below.

In part, this is because underperformance often leads to more attractive valuations. Starting valuation is one of the most important determinants of long-term investment returns and the current dividend yield of around 3% offered by the FTSE 250 index – the most established group of UK quoted smids – implies a potentially more attractive entry point for investors, and the presence of mispriced opportunities that were not available a year ago.

Meanwhile, with a longer runway of growth ahead of them than many of their larger counterparts, investing in small and mid-sized businesses over the long term should ultimately deliver superior performance. Many academic studies have evidenced the premium returns on offer from smaller companies. Indeed, the UK has a better track record than the US at delivering long-term success from this part of the market3. Importantly, this superior growth potential is now available at a more attractive price.

Opportunity knocks

It can be argued that UK stocks are cheap for a reason, and economic and political events have clearly undermined confidence in 2022. Nevertheless, it is always worth remembering that it’s during challenging and uncomfortable periods that opportunities can be most plentiful.

Some of the domestically-focused opportunities in particular look to be pricing in a lot of bad news. The opportunity set is broader than this, however. Sue Noffke, Head of UK Equities and portfolio manager of the Schroder Income Growth Fund plc, sees a diverse range of attractive opportunities across both domestic and global-facing UK smids:

“We see opportunities in both the ‘domestics’ serving the UK consumer and business end user, and the many internationally-focused smids. There is no silver bullet to the issues facing the UK economy, where more than 20% of the working age population is economically inactive. Valuations, however, are very beaten up and the market does not seem to be discerning between the good and less good companies.”

Ultimately, some of the higher quality businesses in this part of the market may prove vulnerable to bids. US buyers paying in dollars have a distinct currency advantage, which makes many UK businesses look appealing from a valuation perspective. Mid cap companies may be in the sweet spot here, as Andy Brough, Head of the Pan-European Small and Mid Cap Team and co-manager of the Schroder UK Mid Cap Fund plc explains:

“Should we see a resumption of bids for cheap UK assets, mid cap companies can be the target of choice – not too big, but sufficiently large to make a difference for the acquirer. As companies are taken out it helps make room for the next tranche of exciting FTSE 250 entrants (only around 20 of the original constituents from 1999 are still in the index today) helping to create a dynamism perhaps not there in other areas of the market.”

Schroder UK Mid Cap Fund plc

As the name suggests, the Schroder UK Mid Cap Fund plc may be viewed as an attractive way of accessing the opportunity in UK smids. The highly experienced team, led by Jean Roche, views the UK mid cap investment universe as the source of the UK’s star businesses of tomorrow. The team has a successful track record of investing in high potential UK smids, capturing their growth as they fulfil that potential, before they eventually become big enough to join the FTSE 100. Clearly not all opportunities will ultimately enjoy this growth trajectory, but overall the Company has delivered a return of 9.8% per annum since Schroders became Managers in 20034. Past performance is not a guide to future performance and may not be repeated.

The team looks to build a high conviction portfolio of 40-50 resilient companies that are capable of delivering dependable long-term growth in cash flows and earnings. Innovation and disruption are constant themes within the portfolio. The managers are not complacent about the economic challenges, but they are confident that the disciplined investment approach that lies behind the Company’s long-term success continues to deliver a portfolio capable of capturing the attractive opportunity that lies ahead. As Jean Roche commented in the recently published annual report:

“As stock pickers, we are confident that the collective strength of our holdings’ balance sheets will provide resilience in a challenging economic environment. We are sticking to our sell discipline, avoiding companies whose business models are in danger of being disrupted while seeking out companies which have the ability to reinvent themselves, or which might be the next mid cap disruptor.”

Schroder Income Growth Fund plc

The current attractive opportunity in UK smids can also be embraced by portfolios with a broader mandate. Take the Schroder Income Growth Fund plc, for example. Managed by Sue Noffke, who has more than 20 years of investment experience specialising in UK equities, the Company has raised its dividend every year since its launch in 19955, making it an attractive proposition for income-seeking investors.

It may invest anywhere across the UK market cap spectrum and the portfolio has a bias towards larger companies. Nevertheless, the investment opportunity in UK smids is well represented within the current strategy, with more exposure to this part of the market now than ever before. Indeed, in her role as Head of UK Equities, Sue confirms that the opportunity is being embraced across practically all of Schroders’ UK investment strategies right now:

“My colleagues across various investment teams at Schroders, whether they follow a ‘growth’ or ‘value’ style of investing, are seeing opportunities in the UK smids for a reason. I blend both styles and the portfolios run by me and my direct team are as exposed, or ‘overweight’ UK smids as we’ve ever been in 16 years running these funds.”

Conclusion

There is clearly an exciting opportunity among UK small and mid-sized companies currently, but as is always the case in the world of investment, it is not without risk. The war against inflation is far from over. Even the best companies are struggling to pass on their higher costs to a UK consumer facing a cost of living crisis of historic proportions.

Higher interest rates could be a major issue for companies with high levels of borrowings, especially if that debt needs to be refinanced over the next couple of years. However, many of the best UK smids have made it through the pandemic and, with the support of strong balance sheets and attractive starting valuations, they are well prepared to weather whatever storms lie ahead.

1 – 43% of FTSE 250 revenues are derived from the UK economy, versus 18% for the FTSE 100. Source: FTSE Russell, 30 September 2022.

2 – Source: Bloomberg on a total return basis to 30 November 2022.

3 – 65 of 985 UK companies with a market cap of more than £150m returned 30x or more over the 30 years to 28 November 2022. That equates to 6.4% of the dataset, compared to 4.6% of the equivalent dataset in the US. Source: Schroders, Thomson Reuters Datastream.

4 – Source: Schroders, Morningstar, 1 May 2003 to 30 September 2022. Net asset value total return.

5 – Source: AIC/Morningstar, July 2022.

Risk considerations The Company may be concentrated in a limited number of geographical regions, industry sectors, markets and/or individual positions. This may result in large changes in the value of the company, both up or down, which may adversely impact the performance of the company. As a result of fees being charged to capital, the distributable income of the company may be higher but there is the potential that performance or capital value may be eroded. The Company may borrow money to invest in further investments, this is known as gearing. Gearing will increase returns if the value of the investments purchased increase in value by more than the cost of borrowing, or reduce returns if they fail to do so.

Important Information

This information is a marketing communication.

This document does not constitute an offer to anyone, or a solicitation by anyone, to subscribe for shares of Schroder UK Mid Cap (the “Company”). Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares.

Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance and may not be repeated.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise. Schroder Real Estate Investment Trust have expressed their own views and opinions in this document and these may change. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy.

Third party data is owned or licensed by the data provider and may not be reproduced or extracted and used for any other purpose without the data provider’s consent. Third party data is provided without any warranties of any kind. The data provider and issuer of the document shall have no liability in connection with the third party data. The terms of the third party’s specific disclaimers, if any, are set forth in the Important Information section at www.schroders.com.

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don’t already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor.co.uk

Issued in January 2023 by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU.

Registration No 4191730 England. Authorised and regulated by the Financial Conduct Authority

Schroder UK Mid Cap Fund plc – Discrete yearly performance

Reference index: FTSE 250 ex Inv Trusts TR

Schroder Income Growth Fund plc – Discrete yearly performance

Reference index: FTSE All Share TR

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Brokers Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.